Arena Energy said its acquisition includes a majority interest in two of the largest fields in the shallow water Gulf of Mexico in Eugene Island 330 and South Marsh 128. (Source: Shutterstock.com)

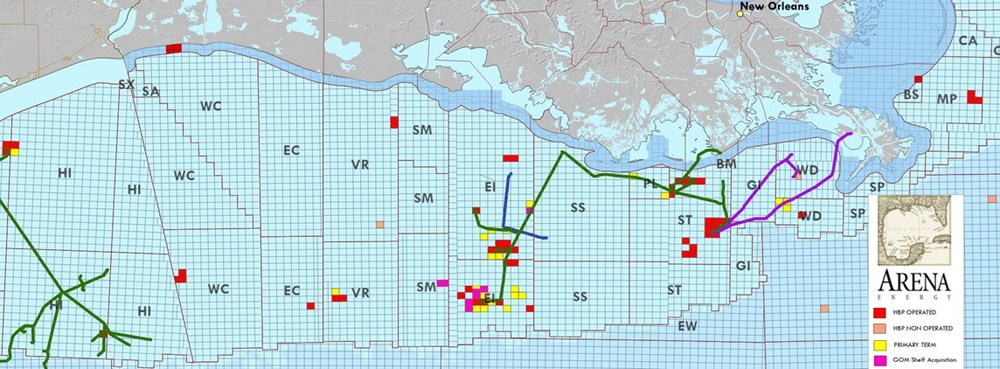

Arena Energy LLC, an offshore operator focused on the Gulf of Mexico (GOM) Shelf, closed on an acquisition of seven blocks and twelve platforms from GOM Shelf LLC. Financial details were not released.

The Woodlands, Texas-based company said its acquisition includes average net daily production of approximately 2,000 boe/d with historically low decline rates and includes a majority interest in two of the largest fields in the shallow water Gulf of Mexico in Eugene Island 330 and South Marsh 128, according to a Dec. 12 press release.

The acquired properties have “significant operating synergies with existing Arena assets” and optionality to restore and increase production and includes four platforms on lease blocks that Arena was recently awarded in Lease Sale 257.

“This transaction is an important milestone for Arena,” said Arena co-founder and CEO Mike Minarovic. “We are ‘all in’ on the future of the shallow water Gulf of Mexico, and this acquisition—coupled with the leases recently acquired in Lease Sale 257—is a natural extension of our strategy to be the premier operator on the Gulf of Mexico Shelf."

On Dec. 5, Arena announced it had been awarded 11 GOM leases by the Bureau of Ocean Energy Management (BOEM) in Lease Sale 257.

The November 2021 lease sale was subsequently vacated by a federal judge in January 2022. However, the Inflation Reduction Act of 2022, signed into law by President Joe Biden, required reinstatement of the sale. The leases were ultimately awarded to the company in October 2022.

Arena was the successful bidder on eleven leases in water depths ranging from 30 ft to 283 ft in Eugene Island, South Pelto, and West Delta in the Gulf of Mexico off the coast of Louisiana. Arena paid $3.8 million in lease bonuses to the federal government for the leases.

Recommended Reading

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

NAPE: Chevron’s Chris Powers Talks Traditional Oil, Gas Role in CCUS

2024-02-12 - Policy, innovation and partnership are among the areas needed to help grow the emerging CCUS sector, a Chevron executive said.

US Drillers Cut Oil, Gas Rigs for Fourth Week in a Row-Baker Hughes

2024-04-12 - The oil and gas rig count, an early indicator of future output, fell by three to 617 in the week to April 12, the lowest since November.

US Drillers Cut Oil, Gas Rigs for Third Week in a Row

2024-04-05 - The oil and gas rig count, an early indicator of future output, fell by one to 620 in the week to April 5, the lowest since early February.

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.