Baker Hughes said the acquisition of 3C complements its existing CCUS portfolio offering, which currently includes turbomachinery, solvent-based state of the art capture processes, well construction and management for CO₂ storage, and advanced digital monitoring solutions. (Source: Shutterstock.com)

Baker Hughes Co. on Nov. 3 agreed to buy Compact Carbon Capture AS (3C), which the Houston-based service company said underpins its strategic commitment to lead in the energy transition.

“This agreement highlights our deliberate and disciplined approach to invest in the energy transition,” Baker Hughes CEO Lorenzo Simonelli said in a statement. “We are positioning our portfolio for new energy frontiers, and we believe there will be strong growth potential of carbon capture for both industrial applications and oil and gas projects.”

The strategic shift by Baker Hughes has also subsequently included the downsizing of its oilfield services and equipment portfolio. The company most recently agreed to sell its surface pressure control flow business unit and sold its rod-lift business, Lufkin Industries LLC, in a deal that closed in June.

In early 2019, Baker Hughes was among the first in the industry to make a commitment to achieve net-zero carbon emissions from its operations by 2050. The company has also differentiated itself from other service companies through its carbon capture, utilization and sequestration (CCUS) portfolio offering, which currently includes turbomachinery, solvent-based state of the art capture processes, well construction and management for CO₂ storage, and advanced digital monitoring solutions.

Headquartered at Marineholmen in Bergen, Norway, 3C is a pioneering technology development company specializing in carbon capture solutions, which Baker Hughes said complements its existing CCUS portfolio offering.

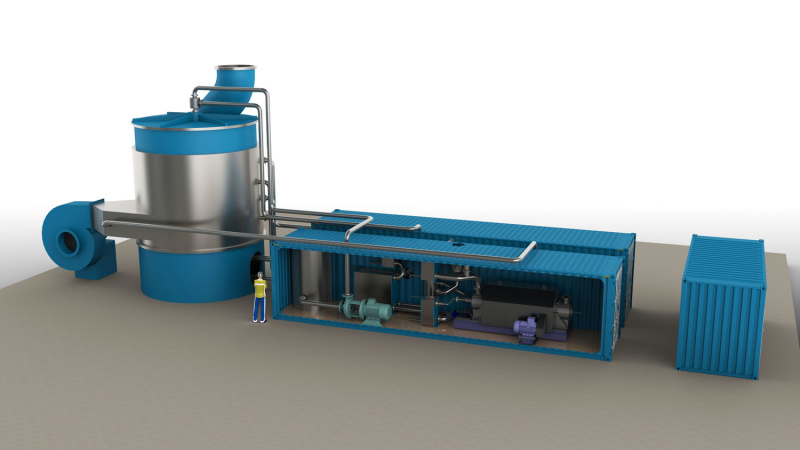

According to a joint release, 3C’s technology differs from traditional carbon capture solvent-based solutions by using rotating beds instead of static columns.

The use of rotating beds in 3C’s technology distributes solvents in a compact and modularized format, enhancing the carbon capture process and results in up to 75% of a smaller footprint plus a lower capex. Additionally, 3C’s modular and scalable configuration can be easily deployed into existing brownfield applications and can be optimized for a broad range of capacity and applications, including offshore and industrial emitters.

Baker Hughes said in the release its 100-plus years of rotating equipment expertise, including in modularized and decarbonization process solutions, will provide an opportunity to scale and commercialize 3C’s technology. Further, Baker Hughes agreed to accelerate the development of the technology for commercial deployment to customers globally.

“By incubating 3C’s technology, we can develop a roadmap to provide one of the industry’s lowest cost per ton carbon capture solutions,” Simonelli added in his statement.

3C was founded through the collaboration between Fjell Technology Group AS, Equinor ASA, Prototech AS and SINTEF. The first patent for the 3C technology was granted in 1999 after which it was tested and developed.

Fjell Technology Group and Equinor separately led the management of the technology development program of 3C between 2007 and 2017. In 2018, 3C was fully established as a company, during which the intellectual property and know-how from both the Equinor and the Fjell Technology Group management periods was fully transferred to 3C.

Currently, 3C runs its technology development with several partners including Equinor, Fjell Technology Group, Sintef and Prototech and benefits from Norwegian Government incentives through Climit, according to the release.

In a statement on Nov. 3, Torleif Madsen, CEO of 3C, said he believes the agreement with Baker Hughes is the right step to grow the company’s technology.

“As we focus on our long-term vision to develop the world’s leading carbon capture offerings, we will leverage Baker Hughes’ strong brand and technology position in the energy industry to further expand our solution by complementing it with world-class turbomachinery and process solutions and access to a global customer base,” Madsen said in the statement.

The agreement with Baker Hughes includes the acquisition of all 3C’s intellectual property, personnel and commercial agreements. Terms of the transaction weren’t disclosed.

ABG Sundal Collier acted as advisers to 3C for the transaction.

Recommended Reading

Texas LNG Export Plant Signs Additional Offtake Deal With EQT

2024-04-23 - Glenfarne Group LLC's proposed Texas LNG export plant in Brownsville has signed an additional tolling agreement with EQT Corp. to provide natural gas liquefaction services of an additional 1.5 mtpa over 20 years.

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.

Association: Monthly Texas Upstream Jobs Show Most Growth in Decade

2024-04-22 - Since the COVID-19 pandemic, the oil and gas industry has added 39,500 upstream jobs in Texas, with take home pay averaging $124,000 in 2023.

Shipping Industry Urges UN to Protect Vessels After Iran Seizure

2024-04-19 - Merchant ships and seafarers are increasingly in peril at sea as attacks escalate in the Middle East.