Greg Ebel bemoans Russia’s ongoing war in Ukraine, but he recognizes Vladimir Putin’s broader geopolitical conflict with the West makes the energy his company moves more valuable to the world than ever before.

“We’ve got to find ways to transition quicker if possible,” Ebel said in an interview with Hart Energy. “But there’s Enbridge, Johnny-on-the-spot with—boom—liquids, gas, renewables and the ability to sequester (carbon). It’s all connected, and it all works.”

The new president and CEO of Enbridge, Ebel splits his time between North America’s largest midstream players’ two biggest strongholds, Alberta and the Texas Gulf Coast. Ebel called Houston home when he led Spectra Energy until it merged with Enbridge in 2017.

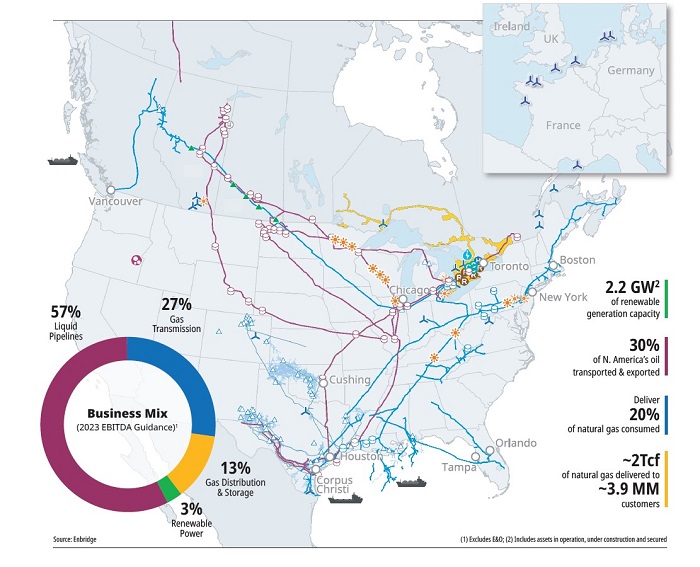

Enbridge is fulfilling its corporate name like never before, serving as the energy bridge to “keep the lights on” as Ebel likes to put it. No energy company traverses the U.S. and Canada as much, moving crude oil, natural gas or electricity to 42 states and eight Canadian provinces.

Enbridge ships nearly one-third of North America’s crude oil and almost 20% of the natural gas consumed in the U.S., as well as operating North America’s third-largest natural gas utility.

But, now, Enbridge is focused on exporting oil and LNG around the world, while also building more renewable energy in Europe. Pardon the forced alliteration, but Enbridge is increasingly moving oil and gas from Calgary and Corpus Christi to Korea and Copenhagen.

Ebel emphasized that Enbridge’s goal is being the “first-choice energy delivery company in North America and beyond,” but with a pivot increasingly on “the beyond.”

“I think you find the public outside of North America are really knocking on the door to say, ‘You guys have so much energy in North America—plenty to fuel your own future. But we need it, and we need it more than ever thanks to what’s been going on in Europe. So, please, deliver it,’” Ebel said.

Rapid growth for exports

With a market capitalization value frequently flirting with $80 billion and a workforce of more than 12,000 people, Enbridge carries at least twice the value of any of its pipeline peers with the sole exception of Houston’s Enterprise Products Partners, which is still nearly 40% behind Enbridge.

But don’t just call Enbridge a pipeline company. It is better to use the vague and gobbledygook term “infrastructure,” which is more accurate precisely because it is so broad.

“It’s a sprawling empire of midstream assets for sure,” said Hinds Howard, a portfolio manager at CBRE Investment Management. “They’re doing all things, but the collection is a sound business.”

With a steadily growing dividend and 4% to 6% annual EBITDA growth, Howard likes the totality of the proposition at Enbridge.

“They seem to have their balance sheet in a solid position to be able to do all of those things. That’s in contrast to some of their peers,” Howard said. “They’re maybe not the sexiest story out there, but they’re solid and reliable and have long-term contracts, and that’s what we like to see in midstream.”

Ebel probably does not mind that description of the company and its lack of sex appeal, personally likening Enbridge to FedEx.

“We’ll pick up your product, we’ll store it, we’ll ship it to you and then you’ll be able to use it,” Ebel said. “Maybe that doesn’t give us as much upside, but it doesn’t give us as much downside, and that allows us to be a really great long-term investment. And we’re comfortable with that.”

“The world’s a bit of our oyster right now, and I like the way things are setting up from an energy transition practicality approach.” Greg Ebel, Enbridge

But he is very bullish and excited about growth.

“We move 20% to 30% of all the oil and gas that moves in North America each and every day, and now we have the largest export facility on the Gulf Coast for liquids,” Ebel said. “And now we’re attached to five or six LNG facilities on the Gulf Coast. And now we’re actually building an LNG facility off the West Coast of Canada with our partners.”

Just last year, Enbridge invested $1.5 billion for a 30% stake in the Woodfibre LNG project in British Columbia to mark Enbridge’s first direct investment in LNG export facilities. The potential remains for further direct LNG investments in western Canada and the U.S. Gulf Coast, he said. The move came with Enbridge also planning to spend well more than $2 billion to expand the length and capacity of its T-South Pipeline system from the Montney shale gas supplies to Vancouver and, ultimately, to the Woodfibre facility once the LNG project comes online in 2027 as planned.

The Woodfibre facility is touted as the lowest-carbon LNG project in North America because it would use clean hydropower electricity to power its operations.

In 2021, Enbridge became the top U.S. crude exporter when it bought Moda Midstream and its Ingleside Energy Center by the Port of Corpus Christi in South Texas for $3 billion. Ingleside can currently export more than 1.5 MMbbl/d with plans to grow to nearly 2 MMbbl/d as more barrels flow from the booming Permian Basin and the steady Eagle Ford Shale. Enbridge is taking over control now of the long-haul Gray Oak Pipeline from the Permian to Ingleside after buying a controlling stake as well.

Enbridge even succeeded where the politicized Keystone XL pipeline project from TC Energy failed. Enbridge’s lesser-known Line 3 Replacement project carried a more boring name but actually came online in late 2021, effectively ending the longstanding heavy oil pipeline bottleneck into the U.S. The Biden administration tacitly approved of it by ignoring it.

The roughly eight-year-old, $4 billion project successfully doubled Line 3’s crude capacity from 370,000 bbl/d to 760,000 bbl/d from Alberta to Superior, Wisconsin. Despite waves of lawsuits and environmental protests and hundreds of arrests, the project still flew relatively under the radar compared to the Keystone XL plans.

With Line 3 as part of Enbridge’s huge Mainline oil network, the broader system now ships a record high of 3 MMbbl/d stretching almost 8,600 miles from the Canadian oil sands near Edmonton to the U.S. Midwest and Ontario. From the Midwest, the expanding Flanagan South and Seaway pipeline systems move the crude to the Texas Gulf Coast for refining or export.

The successful Line 3 fight, Ebel said, highlights the importance of having so many assets already in the ground. It is much easier to expand than to build from scratch.

“It was a replacement of an existing line. That’s brownfield versus greenfield,” Ebel said. “Not that it was easy to get sited. We spent a long time doing it. But it’s a darn way easier than doing everything greenfield. In a strange way, given how long it took and all the effort we had, I think it actually underlies the importance of brownfield projects.”

A ‘bicultural’ history

Initially founded in 1949 as part of Imperial Oil in Canada and named the Interprovincial Pipe Line Company, IPL grew throughout the 20th Century but did not switch to the “Enbridge” name until 1998.

Enbridge carries a long history with just a 25-year-old, Generation Z name.

But Enbridge did not firmly solidify itself as North America’s top midstream player until just six years ago with the acquisition of Houston-based Spectra in a $28 billion, all-stock deal. And Enbridge has only grown from there.

As the CEO of Spectra, Ebel negotiated the deal with recently retired Enbridge chief executive Al Monaco. Ebel stepped into the non-executive chair role at Enbridge in 2017 and stayed there until replacing Monaco on Jan. 1. Monaco spent 27 years at Enbridge and retired at the end of 2022 after nearly 11 years as CEO.

Ebel, 58, acknowledged it is “unusual” to—years later—take over the company that acquired his own. One factor, he said, might be his relative youth as a 40-something CEO previously at Spectra.

“Al and I worked very closely with the management team here creating this strategy, so we’re hand-in-glove in producing that,” Ebel said. “It’s a bit of a unique situation but obviously one the board felt was the right way to go, and I was thrilled to assist when asked.”

A native of central Canada, Ebel considers himself “bicultural” as a dual citizen who has spent much of his career in the U.S. He studied economics and public policy at York University in Toronto and worked with the Canadian government, the World Bank and the International Finance Corp. before finding his way into the energy sector. During this time, he helped work on the privatization of Petro-Canada and saw firsthand some of the bureaucratic inefficiencies of government control, he said.

“I learned a ton from the government and how hard it is to get policy or get anything done. That’s been really valuable,” he said.

In fact, in his most recent earnings call while complaining about pipeline permitting issues, Ebel said the biggest impediment to growth is government, not prices: “Permitting, permitting, permitting, not commodity, commodity, commodity.” Canada and the U.S. East Coast stand out the most.

While working with the World Bank though, Ebel crossed paths with and then decided to join Westcoast Energy, a Canadian pipeline company that came from Petro-Canada that was then doing some business with him in Indonesia.

In 2002, U.S. utility giant Duke Energy acquired Westcoast—and Ebel.

Then came the Enron scandal and the ripple effects of many utility and pipeline companies decoupling. Ebel was leading Duke’s mergers and acquisitions operations. But, in 2007, Duke spun out the gas transmission business as the brand new Spectra Energy.

Ebel started out as Spectra’s first CFO but, just over a year later amid the financial crisis, he was named CEO. “It’s one of those things where crisis breeds opportunity,” he laughed.

While the crisis was tough on the sector, the timing also coincided with the shale boom. “We continued to grow during that very difficult time,” he said.

In just a decade of existence, Spectra built about $20 billion of pipeline and storage projects in Canada and the U.S., specifically the Northeast, Appalachia and Texas.

Having known Monaco dating back to his Westcoast days, they continued to have conversations. Eventually, a deal was struck. “These things—for a deal of that size—take a lot of discussions over a lot of years.

“It was a very solid deal—a true win-win—which you don’t always see,” Ebel said. “It was 100% equity, so no one was adding any debt. It was a relatively low premium, but both companies—if you think about everything that’s happened since 2017—have really been able to do better than they would have done alone. Going forward, we’re just accelerating that further.”

Embracing the transition

Enbridge’s acceleration includes new projects announced as recently as March.

Enbridge will build upon its U.S. crude oil artery by aiming to add 95,000 bbl/d of capacity to Flanagan South, carrying more crude to export south of Houston.

As such, $240 million is newly dedicated to build a new Enbridge Houston Oil Terminal with 2.5 MMbbl of crude storage capacity with the potential to expand up to 15 MMbbl.

Enbridge still has a noncontrolling partnership with Enterprise Products to build the first deepwater, crude-exporting hub offshore Texas, the Sea Port Oil Terminal, called SPOT. The terminal is proposed to be built about 30 miles offshore of Freeport, which is due south of Houston. The deeper water depths offshore are needed for very large crude carriers to load up to capacity. SPOT could load 2 MMbbl/d, handling two very large crude carriers simultaneously.

As for LNG, Enbridge just bought the Tres Palacios gas storage hub west of Freeport for $335 million, specifically to help service LNG facilities along the U.S. Gulf Coast with 35 Bcf of storage across three nearby caverns.

And that leads us more into the energy transition as Enbridge continues to lean into renewables, carbon capture and storage, and hydrogen projects. Enbridge just spent $80 million to buy a 10% stake in Divert Inc. as they pledged to spend $1 billion to expand the food waste-to-renewable natural gas facilities.

“Renewable natural gas—let’s not forget about that,” Ebel said. “Moving things like food waste into renewable natural gas and blending that into the systems—both in homes but also into our mainline systems.”

As for renewable energy, Enbridge last year bought the U.S. wind and solar developer Tri Global Energy. In November, Enbridge partnered to bring online the Saint-Nazaire Offshore Wind Farm, the first wind project offshore of France. Enbridge now has wind farms in France, Germany and the U.K., apart from the U.S. and Canada.

Next up, Ebel said, are carbon capture and hydrogen projects. The Inflation Reduction Act is better incentivizing U.S. projects, while the Canadian government is making headway, but is not quite there yet, he said.

Enbridge is partnering to develop a low-carbon hydrogen and ammonia production and export facility at Ingleside. And, more recently, Enbridge teamed up with Occidental Petroleum Corp. to develop a carbon capture sequestration hub in the Corpus Christi area.

West of Edmonton, Enbridge is developing the Open Access Wabamun Carbon Hub with partners.

Citing the fairytale, Ebel said, “It’s a bit of a Goldilocks world” —a mix of oil and gas solutions for near-term challenges and greater incentives for longer-term renewable energy options.

Essentially, the world needs an energy porridge smorgasbord of hot, cold and just right.

If anything, Ebel said, Russia’s invasion has seemingly ensured that “the world is now focused on a practical energy transition as opposed to a perfect energy transition.” That means saying all-of-the-above energy solutions and really meaning it.

From Ebel’s perspective, Enbridge is perfectly positioned to answer the call on all of those fronts.

“The world’s a bit of our oyster right now, and I like the way things are setting up from an energy transition practicality approach.”

Recommended Reading

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

Well Done Foundation Wins California Orphan Well Project

2024-02-12 - Nonprofit Well Done Foundation will plug orphan wells in Santa Barbara County, California, starting in Orcutt and Santa Maria.

Range Resources Expecting Production Increase in 4Q Production Results

2024-02-08 - Range Resources reports settlement gains from 2020 North Louisiana asset sale.

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.