A pair of Texas deals by Japanese companies Sumitomo and Osaka Gas follow the cautious return of Asian investors to U.S. shale. (Source: Hart Energy and Shutterstock.com)

A pair of shale deals by Japanese companies in the Lone Star State announced days apart point to a growing return by Pacific Rim investors to U.S. shale.

On July 5, Japan’s Sumitomo Corp. said it purchased a tight oil producing asset in the core of the Eagle Ford Shale from IOG Capital LP, Covington Equity Investments LLC and 1836 Resources LLC. The asset includes 100% interest in 624 acres in Karnes County, Texas, where peak production is estimated at 3,000 boe/d.

Sumitomo expects the acquisition to cost less than $50 million, said a spokeswoman for the Japanese trading house, according to a Reuters report.

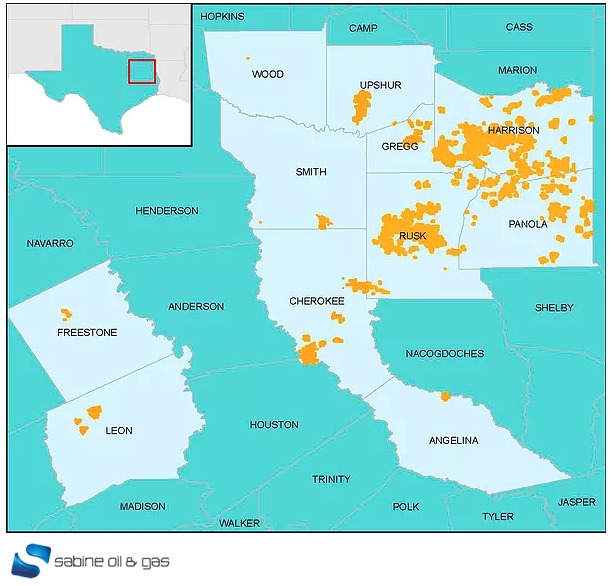

The deal followed the June 29 announcement by another Japanese company—Osaka Gas Co. Ltd.—for the acquisition of East Texas shale gas assets targeting the Cotton Valley Sand and Haynesville Shale formations from Sabine Oil & Gas Corp.

As part of its agreement, Osaka Gas will acquire a 30% stake in Sabine’s East Texas shale gas project for about 16 billion yen (US$144.53 million). The project includes about 450 wells currently producing about 45 MMcfe/d across 100,000 acres, 35,000 acres of which will be net to Osaka Gas.

During the shale revolution, funding from Asian companies poured into the hot plays of the time—the Barnett, Marcellus, Eagle Ford and more. By 2013, total investments in U.S. shale by companies based in India, China, South Korea and Japan had reached about $20 billion in the span of a couple of years.

However, many Asian investments were marred by the downturn in commodity prices raising the question of when, if ever, Asian companies will return with the same aggressiveness to U.S. shale.

Post-downturn, some analysts thought Asian companies might explore a return to the U.S. Lower 48. So far, Asian NOCs have started to pick up their business development, but many have bypassed the U.S. for deepwater exploration hotspots in Latin America or producing-resource opportunities in the Middle East, said Andrew Harwood, Asia-Pacific research director for Wood Mackenzie.

Still, U.S. shale investments by Asian companies have slowly started to trickle in within the past 18 months, but with a new approach: buy good assets along with greater influence and control on how their money is spent.

In addition to Sumitomo and Osaka Gas’ recent acquisitions, a subsidiary of South Korean conglomerate SK Innovation agreed to purchase Oklahoma Stack E&P assets from Longfellow Nemaha LLC in March. Terms of the deal weren’t disclosed.

Kalnin Ventures LLC, backed by Thailand’s Banpu Pcl, has also invested more than $520 million in Marcellus acquisitions from 2016 through 2017.

RELATED: Kalnin Deal Continues Conquest Of Northeast Marcellus

Overall, Bill Marko, a managing director at Jefferies LLC, sees a landscape of once-bitten-twice-shy Asian investors and others that are more comfortable on their “home court.”

“To a great extent, most of them did deals in 2009 to 2012,” Marko recently told Hart Energy’s Oil and Gas Investor. “Many of the deals turned out badly due to falling commodity price or poor reservoir quality or misalignment of strategies. So, a lot of them are spooked about doing bad deals again.”

Yet a few of the Pacific Rim companies that suffered heavy losses have shown signs that they remain determined to make U.S. shale investments work and are proceeding more cautiously.

Marko said most want to do deals of “a few hundred million dollars at a time” rather than the multibillion-dollar investments that were made earlier in the past decade.

Potential buyers generally “want to stick their toe in the water” and test the temperature before deciding what to do next, he said.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

ShearFRAC, Drill2Frac, Corva Collaborating on Fracs

2024-03-05 - Collaboration aims to standardize decision-making for frac operations.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Sinopec Brings West Sichuan Gas Field Onstream

2024-03-14 - The 100 Bcm sour gas onshore field, West Sichuan Gas Field, is expected to produce 2 Bcm per year.

Exclusive: Carbo Sees Strong Future Amid Changing Energy Landscape

2024-03-15 - As Carbo Ceramics celebrates its 45th anniversary as a solutions provider, Senior Vice President Max Nikolaev details the company's five year plan and how it is handling the changing energy landscape in this Hart Energy Exclusive.