(Source: Data Gumbo/Shutterstock)

An industry group recently completed the first pilot leveraging blockchain technology that has the potential to not only transform the business, but save companies much-needed capital.

“Even in a down market, people are looking at being able to save millions of dollars, even on just hauling water,” Data Gumbo CEO Andrew Bruce recently told Hart Energy in an exclusive interview.

The pilot was executed using Data Gumbo’s GumboNet blockchain network in partnership with the Offshore Operators Committee (OOC) Oil & Gas Blockchain Consortium and focused on water haulage in the Bakken Shale. According to Bruce, the results from the program showed the ability to significantly reduce opex by streamlining workflows and also proved the feasibility of the technology across multiple commodities.

“The pilot use case that we developed was looking at the value delivered and it was literally millions of dollars just from water, so you can imagine what it's like for people like for crude oil, chemicals or diesel,” he said. “We’re seeing more and more interest because it is basically free money within a company that's been freed up by streamlining the existing processes.”

The pilot, tested on five wells operated by Equinor ASA in North Dakota, was the first industry-wide use of a blockchain native network for produced water haulage. Water logistics and transportation provider Nuverra Environmental Solutions also participated.

When the consortium set out to test the pilot roughly a year ago, Bruce said they wanted to demonstrate what they called extreme automation or touchless transactions.

“They wanted to explore whether they could take a multi-step manual process involving manual tickets, invoices, reconciliations, payments, and automate it into a touchless transaction. And, the answer is yes, you can,” he said.

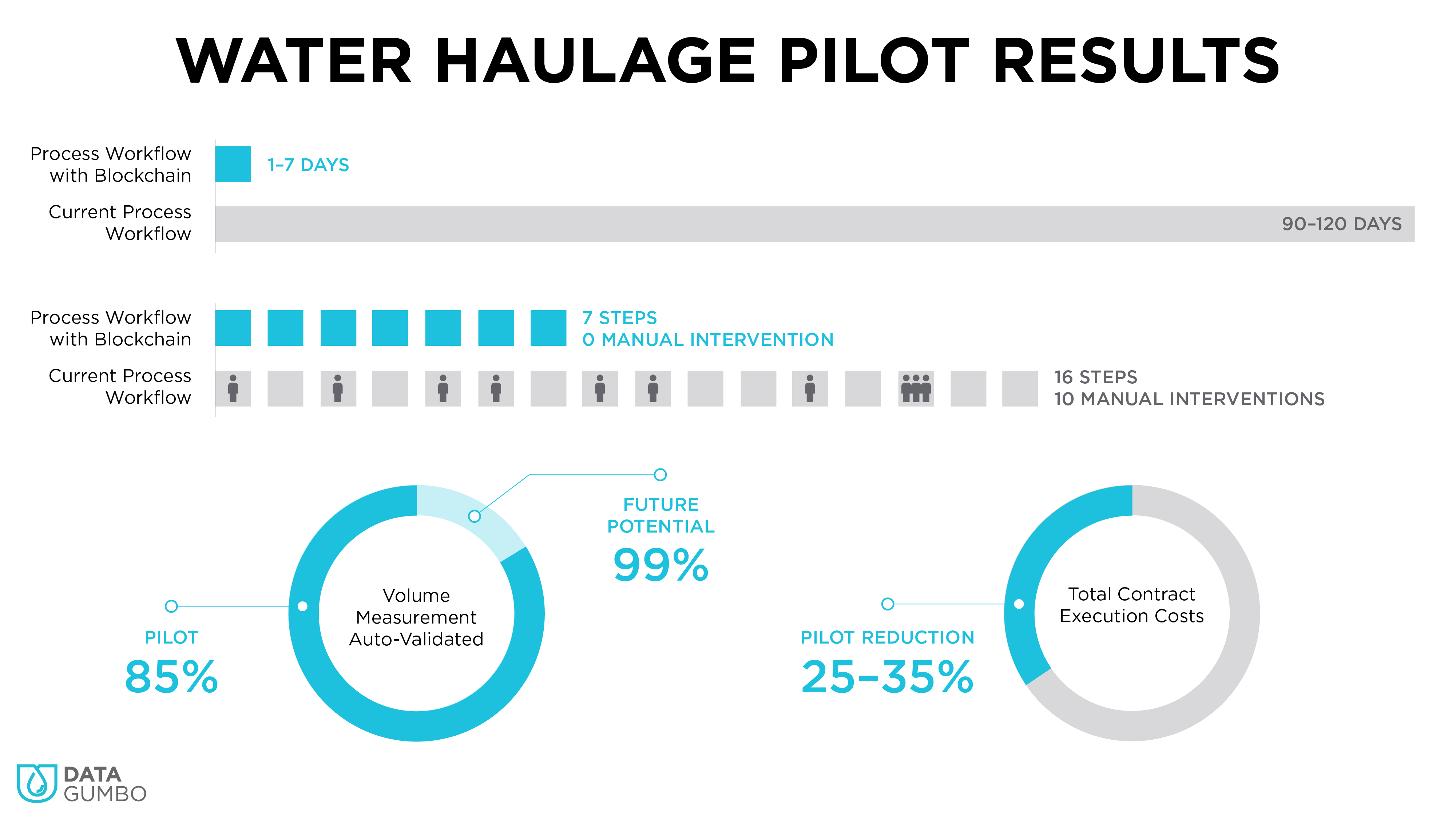

In the initial results, announced in early June, the pilot delivered a 25% to 35% reallocation of resources, validated 90% of all volume measurements while automatically triggering the execution of related invoice transactions. The current process workflow was also reduced from 90-120 days down to less than a week.

“It's all about companies knowing their operating expense and reducing it. The consortium use case produced results that show blockchain delivers the ability to know and lower your costs,” Bruce said. “More importantly the results show collaboration among field operations and technology experts to create a deployable and scalable solution.”

Traditionally, each entity involved has its own record of what was achieved in the contract, but when the invoices start to flow and there are discrepancies, issues arise. But, through IoT data, the network confirms the terms of a contract so there is no dispute.

“We go to the field-based IoT data, read it, and then use that to execute the terms of the contract,” Bruce said. “We’re measuring what's happening in the field, using that to execute the contract and then putting that towards making the payments. There are no longer multiple different records of what happened in the field. There is only one record and we take that from the operation so there is complete trust and transparency built into the system, and that's what makes the whole thing work.”

As a result, the solution has had a positive impact on the relationship between operators and oilfield suppliers and vendors.

“Essentially, all that interest expense disappears from the books and the back-office staff needed to handle all the invoices goes down because there are not as many invoices since they are all automatically generated and the operational and capital costs go down for the service companies,” Bruce said. “This is very advantageous for a drilling contractor, a service company and/or a trucking company because there’s a very big upside. And, now we’re seeing the E&Ps and the service companies coming together on multiple opportunities to look at how they can take an existing contract, or even a new contract, and automate it.”

The pilot set a precedent on water haulage contracts that the consortium, despite ownership, plans to extend across the industry. In fact, with a computer code, other companies can implement the legal intent of the smart contract.

The consortium is comprised of Chevron Corp., ConocoPhillips Co., Equinor, Exxon Mobil Corp., Hess Corp., Marathon Oil Corp., Noble Energy Inc., Pioneer Natural Resources Co., Repsol SA and Royal Dutch Shell Plc. The Houston-based group formed in 2019 to study and define blockchain use cases across the industry value chain.

“The results of this pilot prove that non-manned volume validations can trigger automated payments to vendors, and showcase the opportunities that exist for blockchain to reduce costs, increase efficiency, provide transparency and eliminate disputes in the oil and gas industry,” Rebecca Hofmann, chairman of the OOC Oil & Gas Blockchain Consortium, said. “This is just the tip of the iceberg for the potential of blockchain in our industry.”

Recommended Reading

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.