The Trans-Alaska Pipeline System, which carries crude from the state's North Slope oil development areas.

After discovering one of the largest U.S. onshore hydrocarbon reservoirs in Alaska’s North Slope, Armstrong Oil & Gas Inc. has agreed to sell interests in its North Slope find as part of a deal worth up to $850 million.

Australia’s Oil Search Ltd. said Nov. 1 it will purchase interests in the conventional Pikka Unit, Hue Shale and Horseshoe Block from Denver’s Armstrong and GMT Exploration Co. LLC for an initial price of $400 million.

Armstrong is selling half of its interests and Oil Search has an option through June 2019 to purchase the remaining interests from the companies for $450 million.

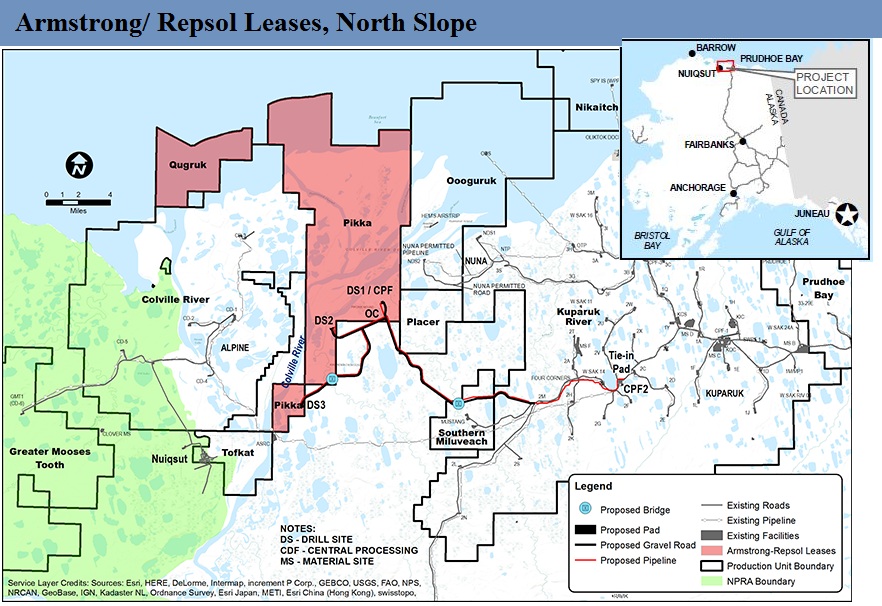

Armstrong’s partner, Spanish oil giant Repsol SA, owns the balance of interests in the Nanushuk prospect where their discoveries were announced in March.

The Nanushuk area assets are believed to hold at least 500 million barrels of oil (bbl) and encompass a 1,115-square-mile area. Oil Search said unrisked resource potential is an estimated 1.5 Bbbl.

“The Nanushuk Field in the Alaska North Slope is a giant oil discovery and has been acquired at an attractive point in the commodity cycle, at a very competitive price of approximately US$3.1 per barrel of discovered resource,” said Peter Botten, Oil Search managing director. “Our joint venture partners in these assets comprise Repsol, with whom we have a strong working relationship in PNG, and Armstrong, which has a proven 15-year track record of finding major oil accumulations in Alaska.”

Bill Armstrong, president of Armstrong Oil & Gas, has previously led independents such as Pioneer Natural Resources Co. (NYSE: PXD) into Alaska. Armstrong did not respond to a request for comment.

In a 2013 interview, he said the North Slope geology offered a “ridiculous amount of opportunity” that is hampered by the environment.

“It’s wicked cold, it’s a remote place and so costs are higher because of that. It’s dark in winter time, below zero a significant amount of time,” he said.

Oil Search said it will continue to work with Armstrong in a long-term partnership that leverages the company’s technical capabilities and experience to identify additional potential growth opportunities in Alaska.

Earlier this year, Repsol and Armstrong made what they called the “largest U.S. onshore conventional hydrocarbons discovery in 30 years.” Wells drilled during the 2016-2017 winter campaign “confirm the Nanushuk play as a significant emerging play in Alaska’s North Slope.”

Since 2008, Repsol has actively explored Alaska and has drilled multiple consecutive discoveries since 2011 on the North Slope with Armstrong.

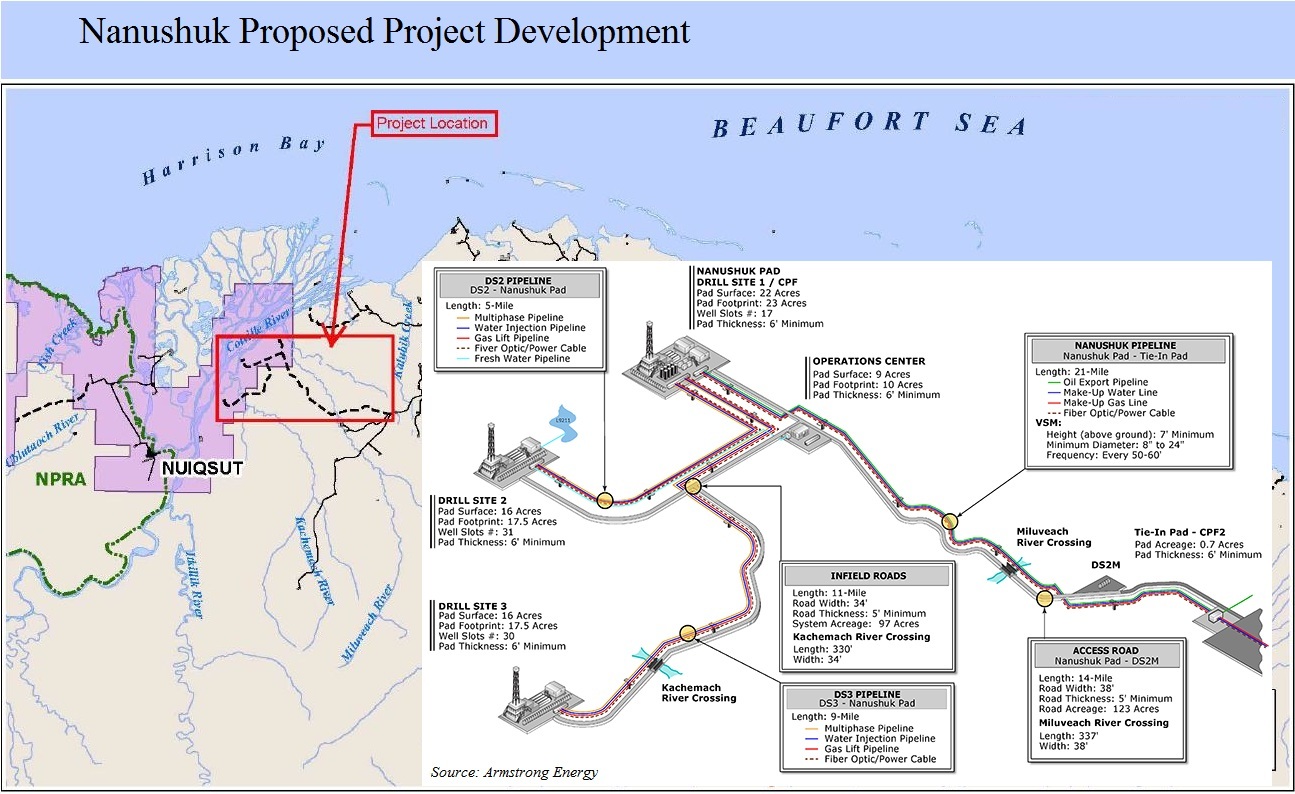

The Nanushuk development project, which is located adjacent to several giant producing oil fields, was discovered in 2013. About 19 exploration and appraisal wells have been drilled on the field, which, combined with full coverage of 3-D seismic data, have delineated a giant oil resource, Oil Search said.

The Pikka Unit, part of the Nanushuk play, extends from the Beaufort Sea to roughly 20 miles inland. Repsol said in March that it owns a 49% working interest in Pikka, with Armstrong holding 51% and serving as operator.

In early October, Repsol and Armstrong’s Nanushuk development plans were made public by the U.S. Army Corps of Engineers. The project includes three drillsites, a central processing facility, infield pipelines, roads and other infrastructure.

Oil Search said it made the acquisition on the basis of a “discovered resource of approximately 500 million barrels, with material prospective resource upside.” The company plans to initially target the Pikka Unit, with first production “anticipated in 2023” and production rates of up to 120,000 bbl/d. The production would move on the Trans-Alaska Pipeline System.

Additionally, Oil Search noted that Repsol, which owns interests in the Pikka Unit, exploration acreage and Horseshoe leases, estimates the discovered resource to be up to 1.2 Bbbl.

The acquisition is subject to U.S. regulatory approvals, including approval by the Committee on Foreign Investment in the U.S. Oil Search said it would assume operatorship on in June 2018.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Report: Crescent Midstream Exploring $1.3B Sale

2024-04-23 - Sources say another company is considering $1.3B acquisition for Crescent Midstream’s facilities and pipelines focused on Louisiana and the Gulf of Mexico.

For Sale? Trans Mountain Pipeline Tentatively on the Market

2024-04-22 - Politics and tariffs may delay ownership transfer of the Trans Mountain Pipeline, which the Canadian government spent CA$34 billion to build.

Energy Transfer Announces Cash Distribution on Series I Units

2024-04-22 - Energy Transfer’s distribution will be payable May 15 to Series I unitholders of record by May 1.

Balticconnector Gas Pipeline Back in Operation After Damage

2024-04-22 - The Balticconnector subsea gas link between Estonia and Finland was severely damaged in October, hurting energy security and raising alarm bells in the wider region.

Wayangankar: Golden Era for US Natural Gas Storage – Version 2.0

2024-04-19 - While the current resurgence in gas storage is reminiscent of the 2000s —an era that saw ~400 Bcf of storage capacity additions — the market drivers providing the tailwinds today are drastically different from that cycle.