Floorhand Cardell Lynch washes down the decking on an H&P FlexRig servicing BHP Billiton's Haynesville shale gas drilling operation on the Elm Grove Plantation 25-24-13HC-1AH well in Bossier Parish near Elm Grove, La., in February 2017. (Source: Hart Energy)

This is a developing story. Check back for updates.

BHP Billiton Ltd. (NYSE: BHP) said July 26 it landed buyers for its treasure chest of U.S. shale assets with two separate transactions worth a total of $10.8 billion cash.

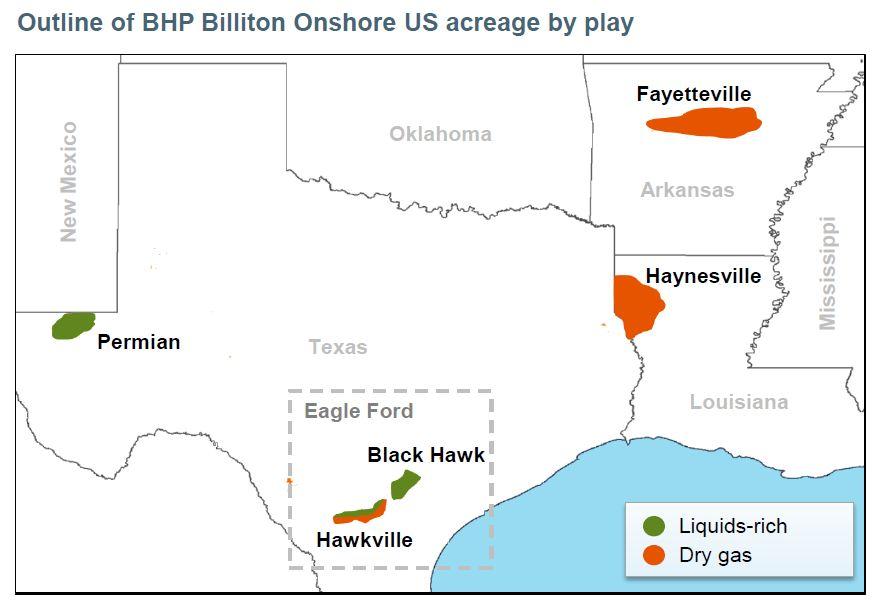

The largest of the two transactions is the purchase by BP Plc (NYSE: BP) of BHP’s Delaware Basin, Eagle Ford and Haynesville assets for $10.5 billion cash. Separately, an affiliate of privately-held Merit Energy Co. agreed to acquire BHP’s remaining U.S. onshore oil and gas assets in Arkansas’ Fayetteville Shale for $300 million.

BHP announced it would divest its U.S. shale assets in August 2017, bowing to activist investors, namely U.S.-based Elliott Advisors.

The Australian company had purchased the assets at the height of the shale oil boom when prices were over $100 a barrel. The sales bring to a close a year of speculation over who would ultimately end up with the sought-after assets.

BHP’s Eagle Ford, Haynesville and Permian positions comprise roughly 526,000 net acres through Texas and Louisiana. The assets currently produce 190,000 barrels of oil equivalent per day (boe/d), of which about 45% are liquid hydrocarbons.

“Some of the best acreage in the best basins in the onshore U.S.,” Bob Dudley, BP’s group CEO, said of the acquisition in a statement. “This is a transformational acquisition for our Lower 48 business, a major step in delivering our upstream strategy and a world-class addition to BP’s distinctive portfolio.”

BP’s upstream CEO, Bernard Looney, added, “We've just got access to some of the best acreage in some of the best basins in the onshore US, and I think we have one of the best teams in the industry to work it.”

The $10.5 billion acquisition is BP’s largest since buying Arco in 1999 and will be fully accommodated within the company’s current financial framework.

BP’s CFO Brian Gilvary said in a statement: “The financial repositioning we have delivered in recent years and the confidence we have in our outlook for free cash flow allow us to take this extremely attractive opportunity now without any adjustment to our financial frame”

The move is fully consistent with BP’s commitment to financial discipline and creating value for shareholders, Gilvary added.

“With our planned additional divestments and buybacks, we expect to deliver this major step forward for a net investment of around $5 billion,” he said.

The combined business will be led by David Lawler, CEO of BP’s Lower 48 business. BP estimates post-integration it will deliver more than $350 million of annual pre-tax synergies, through sustainable cost reductions and commercial and trading opportunities unique to BP.

BP also announced that it has raised the dividend for the first time in 15 quarters, a 2.5% increase to 10.25 cents per ordinary share.

BHP’s Fayetteville position is located in north-central Arkansas and consists of roughly 268,000 net acres. In the 2018 financial year, the company said the Fayetteville assets produced 13.3 million boe, or 79.9 Bcf of gas.

BHP CEO Andrew Mackenzie said that BHP expects to return the net proceeds from the transactions to shareholders.

BHP will continue to operate the assets until completion of the deals, which it expects to occur by the end of October. The transactions will have an effective date of July 1.

Houston-based law firm Baker Botts LLP represented BHP in both transactions.

Recommended Reading

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.