(Source: Shutterstock.com/Hart Energy)

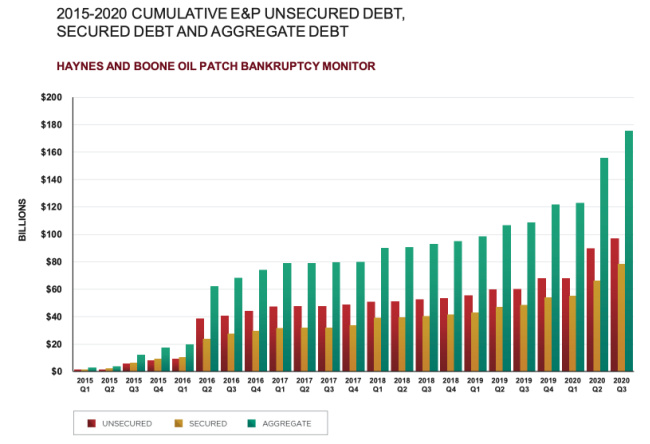

With North American E&P bankruptcy filings rising, the amount of associated debt has skyrocketed along with it as larger companies join smaller ones seeking protection, according to data from Haynes and Boone LLP.

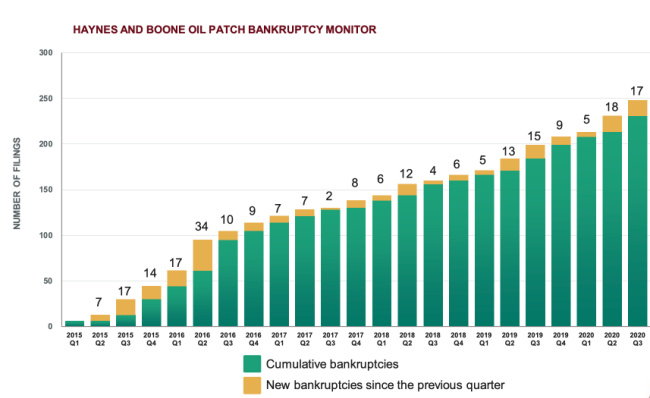

The law firm, which has tracked bankruptcy filings among E&Ps since 2015, reported that 17 producers filed for bankruptcy during the third quarter this year. When added to the 23 others filed earlier this year, the total represents a 21% increase compared to the first nine months of 2019. The figures, however, are not as high as the 61 filed during the first three quarters of 2016 when a drilling surge led to an oil supply glut and the subsequent steep fall in oil prices.

Charlie Beckham, a partner in Haynes & Boone, pointed out during a recent webinar that there is still another quarter remaining. “There are more to come—so, a very stressful time in the industry with respect to the number of cases that have been filed,” he said during the firm’s recent U.S. tight oil and gas outlook webinar.

RELATED: US Shale Reinvestment Rate Falls

As the number of bankruptcies grows, debt also continues to accumulate. Haynes and Boone’s Oil Patch Bankruptcy Monitor shows bankruptcies with more than $50 billion in debt so far this year. Speaking on the rising amount of debt in jeopardy, Beckham explained that “some of it is because the companies that have filed in 2020 have been some of the larger companies that have been around for a while.”

The firm also looked into bankruptcy exits. Some companies are finding it “far more difficult to get home this time,” Beckham said.

“Unlike in 2016 and 2017, we’re seeing material impairment of the RBL (reserve-based loans) across the board,” he said, adding back then the industry typically saw a reinstatement of the RBL and no impairment. “There may have been a borrowing base holiday to allow for prices to recover and sometimes those holidays were as long as two years.”

The expectation was that oil prices would be $70/bbl or higher by 2019 and 2020 and those over-leveraged in 2016 and 2017 would be now returning to borrowing base compliance on their RBL, he explained.

That “simply is not the case,” he added, referring to a sampling of key E&P Chapter 11 exits this year. “Some of them are debt-to-equity conversions with some impact on the RBL, but some of them were simply finding 363 sales as the exit strategy” and selling their assets.

As capital flees the market, however, assets are being sold for much less than they were acquired and purchase prices have fallen.

“Gavilan (Resources), mind you, was put together in 2017 and assets were acquired for $1.13 billion,” Chapman said. “Gavilan filed Chapter 11, unable to successfully reorganize, and has now sold its assets for $50 million.”

Borrowing Bases Views

This comes amid the bi-annual redetermination of how much credit producers could get from lenders. A Haynes & Boone survey shows respondents believe borrowing bases could see a 10% to 20% reduction, said Buddy Clark, a partner in the firm’s energy, power and natural resources practice group.

“That is an improvement, albeit not necessarily in a positive side of the ledger, but it’s an improvement from the decreases that were expected last spring. And obviously, everyone still painfully remembers what happened last March when prices totally collapsed with the Saudi-Russian food fight on oil prices. And not to mention … the impact of the pandemic, which has severely depressed demand across the board worldwide. So, for expectations of this fall borrowing bases and to be only down 10 to 20%, that’s a net positive.”

He later added that banks are giving little credit to associated undeveloped acreage or DUCs.

“They’re basically only crediting proved developed producing acreage. And as that naturally declines, borrowing bases—all things being equal—would naturally decline as well,” Clark said. “So, it remains to be seen where borrowing bases fall out this season. But I think consistent with our poll and consistent with the bank price decks, it would be reasonable to expect no substantial increases in borrowing bases and perhaps some decrease in the 10 to 20% range.”

Generating Capital

Most of the survey respondents expect to generate capital from operations.

“Capital, which used to be freely available either from the equity side, public debt side and bank side, seems to be much more constrained,” he said. “People are expecting to see a significant decrease, or at least not much access to a third-party capital, otherwise known as other people’s money—OPM—in the industry.”

As for business models, the odds may be against E&Ps with the “buy-and-flip mentality” in today’s market environment.

“The concept of giving a management team an allowance of $200 million to acquire some leases, drill a couple of wells and flip it for 5x return. That’s great if you can get it,” Clark said. “That business model, if not broken, is way back on the shelf.”

He foresees the return to what he called an old-fashioned model of putting sweat equity into the business—building it well by well and developing it over years to create value.

For companies who can live within cash flow but are having difficulty selling at a profit, Clark suggests hunkering down for now.

“And when the storm passes, then you take advantage of the opportunities,” he said.

Recommended Reading

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Scotland Ditches 2030 Climate Target to Cut Emissions by 75%

2024-04-18 - Scotland was constrained by cuts to the capital funding it receives from the British government and an overall weakening of climate ambition by British Prime Minister Rishi Sunak, said Mairi McAllan, the net zero secretary for Scotland's devolved government.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

EIA: Permian, Bakken Associated Gas Growth Pressures NatGas Producers

2024-04-18 - Near-record associated gas volumes from U.S. oil basins continue to put pressure on dry gas producers, which are curtailing output and cutting rigs.