Rapid City, S.D.-based utility holding company Black Hills Corp. will buy Mallon Resources Corp. of Denver for $52 million in stock, gaining 53.3 billion cubic feet of gas equivalent and net daily production of 13 million cubic feet of gas equivalent primarily in New Mexico's San Juan Basin. Black Hill's production is about 21.7 MMcfe per day. Mallon operates 149 of 171 gas and oil wells, with working interests averaging 90% to 100% in most. Its reserves are almost entirely of gas in shallow sand formations. "These operated properties provide us with control over the exploration and development program, allowing flexible capital deployment as market conditions dictate," says Black Hills chairman and chief executive officer Daniel P. Landguth. "Moreover, our Denver marketing subsidiary, Enserco Energy, can add gas marketing and transportation expertise." Black Hills is also gaining more than 66,500 gross (56,000 net) acres of leases, most of which are in a contiguous block that is in the early stages of development. It believes it could recover additional gas from the shallow sands and more gas could be recovered from deeper horizons that have yet to be explored but are productive elsewhere in the basin. "This acquisition is an outstanding strategic fit for us," Landguth adds. "In one transaction, we have advanced several of our long-term objectives by dramatically increasing our gas reserves and production." The $52 million price includes assumption of $30.5 million of Mallon obligations, including debt owed to Aquila Energy Capital Corp. and settlement of outstanding hedges. Mallon shareholders will receive 0.044 Black Hills common share per share of Mallon. The companies expect to complete the deal during first-quarter 2003. Mallon chairman and CEO George O. Mallon says, "We feel that this transaction is both prudent and exciting for our shareholders. After pursuing several corporate strategies, we concluded that this merger with Black Hills was the most attractive for our shareholders."

Recommended Reading

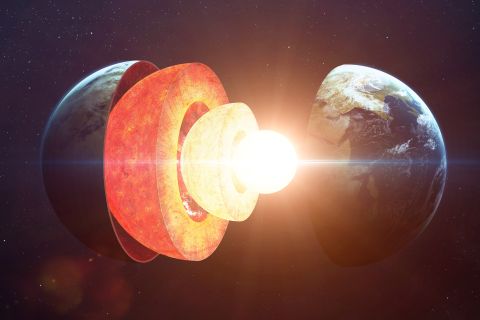

Oil, Gas Drilling Tech Transfer Boosts Fervo’s Geothermal Prowess

2024-02-14 - Geothermal company Fervo Energy is learning from oil and gas drilling and completion techniques to improve geothermal well costs and drill times.

Could Concentrated Solar Power Be an Energy Storage Gamechanger?

2024-03-27 - Vast Energy CEO Craig Wood shares insight on concentrated solar power and its role in energy storage and green fuels.

Amid ‘Battery Arms Race,’ Xerion CEO Talks Tech, Maturing Market, China

2024-04-10 - The late-stage battery startup is active in the military and electronics space, but is gaining attention for technology that extracts lithium from geothermal brine.

Exclusive: Mitsubishi Power Plans Hydrogen for the Long Haul

2024-04-17 - Mitsubishi Power is looking at a "realistic timeline" as the company scales projects centered around the "versatile molecule," Kai Guo, the vice president of hydrogen infrastructure development for Mitsubishi Power, told Hart Energy's Jordan Blum at CERAWeek by S&P Global.

US Geothermal Sector Gears Up for Commercial Liftoff

2024-04-17 - Experts from the U.S. Department of Energy discuss geothermal energy’s potential following the release of the liftoff report.