Within the E&P industry super basins are a wellknown concept. While the term “super basin” is a relatively new idea, coined by IHS Markit, it is based on a series of subsurface and surface characteristics: These basins must have 5 Bboe of produced hydrocarbons and at least 5 Bboe of remaining resource. The prolific production of hydrocarbons from them has buoyed the quest for energy since the early 1900s. Many of the giant fields known today were discovered in the early phase in these basins and led to the exploration drilling and discovery of about 10 Bboe of reserves in basins around the world (the Arabian basins, the Niger Delta basin, the Gulf of Mexico, Permian Basin, Alaska’s North Slope and the Brazil presalt, to name a few). The continued search for additional hydrocarbon resources has resulted in many innovations, changes in technology, leaps in geologic understanding and improvement in the exploration process, which have created the potential for the U.S. to regain its foothold as the largest producer of oil.

The unconventional revolution is now quite conventional and has become a dominant method of exploration and exploitation of hydrocarbon resources in North America. While technology continues to provide new access to what once were uneconomic hydrocarbon accumulations, much of this activity is focused on what are generally considered mature basins.

Old place, new ideas

A quote from Parke Dickey in 1958 is truer today than ever before: “We usually find oil in a new place with old ideas. Sometimes we find oil in an old place with a new idea. But we seldom find much oil in an old place with an old idea.” The caveat to be added is that when the old place is a super basin, the industry has probably not discovered the full potential of that area.

Ian Vann, former executive vice president of exploration for BP, once said, “If you want to find oil, you must look in the oily places.” At first glance this seems to be a rather simplistic thought, but the truth of these words underpins the essence of a super basin. Super basins are unique, and as technology continues to progress, the industry will continue to unlock the ultimate potential of many “oily places.”

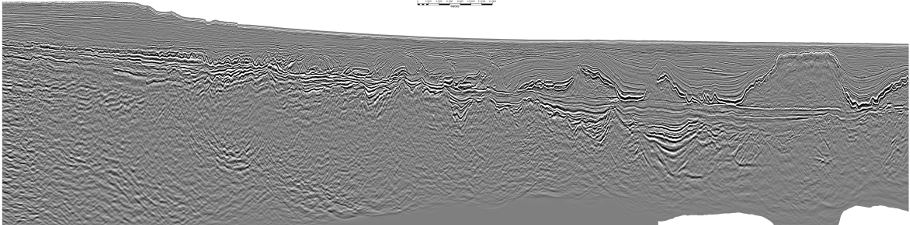

Perhaps the biggest change in the continual rejuvenation of many mature basins has been the ability of seismic data to provide a better image of the subsurface geometry and lithology and the ability to understand basin evolution through time. Long-record long-offset data provide a better image of the deepest parts of a basin. Multiazimuth data enable attribute analysis to better predict fluid types, rock properties and fracture orientation. The development of drilling and completion technologies has changed the conventional idea of reservoir rock quality. The understanding of petroleum systems and the prediction of fluid type variability across a basin provide new ways to drill and complete multiple reservoirs and to better understand the interplay of lithology and petrophysics, fluids, pore space, rock physics, pore pressure and geomechanical properties in the subsurface.

New ideas

The biggest driver will continue to be fiscal terms. High production takes by national oil companies or governments along with taxation or regulation are impediments to continued drilling and future exploration growth.

The access to land leases or blocks in a consistent and transparent manner is also a key factor. If the financial or regulatory hurdles remain high, future exploration will be challenged. A technological innovation or step change in cost structure could provide the ability to overcome fiscal hurdles and lower the cost.

Finally, infrastructure and security are closely related factors. There are many significant discoveries around the world that are not developed due to security risks or the lack of adequate infrastructure to produce the fluids and bring them to market. This changes over time but is an important consideration in understanding exploration drilling in emerging areas.

Regional evaluations and analysis in offshore exploration, particularly in salt basins, relies primarily on seismic data and the development of play fairway concepts. Reconstructing the conjugate margin of what initially was a single basin can provide insight into new ideas in a new area. How does our current understanding of offshore Brazil impact the search for hydrocarbons on the conjugate margin of West Africa? Is the scale relevant? Does it help us develop new methods and understanding that will lead to a new exploration play concept in an area that has been previously drilled without success?

The recent discoveries along the transform margin of Africa in Ghana are a great example of a play type that has been extended to the conjugate margin, as evidenced by the major discoveries in offshore Guyana. Understanding similarities and differences in analogous play types around the world will continue to be a key factor in transforming emerging basins with significant discoveries (e.g., East Africa/Senegal) into the next super basin or guide us to look for a similar play type in a new area.

The ability of high-speed computing and data storage has led to the creation of large 3-D datasets. These legacy data acquired over the past 25 years from multiple different surveys can add significant value at a much lower price point. Development in seismic processing algorithms such as reverse time migration and full waveform inversion has enabled companies to reprocess legacy seismic data acquired with various parameters to be merged and reprocessed, creating new fit-for-purpose 3-D data that provide a product that is comparable to many modern wide-azimuth surveys at 10% of the cost. This innovation provides operators with a more cost-effective solution for license round evaluations. Similarly, the consistency of a large volume of data enables companies to create exploration opportunity portfolios that are well calibrated.

Looking toward the future

Super basins are not super by accident. Their endowment of hydrocarbons is the result of many different factors that have developed in the optimal time frame with the optimal petroleum system. Understanding what makes these basins work, why they contain the recoverable reserves of great magnitude and the salient similarities and differences between super basins will be keys to unlocking the ultimate potential of these areas. Perhaps the most important factor is the presence of prolific source rocks. Without an active petroleum system there are no exploitable hydrocarbons. Sound fundamental analysis and technical innovation will be essential in future exploration programs in these basins. However, as Wallace Pratt said, “Oil is first found in the final analysis in the minds of men.”

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.