Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

In the heyday of the shale boom, a Houston-based oil and gas company began targeting investors through Asian newspaper, TV and radio ads.

At seminars, the cheerful Bingqing Yang, a Chinese citizen and U.S. permanent resident who founded Luca International Group LLC, gave a compelling pitch. In part, the company enticed Chinese citizens with the opportunity to obtain a green card by making U.S. investments.

Luca told potential investors it had cracked the code in the oil and gas industry. The company promised investors an annual return of up to 30% and that it would ultimately quadruple an investment over a 20-year span.

The U.S. Securities and Exchange Commission (SEC) says in a federal lawsuit the investment was largely fiction. Luca has since filed for bankruptcy and a court-ordered sale of its assets is underway.

Rather than earning profits, as investors were told, Luca was “sinking under a mountain of debt,” the SEC said in a July press release. On the side, Yang was using investor funds to take her children to private school and keep the grounds at a $2.5 million house, a federal suit says.

All told, Yang, Luca’s founder, CEO and president, raised $68 million to acquire, develop and exploit oil and natural gas wells in Texas, Montana, North Dakota and elsewhere, the SEC said.

By the time the company filed for bankruptcy in August, Luca International had whittled nearly $70 million in investments down to $8,173.55, federal court filings show.

In July, the SEC filed a complaint against Luca, accusing Yang and her company of running a “Ponzi-like scheme and affinity fraud that targeted the Chinese-American community in California and investors in Asia.” Japanese investors contributed about $30.8 million.

The SEC accuses Yang and various Luca executives with multiple violations of the Securities Act and Securities and Exchange Act. No criminal charges have been filed.

On Oct. 21, some of the company’s assets in Iberville and Ascencion parishes in Louisiana were put up for sale. Production consists of about 150 barrels per day of condensate and 1.8 million cubic feet per day of natural gas.

The sale is expected to close Dec. 16, according to OFSCap LLC, an energy investment and merchant bank handling the transaction. Final sales are subject to approval by a bankruptcy court.

With $2.6 million in assets, creditors may find it difficult to collect.

Trappings

Yang surrounded herself in the trappings of success.

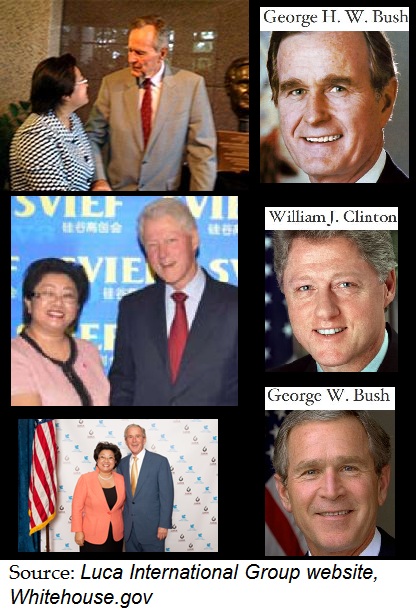

She posed in photos with at least three former presidents at various events: George H. W. Bush, Bill Clinton and George W. Bush.

Her biography was somewhat in flux. Yang said she was born in the “famous oil and gas field of Sichuan, China,” and was a featured energy investment speaker for radio talk shows in San Francisco, Los Angeles and Phoenix.

From 2007 to 2012, she variously described her degree from California State University as a bachelor’s degree in finance, in business science and in business administration.

In 2007, Luca began attracting investors with presentations that suggested “zero risk of losing entire principal (sic),” the SEC said.

A Luca Oil brochure further estimated “20-30% annual returns” and included charts of “estimated income” showing cumulative returns of 407.29% over 20 years, the SEC said.

Company books, however, showed that the costs of running Luca’s oil and gas drilling operations “far exceeded the proceeds from the sales of oil and gas from the inception of the Luca Funds,” according to court documents.

Yang is also accused of portraying well prospects as having millions of barrels in oil reserves and billions of cubic feet in gas reserves.

On one of Luca’s websites, the company said it operated 10 oil fields in Louisiana and Texas with estimated reserves of 50 million barrels of oil equivalent.

However, just three of Luca’s 20 oil and gas wells had estimated reserve reports. “The remaining ‘reserve’ numbers were picked out of thin air,” the SEC said in its complaint.

Luca’s sales teams not only talked a good game, the SEC said, but in some cases guaranteed in writing risk free returns of 12-15%.

In seminars, Yang and Luca employees said profits were rolling in, when “in reality they were losing millions of dollars from their oil and gas investments,” the SEC said in a court filing.

To raise more funds, Yang is accused of offering Chinese citizens the chance to apply for permanent residency through a federal investment program. To qualify, foreign nationals must make an investment in a commercial enterprise in the U.S. and plan to create or preserve 10 permanent full-time jobs for qualified U.S. workers.

“Receive your green card in 12 months,” a Luca website said.

Returns

Luca was bleeding money, but Yang kept investors happy. And she kept herself even happier, court documents say.

Yang is accused of mixing investor funds “to prevent the scheme from collapsing and used money from new investors to make sham profit payments to earlier investors,” the SEC said.

She also wined and dined them. In 2012, for instance, Luca spent $510,000 of investor funds for a “U.S. China Energy Summit”—a 10-day, expenses-paid golf junket to Pebble Beach, Calif., for potential investors from China, the SEC said. Costs for the Summit included a $200,000 speaking fee for George W. Bush.

The SEC said Luca's spending is inconsistent with the use of funds described in the offering materials given to investors.

Behind the scenes, Yang is accused of diverting millions of investor funds to fund a movie-star lifestyle.

In March 2012, Yang transferred about $1 million from a subsidiary to Luca International for “trademark licensing fees,” the SEC said.

However, Luca did not register any trademark logos in March 2012, the SEC said.

Before the end of the month, Yang transferred $950,000 of the money to her personal bank account, court documents show.

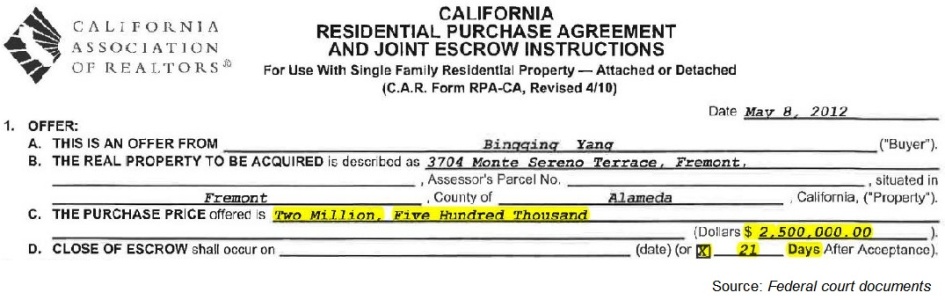

In June 2012, Yang is accused of misappropriating funds by sending $2.5 million from a Luca subsidiary to a Chinese company controlled by her brother. A few days later, the company wired about $2.4 million to an escrow company Yang had arranged to buy her house, according to court documents.

Yang is accused of using the funds to buy a 5,600-square-foot property in the Avalon Heights gated community of Fremont, Calif. The six-bedroom, five-bath, four-fireplace home includes a showcase pool, garden statuary of people and elephants and a basketball court.

Luca funds were used to pay for pool and gardening services and homeowner’s association dues from August 2012 to December 2014, the SEC said in court documents.

“To cover up her misappropriation of the $2.4 million, Yang falsely described in a June 4, 2012 email to Luca International’s bookkeeper, and again in a June 5, 2012 ‘letter of intent’ … that the wire transfer was for the purpose of making a deposit on an oil drilling rig in China,” the SEC suit says.

The SEC also accused Yang of using Luca funds to pay her personal federal income taxes, her children’s private school and martial arts lessons and trips to China and Hawaii.

Distress

As Luca deteriorated from unpaid bills and debt, Yang did not disclose to investors that the company was in arrears, the SEC said.

Instead, “Yang further compounded the problem by borrowing about $12 million from a lender in Hong Kong at an interest rate of approximately 30%,” the SEC said.

A Luca subsidiary was made guarantor for the loan's repayment.

In August 2013, while Yang and other Luca employees continued to raise money from new investors, the company’s accounts payable had grown to more than $11 million, most of which was more than 90 days delinquent, according to court documents.

In April 2014, Yang stopped making monthly payments to investors as debts and lawsuits mounted.

After its bankruptcy in August, a financial report showed that Luca’s September revenues were $0.01 and that the company suffered a $20.99 net loss.

A bankruptcy report filed Oct. 22 by a court-appointed restructuring officer said the company’s finances show a “high probability that material errors and/or omissions exist.”

Freefall

Yang’s California home is up for sale, listed at more than $3 million.

Luca’s former CFO agreed to pay a $25,000 penalty to settle charges he played a role in the purported fraud, the SEC said.

The company’s oil and gas assets are also being marketed.

OFSCap LLC said the offer includes three producing wells, one shut-in well awaiting workover and a saltwater disposal well. The 21-lease position is on about 1,500 acres HBP and about 2,700 acres with new leases.

The assets include 100% working interest with 71.5-75% net revenue interest. The leaseholds are located about 30 miles south of Baton Rouge, La., about 500 meters from the Mississippi River.

A virtual data room is open and a physical site opens Oct. 28.

Expressions of Interest and entrance into the virtual data room should be submitted to luca@ofscap.com.

Initial interests are due Dec. 1. Bidders will be subject to posting a $50,000 letter of credit. The sale tentatively is set for 9 a.m. Dec. 16 at the offices of Hoover Slovacek.

Contact the author, Darren Barbee, at dbarbee@hartenergy.com.

Recommended Reading

ONEOK CEO: ‘Huge Competitive Advantage’ to Upping Permian NGL Capacity

2024-03-27 - ONEOK is getting deeper into refined products and adding new crude pipelines through an $18.8 billion acquisition of Magellan Midstream. But the Tulsa company aims to capitalize on NGL output growth with expansion projects in the Permian and Rockies.

Global Partners Buys Four Liquid Energy Terminals from Gulf Oil

2024-04-10 - Global Partners initially set out to buy five terminals from Gulf Oil but the purchase of a terminal in Portland was abandoned after antitrust concerns were raised by the FTC and the Maine attorney general.

Dallas Fed Energy Survey: Permian Basin Breakeven Costs Moving Up

2024-03-28 - Breakeven costs in America’s hottest oil play continue to rise, but crude producers are still making money, according to the first-quarter Dallas Fed Energy Survey. The situation is more dire for natural gas producers.

Report: Devon Energy Targeting Bakken E&P Enerplus for Acquisition

2024-02-08 - The acquisition of Enerplus by Devon would more than double the company’s third-quarter 2023 Williston Basin production.

Chord Buying Enerplus to Create a Bakken Behemoth

2024-02-22 - Chord Energy said Feb. 21 it will acquire Enerplus Corp. for nearly $4 billion in a stock-and-cash deal to potentially create the largest producer in the Williston Basin.