Arena Energy said its acquisition includes a majority interest in two of the largest fields in the shallow water Gulf of Mexico in Eugene Island 330 and South Marsh 128. (Source: Shutterstock.com)

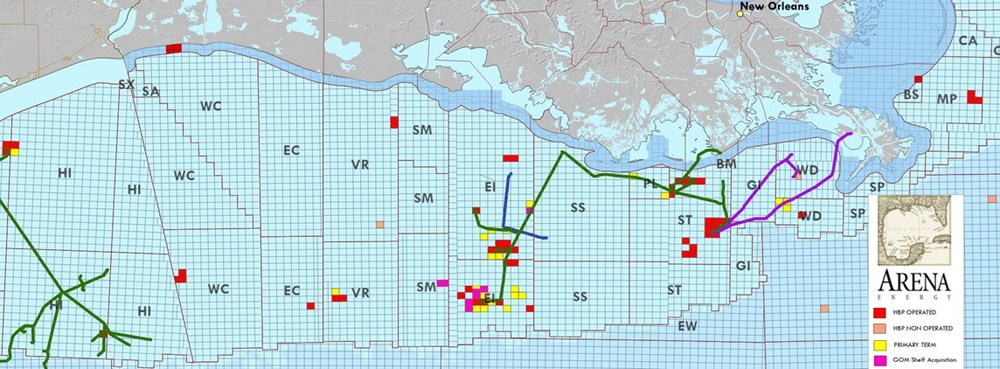

Arena Energy LLC, an offshore operator focused on the Gulf of Mexico (GOM) Shelf, closed on an acquisition of seven blocks and twelve platforms from GOM Shelf LLC. Financial details were not released.

The Woodlands, Texas-based company said its acquisition includes average net daily production of approximately 2,000 boe/d with historically low decline rates and includes a majority interest in two of the largest fields in the shallow water Gulf of Mexico in Eugene Island 330 and South Marsh 128, according to a Dec. 12 press release.

The acquired properties have “significant operating synergies with existing Arena assets” and optionality to restore and increase production and includes four platforms on lease blocks that Arena was recently awarded in Lease Sale 257.

“This transaction is an important milestone for Arena,” said Arena co-founder and CEO Mike Minarovic. “We are ‘all in’ on the future of the shallow water Gulf of Mexico, and this acquisition—coupled with the leases recently acquired in Lease Sale 257—is a natural extension of our strategy to be the premier operator on the Gulf of Mexico Shelf."

On Dec. 5, Arena announced it had been awarded 11 GOM leases by the Bureau of Ocean Energy Management (BOEM) in Lease Sale 257.

The November 2021 lease sale was subsequently vacated by a federal judge in January 2022. However, the Inflation Reduction Act of 2022, signed into law by President Joe Biden, required reinstatement of the sale. The leases were ultimately awarded to the company in October 2022.

Arena was the successful bidder on eleven leases in water depths ranging from 30 ft to 283 ft in Eugene Island, South Pelto, and West Delta in the Gulf of Mexico off the coast of Louisiana. Arena paid $3.8 million in lease bonuses to the federal government for the leases.

Recommended Reading

Excelerate Energy, Qatar Sign 15-year LNG Agreement

2024-01-29 - Excelerate agreed to purchase up to 1 million tonnes per anumm of LNG in Bangladesh from QatarEnergy.

UK’s Union Jack Oil to Expand into the Permian

2024-01-29 - In addition to its three mineral royalty acquisitions in the Permian, Union Jack Oil is also looking to expand into Oklahoma via joint ventures with Reach Oil & Gas Inc.

Eni, Vår Energi Wrap Up Acquisition of Neptune Energy Assets

2024-01-31 - Neptune retains its German operations, Vår takes over the Norwegian portfolio and Eni scoops up the rest of the assets under the $4.9 billion deal.

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.