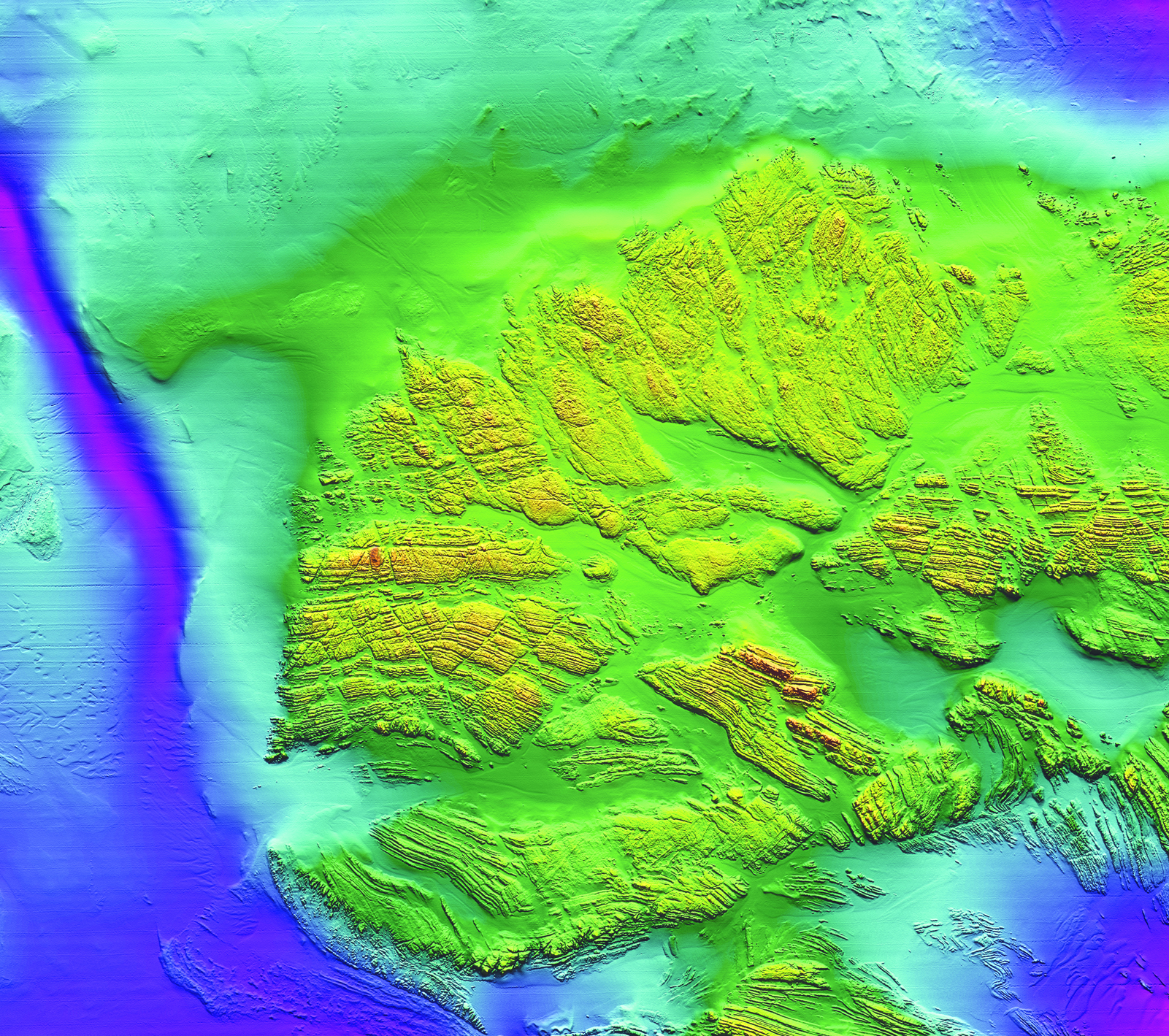

Development favorability zones have been superimposed on a 3-D seabed rendering showing an optimized pipeline route between two locations based on geotechnical and geohazard risk assessment. (Source: Fugro)

Seabed images tend to depict the ocean’s floor as a flat, sandy environment. This is not often the case. In fact, companies that want to install a subsea development scheme spend a lot of time and money characterizing the seabed before the first item of kit is installed.

E&P recently spoke to Brian Mackenzie, service line director of Marine GeoConsulting, Europe & Africa, at Fugro about the concerns that operators face when planning a subsea development.

E&P: What are some of the main considerations when conducting a seabed survey?

Mackenzie: We would always start with the end-goal of working with our client toward the successful design and installation of seabed infrastructure.

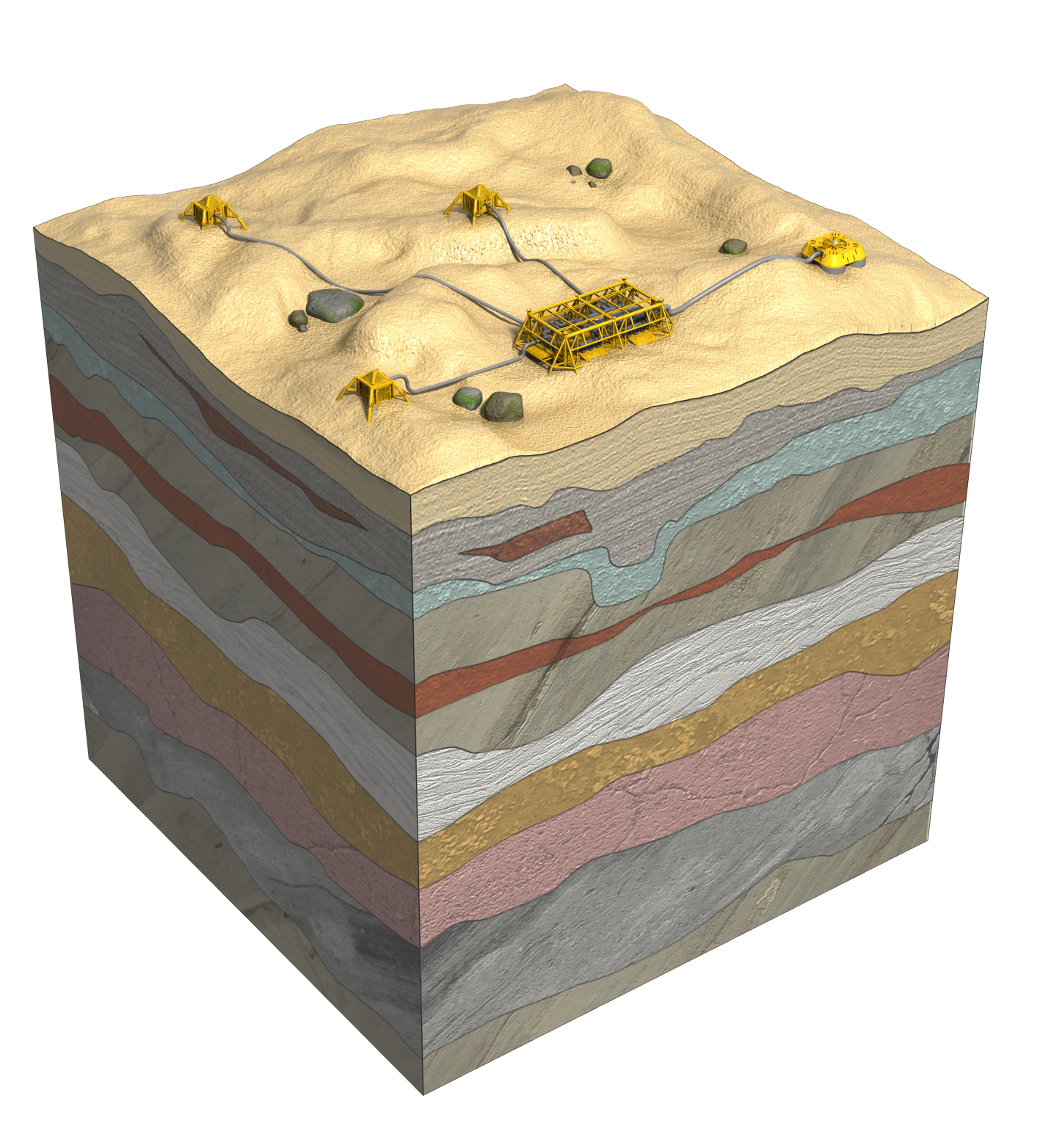

Implicit in ‘successful design and installation’ is its safe and reliable operation and assured asset integrity over its design life. With that in mind, considerations would include what the client is planning to build. The layouts associated with subsea and offshore projects can be complex, and also the shape, size and weight of the installed equipment affect its interaction with the seabed and determine the coverage and type of survey required.

Often the layout, or indeed the equipment to be installed, may not be known at the time of the survey. This certainly makes things interesting because, rather than surveying to a known pattern or layout, we would try to characterize some overall volume of seabed, and from that we would be able to help the client identify the optimum development site within the overall notional project area.

Our first question when receiving an inquiry from a client about a survey is, ‘What is it for?’ Then we start to think about the seabed itself, with the most fundamental question being, ‘What’s the water depth?’, because that would determine the choice of platforms available from which to conduct the survey as well as driving the development concept on the client side.

Once we know the client’s development plans, location and water depth, the next consideration is the seafloor and the sub-seafloor itself as well as its features and ground conditions.

We aim to identify the constraints and hazards that might be posed to the development (for example, any adverse ground conditions). This could simply be excessively soft or sensitive sediment that can’t support infrastructure or, conversely, hard ground or buried rock that poses installation risk. Then there could be a whole host of hazardous features such as faults, steep slopes or gas expulsion features to be taken into consideration.

These are static features that can sometimes be readily identified simply by examining the bathymetry, but it’s also necessary to consider dynamic features such as a mobile seabed. This is something that tends to be talked about more in the offshore renewables sector rather than in oil and gas field development. For example, there is a wind farm development off the U.K. coast that has been built on what turned out to be a mobile sandbank, so the ground is actually shifting.

These are dynamic hazards that you wouldn’t necessarily see in a snapshot survey. And in the so-called ‘frontier developments’ around the world, there may be other dynamic geohazards. The classic threats in such environments include steep unstable slopes characterized by very soft sediment and earthquake-prone environments. These can trigger instability, essentially a soil avalanche developing into a debris flow, with huge amounts of energy and the ability to cause a lot of damage if not destruction. Such geohazards are a crucial consideration in a seabed survey.

Another important point is that in such circumstances the threat to the subsea development can actually originate some distance from the development itself. It could be tens of kilometers away, so in considering and planning the survey, not only are we interested in where our client is going to build, but we may also be interested in the surrounding seabed terrain and the source of threats to the development.

Once the inherent hazards have been examined, we investigate the actual engineering properties of the seabed itself such as the characteristics that tell us, for example, what load it can support, whether its strength might degrade over time and what foundation settlement might be expected. Those engineering properties feed directly into the design process, so they drive the foundation sizing and configuration as well as the selection of installation equipment and therefore any direct financial consequences relating to the characterization.

In the wider context of marine site characterization the environmental habitat conditions are also important, so we can assess the impact of a development against those baseline conditions. Metocean conditions are also important, as waves and seabed currents will determine the load on what the client builds.

E&P: What are some of the technologies that are used for these surveys? What information do they provide?

Mackenzie: Fundamentally there are two main types of methods used to characterize the seabed.

The first is geophysics. That’s using an acoustic source and reflections, so it’s a nonintrusive means of investigating the seabed, and it uses the same overall method used for prospecting for oil and gas, just with a shallower focus for subsea developments.

The other fundamental option is geotechnical investigation. That involves drilling into or otherwise probing a sampling device or form of instrumentation into the seabed, so it’s an intrusive process. In a full borehole program we extract high-quality samples from the sub-seabed and then undertake a range of further examinations. Obtaining samples from the seabed isn’t exactly straightforward.

In terms of what the two methods produce, geophysics gives a spatially continuous picture of the investigated area. It provides the bathymetry and the subsurface layering, so it is great at picking up variability across the site, but what it doesn’t provide is the actual engineering properties of the soil, so it’s not advisable to design on the basis of geophysical information alone. In the field of geophysics there is quite a technological drive for increased resolution, being able to pick up smaller and more detailed features. Of course there is also a technological drive to make the process less weather-sensitive.

Having said that, geophysics doesn’t give engineering data; there is a further technological drive in the industry to improve upon this and, by using innovative interpretation methods, to try to derive more engineering properties from geophysics. Ultimately, it will rely on calibration with ground-proving geotechnical data, so in effect it requires a marriage between the two technology types.

Conversely, the result of geotechnical investigations is a very detailed characterization with soil samples in our hands to test but only at discrete points on the seabed. They offer a continuous depth profile of all the governing properties needed to design the foundations for a subsea development. A technological drive on this side is for enhanced quality sampling to be able to extract the sample from the sub-seabed, which is as close to its in situ state as possible. This again involves reducing the weather sensitivity of the drilling and sampling process.

The overall objective of a reliable seabed survey is to combine the data from both the geophysics and the geotechnics to deliver the detail, continuity and spatial extent, resulting in a state of knowledge that is known as a ground model.

E&P: What are some of the main considerations when it comes to subsea installations? Do you have examples where operators have had to work around a particularly difficult environment? Or were they surprised by the difficulty of the subsea environment?

Mackenzie: Overall, the considerations are the same as when planning a survey because the objective of the survey includes enabling a good installation.

More specifically, when you talk about subsea installations, you are describing the placement of equipment on the seabed—undertaking the construction work having done the design. An initial consideration would simply be the levelness of the seabed and any obstructions on it. And for design purposes, the soil strength is a key consideration, or more specifically its resistance to foundation installation. There are various ways of installing foundations into the seabed, including pile driving using a hammer or the penetration of skirts around a seabed structure, which relies on the structure’s selfweight pushing the skirts in. It also could be suction installation, which is a concept that is widely used for subsea oil and gas. These all rely on us enabling the operator to predict the soil resistance, and that includes any buried obstructions such as boulders.

There are indeed examples of operators having difficulties. Sometimes they are manmade, such as unexploded ordnance that can be detected using geophysical methods and therefore managed. Another classic man-made example is the legacy of previous drilling activity before the development. For example, drilling and cementing of wells can complicate things because they result in a seabed that is harder to manage than in its original state.

The weather and tidal and current conditions can also cause difficulties with equipment placement. As a site investigation contractor we experience difficulties, and it is likely that the same difficulties will be experienced when it comes to building on the seabed. We are often a good barometer for potential construction difficulties.

There are also countless examples of operators having to work around difficult ground conditions, sometimes anticipated and sometimes not. Ideally the surprises are discovered in the seabed survey—that’s the point of it, but it doesn’t always happen. Sometimes surveys are insufficiently specified or just don’t cover the extent of the development area. Things change; layouts change. The industry still often faces difficulties due to unforeseen ground conditions. Where ground conditions are not adequately revealed by the survey, there are inevitably surprises.

Where ground conditions have been adequately revealed by the survey, there should not be surprises, but there can still be unfortunate outcomes against an acceptance of residual risk. In hard ground with boulders, for example, there will be differing levels of risk associated with different foundation designs and installation methods. Even with knowledge of the ground conditions, such difficulties can manifest themselves in pile driving damage and refusal that requires quite extensive mitigation.

A reliable survey is all about identifying risks for a range of development and foundation design options, mitigating them and quantifying the residual risk, which enables the operator to make the best decisions in terms of mobilizing the appropriate equipment to deal with challenges. Hence, if the survey shows a hazardous environment, it still puts the operator in a better place, proving that knowledge is power.

E&P: Are there areas where subsea developments simply don’t make sense? Does the subsea environment ever dictate an operator’s choice of development scheme (i.e., floating production, jackup, spar, etc. versus subsea)?

Mackenzie: Yes, absolutely. Water depth is a great fundamental driver of the choice of the scheme. Different concepts have different economic suitability based on water depth, or in some cases a technical cut-off. For example, the biggest jackups would operate in a water depth of something like 120 m [394 ft] but are wholly incompatible with a deepwater development. In the past some pretty tall fixed structures have been built, probably because at the time they were considered the most economical solution. Hence, there are some rather tall fixed platforms in the Gulf of Mexico. Since then floating production technology has advanced along with pure subsea solutions with an export to shallower waters or ashore. A development’s proximity to existing infrastructure will also dictate the export scheme.

Considering the seabed itself and the soil condition aspects of the subsea environment, these are less likely to drive the overall development concept, but they are certainly likely to drive the foundation concept needed to make the development successful. If an operator has done all its economics and has decided that a floating production system is preferable to a fixed platform, the decision between the two alternatives is unlikely to be the result of considering the soil strength or detailed seabed conditions.

However, the foundation concept needs to support the chosen solution. For example, a floating production system needs anchoring, and the foundation design will be wholly dictated by the seabed conditions.

If the seabed conditions are ignored, the foundation design will not be reliable, and this could compromise the asset integrity irrespective of the choice of overall development scheme.

Recommended Reading

Greenbacker Names New CFO, Adds Heads of Infrastructure, Capital Markets

2024-02-02 - Christopher Smith will serve as Greenbacker’s new CFO, and the power and renewable energy asset manager also added positions to head its infrastructure and capital markets efforts.

Humble Midstream II, Quantum Capital Form Partnership for Infrastructure Projects

2024-01-30 - Humble Midstream II Partners and Quantum Capital Group’s partnership will promote a focus on energy transition infrastructure.

SunPower Appoints Garzolini as Executive VP, Chief Revenue Officer

2024-03-14 - Tony Garzolini will oversee SunPower’s sales, including the direct, dealer and new homes channels, along with pricing and demand generation.

enCore Energy Appoints Robert Willette as Chief Legal Officer

2024-02-01 - enCore Energy’s new chief legal officer Robert Willette has over 29 years of corporate legal experience.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.