Based in Midland, Texas, Delaware Energy Services provides operators and water haulers with reliable, cost-effective solutions for saltwater disposal and produced water reuse with customers throughout southeastern New Mexico. (Source: Delaware Energy Services)

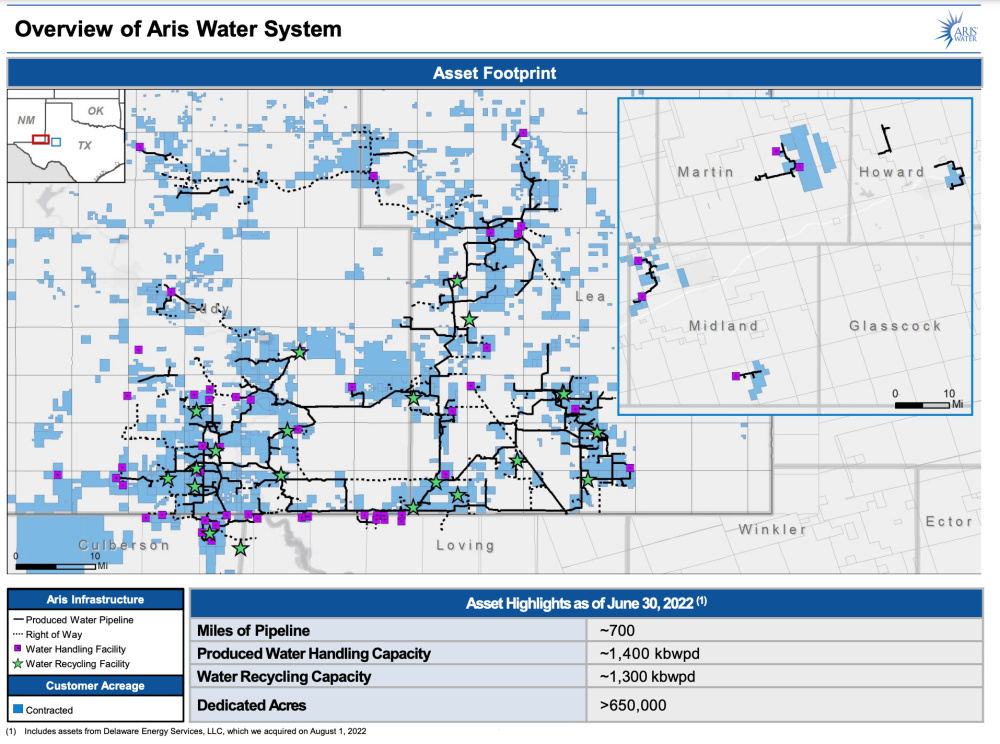

Aris Water Solutions Inc. acquired the assets of Delaware Energy Services, which are located in Aris’s core areas in the Northern Delaware Basin.

“The acquisition of Delaware Energy’s assets represents a unique opportunity to add strategic operating assets and customers adjacent to our core infrastructure in New Mexico,” Aris CEO Amanda Brock commented in a company release.

Delaware Energy Services provides operators and water haulers with reliable, cost-effective solutions for saltwater disposal and produced water reuse with customers throughout southeastern New Mexico. Based in Midland, Texas, the Delaware Energy team includes individuals with extensive experience in engineering, geophysics, land management, regulatory, legal and business development, according to the company website.

Aris said in its earnings release that it had acquired all of Delaware Energy’s assets on Aug. 1 in exchange for 3.37 million Class A shares and a small, volumetric-based contingent consideration paid over five years.

“A combination with Aris was a natural geographic fit and we’re excited to participate in the next phase of growth as shareholders,” said Shaesby Scott, president of Delaware Energy, in the Aris release.

Delaware Energy’s assets include seven produced water handling facilities and associated gathering lines in Aris’s core areas of Eddy and Lea counties, New Mexico.

“By integrating our assets into Aris’ larger gathering, handling, and recycling network,” Scott continued, “we can realize enhanced flexibility and efficiency while offering additional capabilities to operators in the Northern Delaware Basin.”

Once integrated, the Delaware Energy assets will allow Aris to bring additional water volumes into its network, enhance its recycling capabilities and further accelerate its organic growth, Brock added.

“By integrating Delaware Energy’s assets into our broader network, we will be able to drive additional system utilization and facilitate increased recycling,” she said. “We are pleased to work with legacy Delaware Energy investors as new shareholders of Aris and look forward to quickly realizing the benefits of this combination.”

As of June 30, Aris had about $35 million in cash and an undrawn and available $200 million revolving credit facility for a total available liquidity of approximately $235 million.

Aris reported total water volumes for the second quarter of approximately 1.2 million bbl/d, up 34% versus second-quarter 2021. The company’s second-quarter recycled produced water volumes of approximately 297,000 bbl/d, up 186% versus second-quarter 2021.

On Aug. 3, the Aris board of directors declared a dividend on its Class A common stock for the third quarter of $0.09 per share. In conjunction with the dividend payment, a distribution of $0.09 per unit will be paid to unit holders of Solaris Midstream Holdings LLC, according to the release.

Recommended Reading

Trio Petroleum to Increase Monterey County Oil Production

2024-04-15 - Trio Petroleum’s HH-1 well in McCool Ranch and the HV-3A well in the Presidents Field collectively produce about 75 bbl/d.

US Drillers Add Most Oil Rigs in a Week Since November

2024-02-23 - The oil and gas rig count rose by five to 626 in the week to Feb. 23

US Drillers Cut Oil, Gas Rigs for Second Time in Three Weeks

2024-02-16 - Baker Hughes said U.S. oil rigs fell two to 497 this week, while gas rigs were unchanged at 121.

US Gas Rig Count Falls to Lowest Since January 2022

2024-03-22 - The combined oil and gas rig count, an early indicator of future output, fell by five to 624 in the week to March 22.

Sangomar FPSO Arrives Offshore Senegal

2024-02-13 - Woodside’s Sangomar Field on track to start production in mid-2024.