Presented by:

[Editor's note: A version of this story appears in the January 2021 issue of Oil and Gas Investor magazine. Subscribe to the magazine here.]

It’s hard to believe, but it’s been 40 years since George Mitchell, the father of the shales, drilled his famous C.W. Slay #1 in Wise County near Fort Worth, proving the concept that the Barnett Shale can produce gas. And it was 30 years ago, in 1991, that Mitchell Energy & Development Corp. drilled the first horizontal well to the Barnett, proving that this shale could produce a lot of gas.

Those pioneering acts ushered in the U.S. shale revolution that is still transforming global oil and gas markets. U.S. dry gas production reached 93.1 Bcf/d in 2019, largely from horizontal wells drilled into shales around the country. It’s a performance trifecta: the EIA says U.S. gas production, demand and gross exports hit all-time highs in 2019. Exports alone rose an impressive 29% to 12.8 Bcf/d.

We can thank the Barnett Shale, the grand daddy of gas shales, for that. Mitchell’s discovery excited explorers, encouraging them to fan out across the oil patch, where they found even richer gas pays in the Haynesville, the Marcellus and more. “Find me another Barnett,” CEOs said.

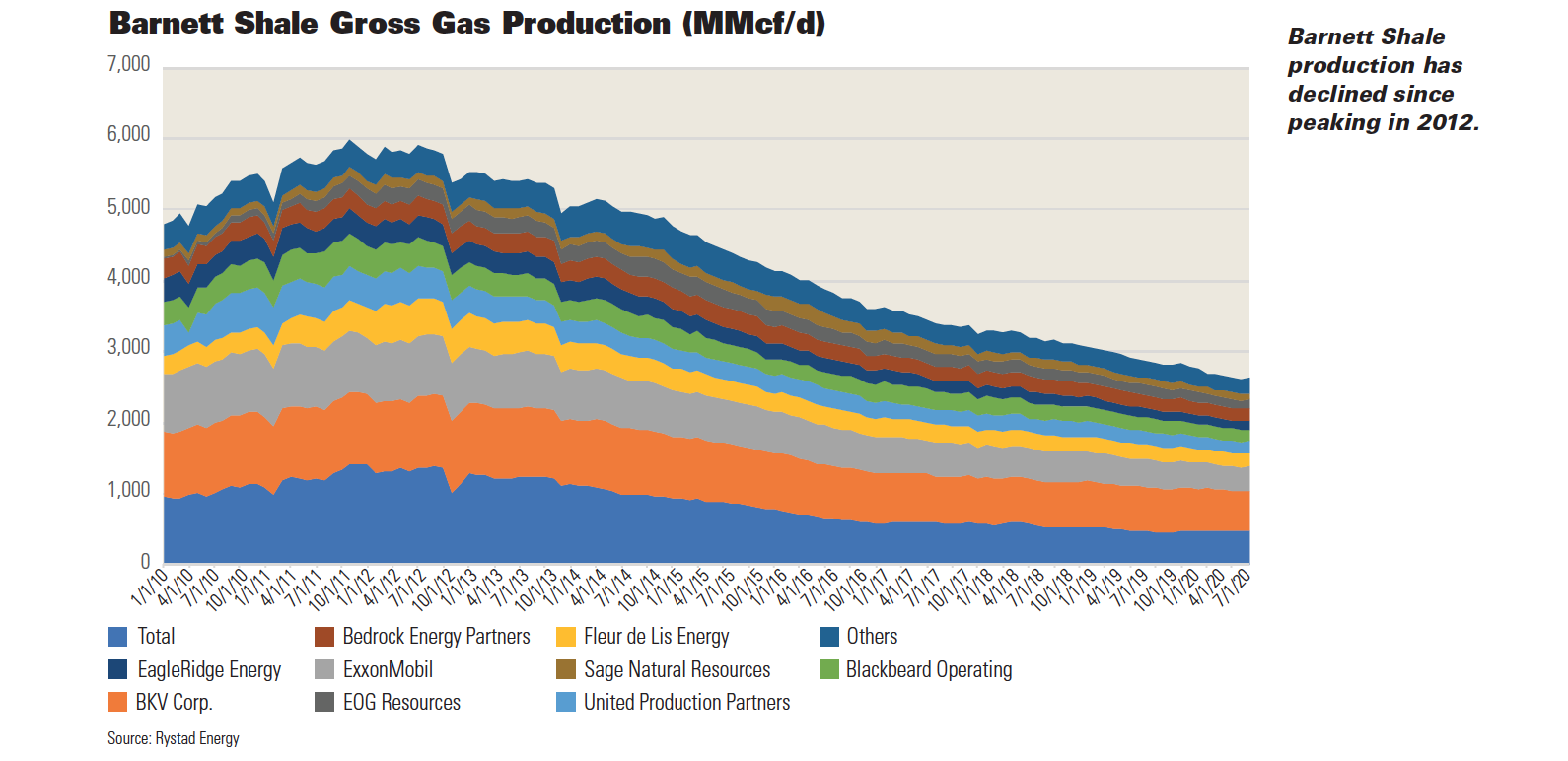

When it peaked in 2012, the Barnett, designated the Newark East Field, was producing 5.7 Bcf/d from Johnson, Tarrant, Wise, Parker and other counties in North Texas. Its productive area spanned over 5,000 square miles in 18 counties. At its height there were 194 rigs working in the play—fueled by impressive flow rates at the wells, but $12 gas prices fanned the flames. Barnett drivers now

Production in every play declines over time, the Barnett being no exception. It’s producing about 2.6 Bcf/d today, about half what it was at the peak. It declines 7% to 9% annually, according to Artem Abramov, partner and head of shale research at Rystad Energy.

Activity has slowed as the play matured, operators have gone elsewhere, and low gas prices stymied incentives to drill. In mid-November2019, not a single horizontal rig was drilling in the play, quite a comedown from the heyday, when there were more than 100 operators of record and frenzied leasing deals and joint ventures were announced regularly. At one time, Chesapeake Energy Corp. even drilled on a lease under the DFW airport.

Despite its maturity though, the play still has more to give, and some producers remain interested in its long-life reserves. The University of Texas’ Bureau of Economic Geology said in a February 2013 study that the playholds 44 Tcf of recoverable reserves—and that was the estimate before the advent of extended reach laterals of up to 2 miles and the latest completion techniques that might unlock even more gas.

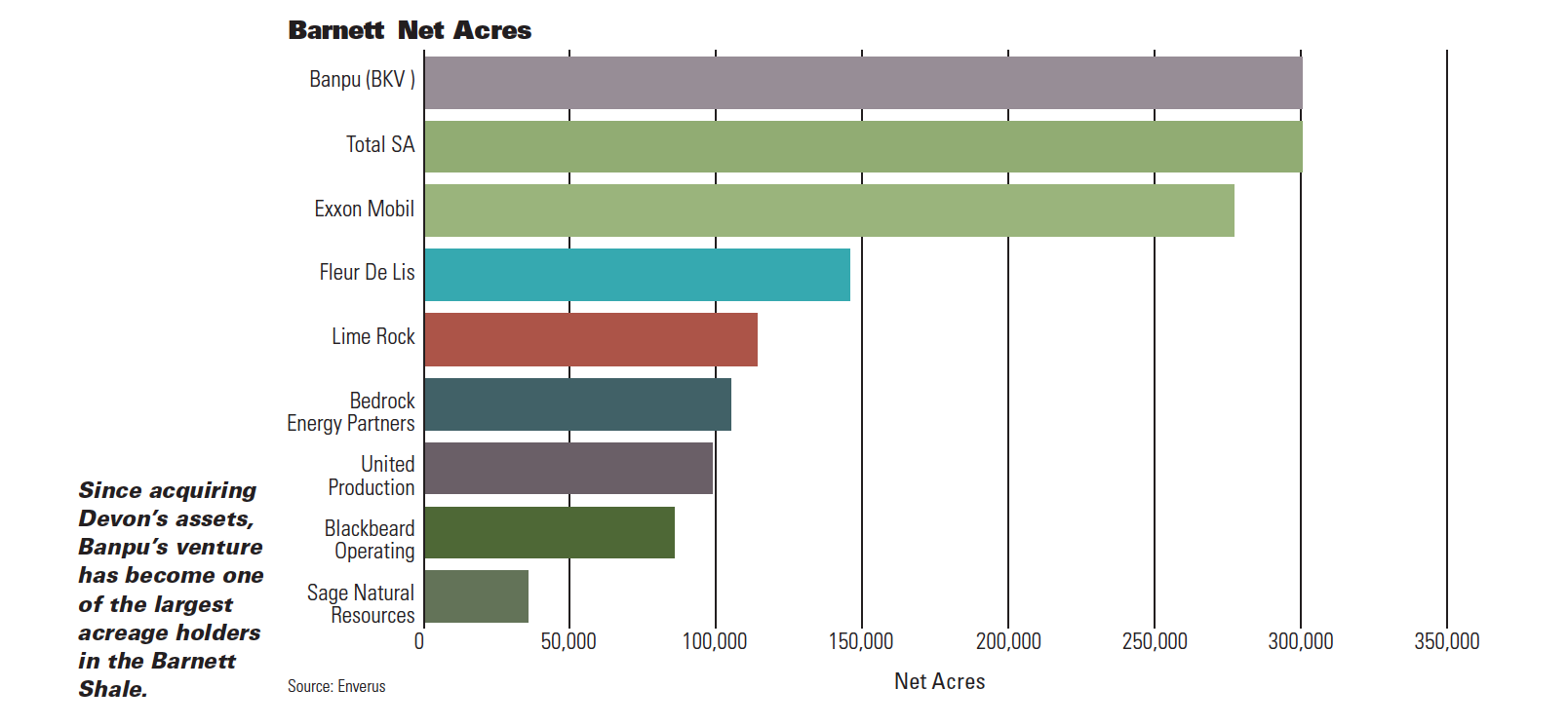

While some of the biggest Barnett producers have left the scene (including Barnett leaders like Chesapeake and Devon Energy Corp.), others have bought in. It illustrates the classic life cycle of a shale play. Proved developed producing reserves (PDP) are the main attraction now. Further development hinges on the strategy of the newer players, natural gas prices and the feasibility of refracking old wells with the latest techniques.

“We think there’s more upside to gas prices than the current 2021 strip shows, so there’s potential for rig growth in the coming year,” said David Dubetz, energy analyst for East Daley Capital.

“We’re seeing some evidence of this already as [Barnett] applications for permits to drill more than doubled from 2Q to 3Q …,” he told Oil and Gas Investor. (Most permits were for vertical wells, however, and from private operators. But Total has filed for 22 horizontal permits, according to Texas state data.)

“If those are drilled, the Williams and Summit Midstream G&P systems will see volume growth,” Dubetz said. He pointed out that Exxon Mobil Corp., the basin’s only super-major, said in December that it will halt activity in its U.S. gas basins, which would be a downside for Energy Transfer Partners LP’s Godley gas plant, which gathers about 30% of the latter’s gas production, he said. He forecasts that the Barnett’s output will decline another 7% in 2021 from its productive level of 2020.

“We’ve seen some re-frack programs in the last five to seven years, but they were hardly sufficient to limit the decline rates,” Rystad’s Abramov told Oil and Gas Investor. “The play offers some cheap infill drilling options (not very productive, but shallow and cheap wells), but even the best remaining sweet spots can’t compete with the Tier 1 inventory in Appalachia and the Haynesville.

“This is one of the main reasons you do not see any dedicated shale gas names in the list of top 10 Barnett producers these days.”

Changing of the guard

Private-equity players think that the Barnett’s PDPs are undervalued due to lack of interest, thus setting up buying opportunities, Abramov noted. PDP is seen as a safe investment idea, an annuity of sorts. And, one has to wonder: How many of the historic play’s wells were drilled years before extended-reach horizontals and new fracturing techniques came along, the very factors that now propel big gas output from the Haynesville and Marcellus, and indeed, associated gas in the Permian Basin? There is possibly some upside if technology unlocks new commercial opportunities in the future.

One operator seeing the opportunity, Chris Kalnin, has gone all in. Before now, his company, BKV Corp., has focused on the Marcellus gas play in the Northeast, growing there through several acquisitions. But last fall, BKV Corp. joined with Thai company Banpu to form BKV Barnett LLC to enter another play outside of Appalachia, the Barnett.

They closed their deal in October 2019 to buy the Barnett assets of Devon Energy Corp. for $570 million in cash and up to $260 million in contingency payments, to be paid over the next four years, based on oil and gas prices, with $2.75/Mcf at Henry Hub the trigger.

Devon had grown in the play when it acquired Mitchell Energy & Development Corp. in 2001, when former chair Larry Nichols recognized that “something was up” in Mitchell’s North Texas holdings. That landmark deal helped kickstart the Barnett boom, and the play became one of Devon’s most important assets for many years. It liked it so much that in 2006 it paid another $2.2 billion to bolster its Barnett position when it acquired Chief [Oil & Gas] Holdings LLC.

Now, BKV Barnett manages that old production, which averaged 600 MMcfe/d net in third-quarter 2019 following Devon’s 18-year run.

“We look forward to continuing the wonderful work Devon has established in the Barnett and expanding our investments to deliver high-quality gas production for many years to come,” said Kalnin at the time of the deal closing.

His immediate plans now that he’s the largest Barnett producer might be considered cautious, if not ironic.

“I do not see us drilling any wells in the Barnett in 2021,” Kalnin said. “Instead, ’21 is a massive learning and data analysis year for us. We’ll do our homework, establish a baseline and develop a plan. But do we have inventory? Absolutely.”

Why the Barnett?

He said Kalnin took almost a year to study the Barnett as part of its normal M&A due diligence process, after deciding it was time to expand outside of the Marcellus. He said the Kalnin M&A team “watches the market likes hawks and looks at everything that is gassy.” In his words, their process “is incredibly vigorous,” including developing up to a 100-page book on a play that it’s considering. Kalnin also brings in consultants to conduct peer reviews of the company’s evaluations and processes.

“I’m an ex-McKinsey guy, so I’m obsessed with strategy and thinking about what’s going to happen in the marketplace next,” he said.

“We studied the market for over a year after forming in 2016 and that led us first to Pennsylvania. We had concluded gas was going to go big from a demand side. Second, we looked at what I call ‘the arc of pain’ or the midstream constraints that we saw would be a major issue all over the country. That elevated the Barnett because it has a lot of infrastructure, and it’s close to some demand centers.”

Kalnin determined the Haynesville fit some of these criteria, but the prices the market was asking there in 2018 and early 2019 “were insane,” so he took a pass.

Finally, Kalnin said he looked at risk and return in the same sentence. That reinforced a company decision to go after PDP reserves such as the Barnett.

“We looked back at what we’ve done by developing PUDs vs. acquiring PDP, and we found that acquiring PDP was way better. We showed our board that on a risk-adjusted basis. That convinced us to chase PDP-heavy deals.”

What he also liked about the Barnett was its wealth of data from literally thousands of wells, “and that it had been nicely taken care of” by Devon. His team even scattered about the play to take photographs of every pad. “We did the work, we saw the opportunity, we did the research, it had access to demand and critical mass.”

The plan now

Kalnin is cautious on the future of natural gas prices, believing there is going to be an oversupply coming out of 2021 and going into 2022. Recent higher gas prices have encouraged a few more rigs to drill in gas plays, and as the industry recovered from the pandemic in 2021, he expects more supply to surface.

“We have two main initiatives,” Kalnin said. “One is to spend on capital efficiency projects where if you put in a dollar, you get it back quickly. The second thing is, study, study, study. We’ll look at this basin with fresh eyes. What people forget is that information is flowing in constantly, and we’ll see whether there are additional zones we can target, or refracs we can do.”

BKV Corp. typically spends about a third of its EBITDA on capital projects, he said, with the rest distributed back to its investors—or to build up a war chest for the next deal. The Barnett projects will include putting in more artificial lift equipment and using algorithms to automate these systems. Kalnin will try different sands in completions and different tubing settings and optimize gas compression as well.

“Right off the bat, of the 2,000 horizontal wells we have, at least 10% were sub-optimally completed, and the remainder we are still studying. We’re actively exploring that right now,” he said.

Of the ins and outs of the Barnett deal, Kalnin said, “Someday I’m going to write a book.”

Other recent results

The best wells in the Barnett were mostly announced years ago when the play was new, but good wells are still possible. TEP Barnett USA, a unit of France’s Total, unveiled a well in January 2020, the #3 Carden-Heidi-Little, with an IP of 6.17 MMcf/d in Tarrant County. Total entered the play via a joint venture with Chesapeake in 2009 and added to that in 2016 when it took over 100% of the joint venture assets as Chesapeake exited. TEP now has over 2,800 wells on some 750 pad sites and 200,000 mineral acres.

In November 2018, ConocoPhillips exited the Barnett by selling its assets there to LimeRock Resources, the E&P arm of the private equity firm, for $230 million. Lime Rock has made a business out of acquiring production—through 2019, its cumulative purchases have been 72% PDP, so the Barnett fits right in. The Barnett position it acquired, 114,00 net acres in four counties, was liquids rich and flowing cash. Production had averaged about 9,000boe/d, 55% gas and 45% NGL, before the deal closed that year.

Lime Rock Resources reported four wells in Denton County in January 2020, the Shifflet wells on the Crawford pad, each with 1.5-mile laterals. Their average IPs ranged from 4.4- to5 MMcfe/d.

Privately held Fleur de Lis operates about 1,000 wells in the Barnett on 146,000 acres spread over Johnson, Tarrant and Parker counties. It reports less than a 10% annual decline and a recent production rate of 210 MMcfe/d. The assets were acquired in 2018.

Several other private operators continue to manage Barnett assets, and they wait for the time natural gas prices move high enough to justify more capital spending. Meanwhile, the play contributes nearly 3 MMcf/d to U.S. gas production.

Recommended Reading

Keeping it Tight: Diversified Energy Clamps Down on Methane Emissions

2024-04-24 - Diversified Energy wants to educate on emission reduction successes while debunking junk science.

Exclusive: Scepter CEO: Methane Emissions Detection Saves on Cost

2024-04-08 - Methane emissions detection saves on cost and "can pay for itself," Scepter CEO Phillip Father says in this Hart Energy exclusive interview.

Exclusive: Rebellion Energy Orphan Well Method Pinpoints the Particulars in Plugging

2024-03-01 - Rebellion Energy Solutions CEO Staci Taruscio dives into the company's methods when plugging for permanence in this Hart Energy LIVE Exclusive with Editorial Director Jordan Blum.

Darbonne: ESG, ‘Oh So 2022,’ Reduced to Table Stakes?

2024-02-11 - ESG champion BlackRock is paring, while Exxon Mobil’s growing. Today, ESG is just table stakes.

Qnergy Tackles Methane Venting Emissions

2024-03-13 - Pneumatic controllers, powered by natural gas, account for a large part of the oil and gas industry’s methane emissions. Compressed air can change that, experts say.