In the Gulf of Mexico, BHP recently sanctioned $800 million of new investment at the Shenzi hub (pictured). Production from the project is expected to start in fiscal 2024. (Source: BHP Group)

Editor’s note: Company value corrected in first paragraph and deck.

After weeks of speculation, BHP Group agreed to sell its petroleum business to Woodside Petroleum Ltd. on Aug. 17 in a merger the companies said in a joint release will create a global top 10 independent energy company worth about $28 billion.

“The merger of our petroleum assets with Woodside will create an organization with the scale, capability and expertise to meet global demand for key oil and gas resources the world will need over the energy transition,” commented BHP CEO Mike Henry in the release.

The sale of BHP’s oil and gas assets to Australia’s Woodside, which analysts expected could fetch anywhere between $10 billion and $17 billion, would create a new international “super independent” with a long-term focus on LNG but exposure in the medium term to high-margin, deepwater oil, according to Wood Mackenzie research director Andrew Harwood.

“An exit from its petroleum business has been long rumored for BHP, and as it faces rising pressure from the energy transition, it would seem that the mining conglomerate has determined now to be the optimum moment to achieve maximum value,” Harwood said in an emailed statement on Aug. 16 prior to the merger announcement.

Under terms of the merger agreement announced Aug. 17, BHP shareholders will receive newly issued shares of Woodside expected to give the company’s investors a 48% stake in the expanded Woodside. The transaction effectively values BHP’s petroleum business at about $13 billion as of close on Aug. 16, roughly in the middle of analysts’ valuations, according to a Reuters report.

Speculation of the deal was first reported in late July following a report by Bloomberg News that BHP had initiated a strategic review of its petroleum business, which the company confirmed in a release on Aug. 16.

Headquartered in Melbourne, BHP is an Anglo-Australian miner that has owned oil and gas assets since the 1960s. The company began its retreat from oil and gas in 2018 with the sale of its U.S. shale assets in two separate agreements—the largest of which was the $10.5 billion sale of its Permian Basin, Eagle Ford and Haynesville positions to BP.

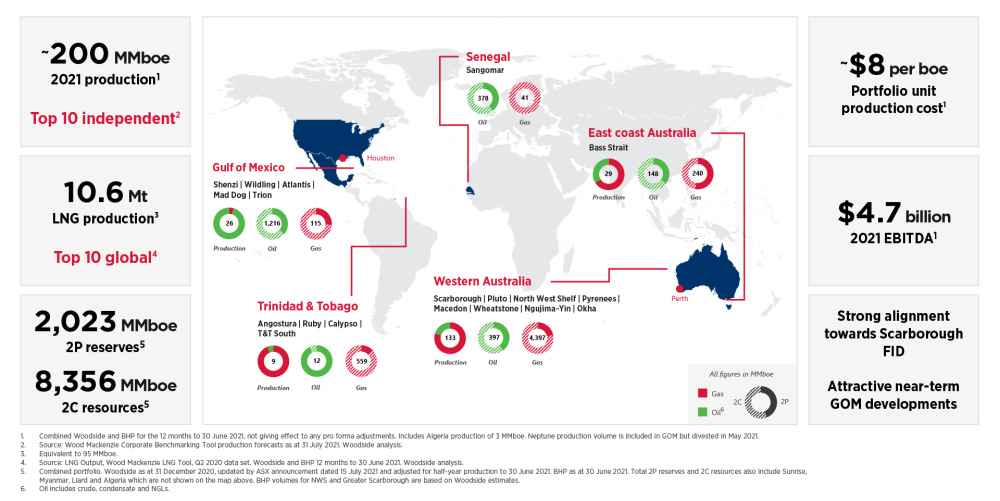

Today, BHP’s petroleum business includes conventional oil and gas operations centered in the U.S. Gulf of Mexico, Australia, Trinidad and Tobago, and Algeria. The company also has exploration, development and production activities in Mexico, deepwater Trinidad and Tobago, Western Gulf of Mexico, Eastern Canada and Barbados.

Wood Mackenzie’s Harwood noted on Aug. 16 that BHP’s oil operations in the Gulf of Mexico complements Woodside’s deepwater capabilities and adds a new core focus area to Woodside’s existing portfolio.

“Strong cash flow from BHP’s GoM assets over the next decade will provide steady shareholder returns while supporting planned investment across the wider business in LNG growth and new energy opportunities,” he said.

Woodside and BHP have estimated annual synergies from the merger transaction to be in excess of $400 million per annum, according to the joint release.

On completion of the transaction, the combined business is projected to generate revenue of more than $8 billion and EBITDA of $4.7 billion. Additionally, the companies expect operating cash flow of more than $3 billion.

Meg O'Neill, who was also appointed as Woodside CEO on Aug. 17 after serving as acting CEO since June, said: “Merging Woodside with BHP’s oil and gas business delivers a stronger balance sheet, increased cash flow and enduring financial strength to fund planned developments in the near term and new energy sources into the future.”

The merger is expected to be completed in the second quarter of the 2022 calendar year with an effective date of July 1.

Woodside’s financial advisers are Gresham Advisory Partners Ltd. and Morgan Stanley Australia Ltd., and its legal advisers are King & Wood Mallesons and Vinson & Elkins LLP.

BHP’s financial advisers are J.P. Morgan, Barclays and Goldman Sachs and its lead legal adviser is Herbert Smith Freehills.

Recommended Reading

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: Autonomous Drone Aims to Disrupt Subsea Inspection

2024-01-30 - The partners in the project are working to usher in a new era of inspection efficiencies.

Drilling Tech Rides a Wave

2024-01-30 - Can new designs, automation and aerospace inspiration boost drilling results?