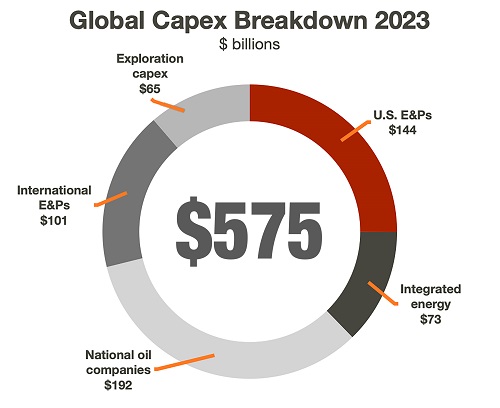

Global capex will increase to $575 billion, which is well shy of what is needed to meet long-term oil and gas demand, analysts say. (Source: Shutterstock.com)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

U.S. upstream capex will increase to about $144 billion in 2023, AllianceBernstein said in a Jan. 13 report. That represents a 15% rise over 2022. U.S. onshore capex is projected to go up by 16%.

Overall E&Ps are still being stingy — spending is roughly on par with outlays from more than a decade ago, which should provide support for oil prices in the $75 to $80 range, according to the report.

Globally, capex will increase to about $575 billion in 2023, Bernstein said, but that figure is well below what is needed to meet long-term oil and gas demand. The amount includes $65 billion for exploration, while the analysts estimate that an incremental $75 billion is needed, even in a rapid energy transition. That adds up to an underinvestment of about $500 billion in exploration from 2016 through 2023.

“Adjusted for inflation, the upstream sector is investing in supply at ’05-’09 levels and real capex per flowing barrel is near a 20-year low,” the analysts said in the report.

Bernstein’s estimate was more optimistic than S&P Global, which predicts an increase of about 10%, based on both lower oil prices and inflation compared to 2022 levels. Moody’s Investors Service expects a 10% to 15% increase in capex, according to its Jan. 5 forecast.

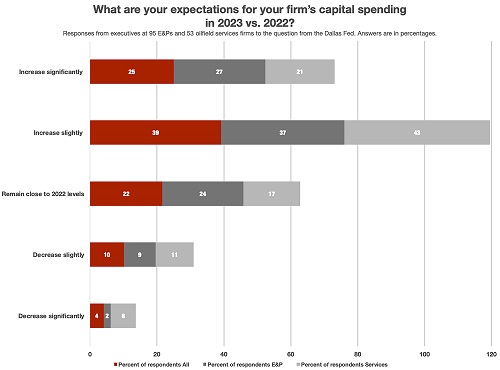

The Dallas Fed’s survey of oil and gas executives found that 63% expected capital spending to increase either significantly or slightly in 2023. Only 4% of those responding expected a significant decrease in capex.

Capital discipline

In reviewing prior forecasts, Bernstein said it overestimated global development capex by about $100 billion a year, based on assumptions of how the industry would respond as crude oil prices rise. The sector reinvested just over 30% of cash flow into supply in 2021-2022, compared to 55% in 2017-2019. Meeting global demand in 2022 required tapping oil inventories to compensate for underinvestment in supply.

In Bernstein’s model, a $5 move in the Brent price drives $20 billion to $25 billion in development capex, while a 1% move in the national oil company reinvestment rate drives $5 billion to $10 billion of spend.

For investors, continuing that spending model could be a plus. As Bernstein noted, “capital discipline and underinvestment are structurally supportive to price and free cash flow.”

“We believe that, left unaddressed, underinvestment in supply should continue to provide positive support to crude price at the $75-80 level,” the analysts wrote. “Longer-term, either capital discipline breaks (we fail to see where geographically or at an asset level) or price breaks (upward).

“We continue to believe the upstream sector can offer attractive returns for investors and operators willing to put capital to work,” they added.

Recommended Reading

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

Trio Petroleum to Increase Monterey County Oil Production

2024-04-15 - Trio Petroleum’s HH-1 well in McCool Ranch and the HV-3A well in the Presidents Field collectively produce about 75 bbl/d.

Trillion Energy Begins SASB Revitalization Project

2024-04-15 - Trillion Energy reported 49 m of new gas pay will be perforated in four wells.