The Dallas Fed’s first quarter survey of oil and gas executives reveals concerns over inflation, growth and future uncertainty. (Source: Tallmaple/Shutterstock.com)

Growth has stalled, production is sluggish, costs are up and oil and gas executives are grumpy, the Federal Reserve Bank of Dallas reported in its first-quarter energy survey on March 29.

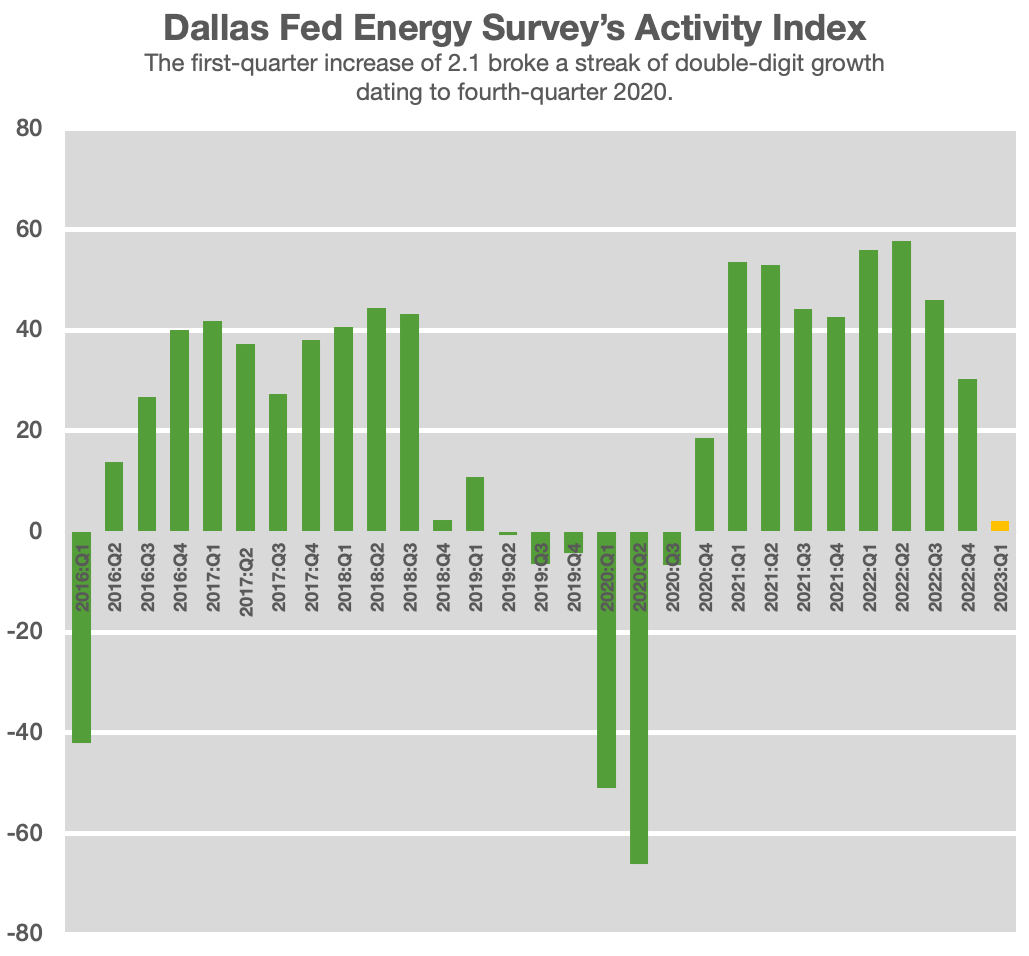

The business activity index plunged to 2.1 in the quarter from 30.3 in fourth-quarter 2022, indicating that activity grew little in the first three months of the year. For more than two years, activity had been on the rise in double-digits, and the drop, based on responses from energy executives, is due to the cloud of uncertainty hanging over the industry. The index is the survey’s broadest measure of conditions facing energy firms in Texas, northern Louisiana and southern New Mexico.

Inflation and the health of the global economy will have the most influence on profitability this year, executives at 136 oil and gas companies said in response to the Dallas Fed’s survey earlier this month. Access to and the cost of capital, government regulations and supply chain issues ranked further down the list.

Comments by executives reflected uncertainty colored by dread:

- “It is extremely difficult to plan for the future with so much of the base data we are used to using being all over the board. Seems like business patterns go against trends proven over the last 30-40 years in the oil and gas industry as a whole and the oil and gas service business specifically.”

- “Outside investors seem to be losing interest in hydrocarbons. The worldwide macroeconomic and political outlook is cloudy. The road ahead looks difficult but passable. We expect another ‘muddle through’ period in a cyclical business where more players will be winnowed out.”

- “Oilfield inflation has to be the No. 1 problem. Capital expenditure increases are soaring well past consumer price index data. I’m noticing apparent quality problems beginning to plague new projects; specifically, I’ve never seen so many cases of parted tubing with new tubing, particularly with poor quality collars, as I’m seeing in recent months.”

Price Outlook

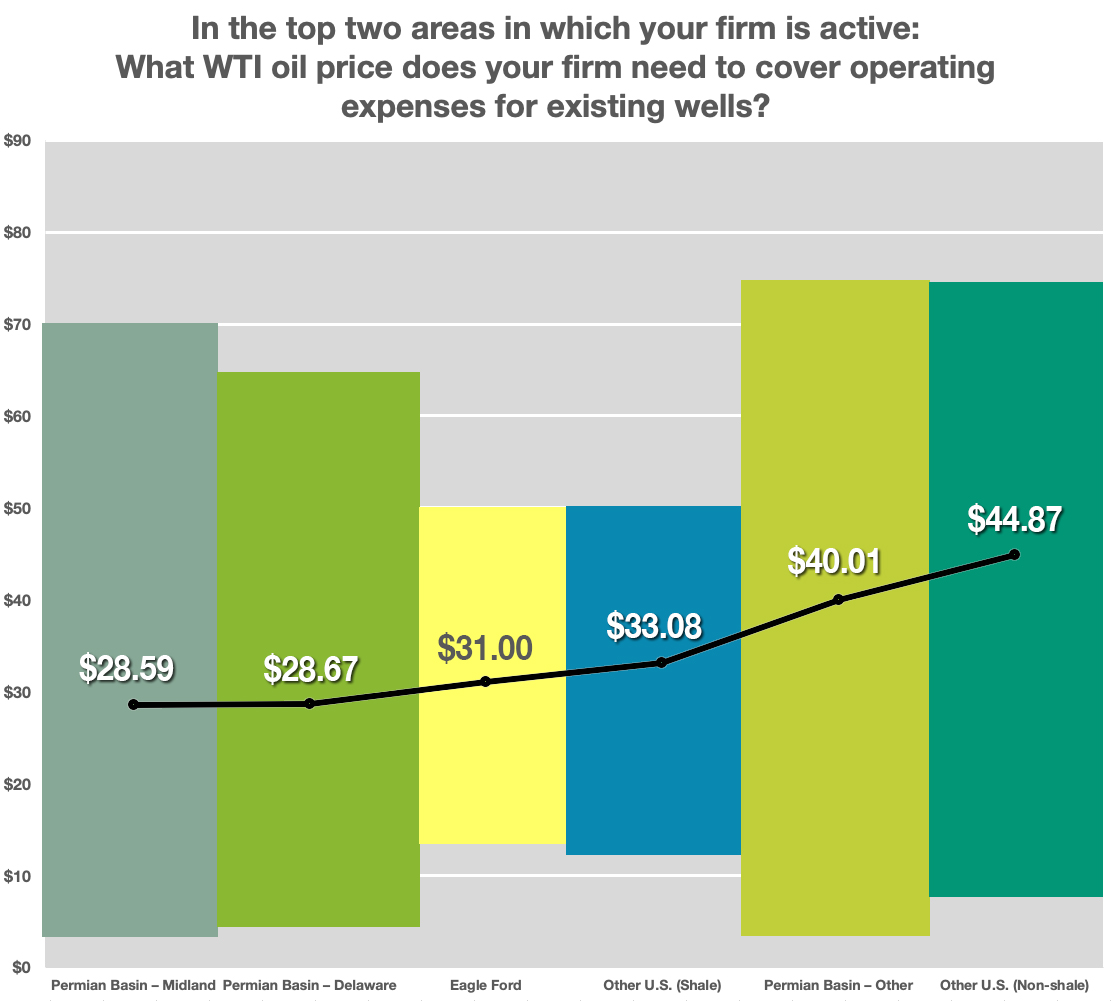

Across the regions where the surveyed companies operate, the average WTI price needed to cover operating expenses for existing wells ranging from a low of $29/bbl in the Midland Basin to $45/bbl in U.S. non-shale areas. The average price of $37/bbl was up from $34/bbl in 2022.

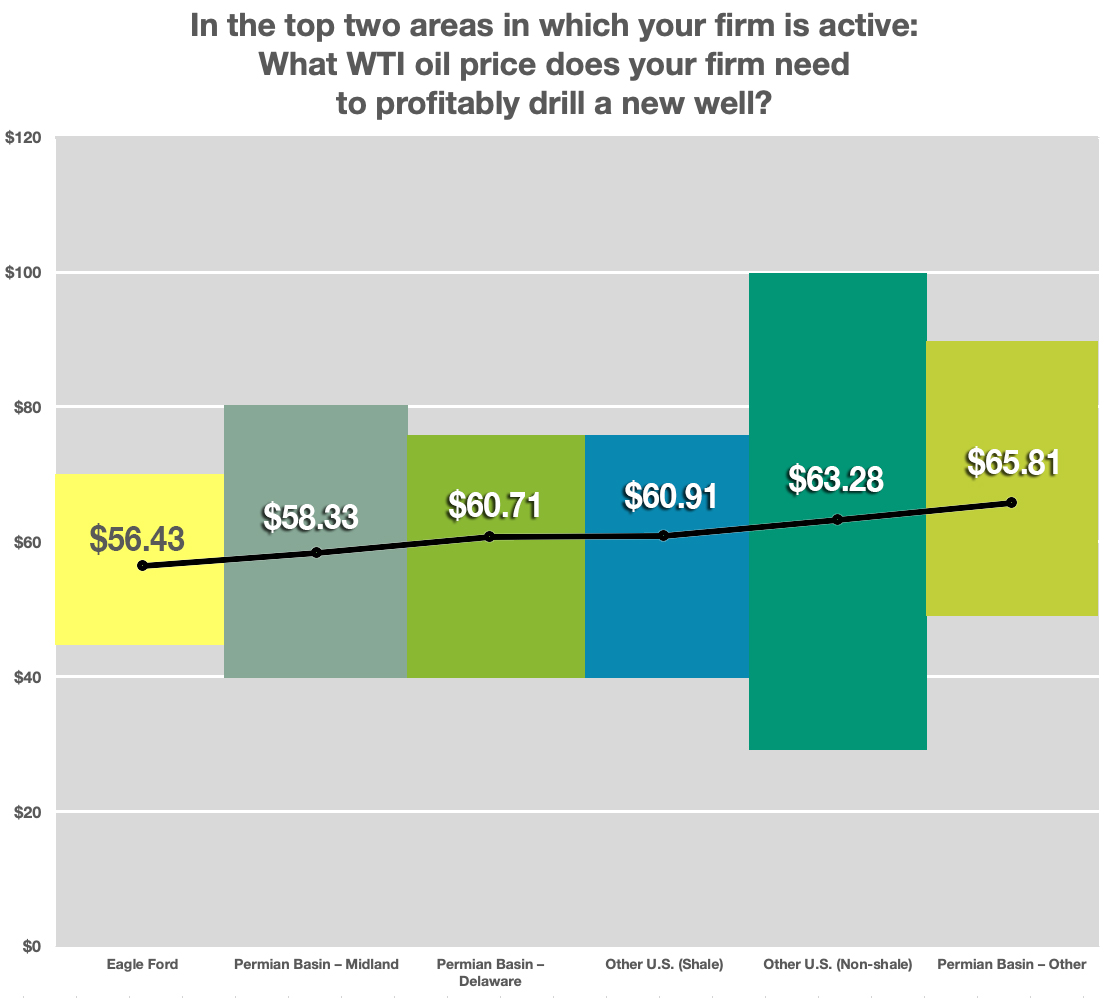

The price of WTI needs to be $62/bbl, on average, to warrant drilling a new well, executives who were surveyed said. That price is above the $56/bbl average of last year. Average breakeven prices across the regions in the Permian Basin and Eagle Ford and elsewhere range from $56/bbl to $66/bbl. In the Permian Basin, the $61/bbl average is $9/bbl higher than last year.

Size does matter when it comes to breakeven pricing. For large firms that produce 10,000 bbl/d or more, the average is about $55/bbl across all regions. Smaller companies require a WTI average price of $64.

Comments from executives on pricing:

- “Oil price correction is adding pressure on the continuation of drilling and frac activities. [We] expect the activity level to be flat to down in 2023 versus 2022’s exit.”

- “Service costs and authorization for expenditures keep climbing. The latest commodity price action feels like the sword of Damocles is back; where is oil going to bottom this time?”

- “Overall, prices have impacted the revenue but not yet costs. We are still waiting for costs to catch up with the new pricing levels. We do not expect prices to increase significantly.”

Recommended Reading

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.