[Editor's note: A version of this story appears in the August 2020 edition of E&P. Subscribe to the magazine here.]

Shutting in an oil and gas well is routine, as is restarting it. What is anything but routine is leaving the well shut in for a prolonged period while grappling with a pandemic-fueled global economic recession that clobbers both market price and demand with no end in sight.

While many wells returned to production in certain basins when prices rose from their abyss in May and June, many wells in other basins did not and will not until COVID-19 recedes in the U.S. and economic activity is sufficient to sustain higher oil and gas prices.

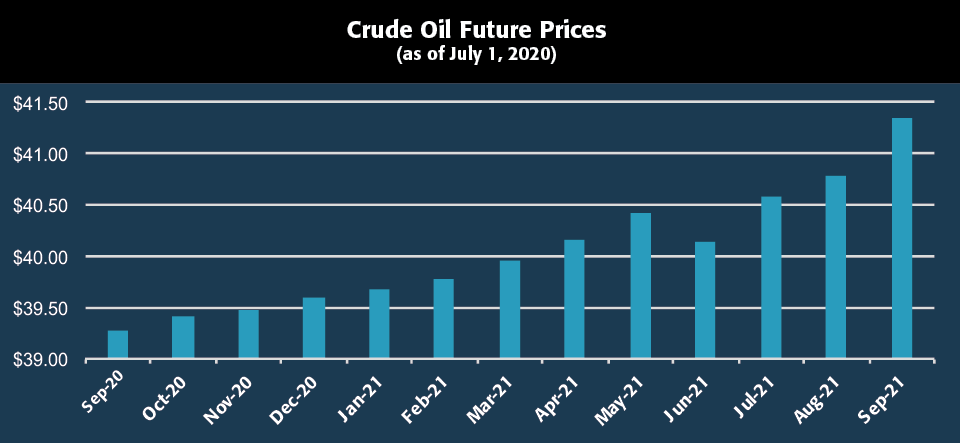

That might not happen until 2021, when it is hoped that a vaccine will be available and the U.S. Energy Information Administration expects WTI’s price to average $43.88/bbl for the year. That means that thousands of unconventional wells could be shut in for months or even more than a year—the longest stretch since the start of the shale revolution. But it’s not just producers that are affected. When prices crashed, midstream operators had to react quickly as well.

“My biggest concern, obviously, was what do we do with these pipelines?” Martin McHale, Oryx Midstream COO, told E&P. “How long is this going to last? Is it going to be a one-month, two-month, six-month economic set of conditions that require that production stay shut in?

If this downcycle poses a lot of questions, it also presents the opportunity to find some answers by gathering downhole data from shut-in unconventional wells.

“I think we’re in uncharted territory,” Chris Mountford, technical account manager with Endurance Lift, told E&P. “We’re going to learn a lot going forward if there’s a months-long period of shutting in a whole lot of unconventional wells, tight wells.”

But what is known right now are the best practices the industry can employ during this time to prepare wells for the upcoming recovery.

In or out?

A producer utilizes an array of assets in a well below ground, everything from simple production tubing to complex electric submersible pumps (ESPs) and sucker rod pumps. A typical shut-in that results from problems with flowlines, a compressor or a pipeline is a straightforward process—address the issue and rev up again. But a shut-in during these atypical times, which results from massive economic disruption, requires a plan for protecting all downhole and surface equipment.

“You have to have some kind of treatment plan or setup plan when you shut the well in because the last thing you want to do is physically go from producing to not producing the well and allow your production tubing and artificial lift system to sit in the formation fluids for a long period of time,” Matt Young, sales manager with Flowco Production Solutions, told E&P.

Unprotected equipment is vulnerable to paraffin and wax buildup, corrosion and blockage from debris in the well.

In general, the plans take two shapes—pull the equipment out or leave it in with an anti-corrosion program in place.

“A really proactive approach is to go in and pull everything, or remove the tubing and gas lift from the well,” Young said. “It has the highest upfront costs when it comes to preparing for a shut-in, because you have to pay for a rig to be on location. You have to pay to have personnel on location. You have to pay to have somebody pull and store the equipment that they removed from the wellbore. So, you have all these associated costs upfront, but the benefit to that is the fact that you don’t have to worry about the artificial lift and tubing after that point.”

A shut-in strategy also can hinge on the type of artificial lift at work in the well. While gas-lift equipment can be left in the well, plunger equipment should be pulled out.

“In the plunger lift world, people would want to retrieve the plungers, bringing them to the surface rather than allowing them to stay down in the bottom of the wells,” Jack Rogers, director of plunger lift products with Endurance Lift Solutions LLC, told E&P.

The procedure entails securing the plunger in the lubricator and then closing the master valve when shutting the well in, he said. Sand and debris can gather at the bottom of the hole, so bringing the plunger to the surface and inspecting it for wear or damage is a key part of the removal. Can it ultimately return to service? Is replacement the best option? Or does the plunger just need some maintenance before getting back to work?

Rogers suggests examining the lubricator system at the wellhead. The system absorbs energy when the plunger surfaces, contains well pressure and redirects flow from the tubing into the flowline. How is that equipment holding up? Are there O-ring seals that need to be replaced? Is everything secure? He recommends applying a lubricant onto the threads where the lubricator connects with the wellhead. Control valves on the surface—those that open and close the well intermittently—likely could use some grease so they don’t stick in the closed position and complicate the future restart.

Similar procedures should be followed with master valves at the wellhead.

Wells all in this together

In terms of collaboration with operators of nearby wells, the best practices for shutting in wells are akin to fracking, Joe Irvin, Permian Basin area manager with Flowco, told E&P. During fracking, producers often communicate with each other to ensure that no one’s wells suffer collateral damage.

“They shut in all the wells they can,” Irvin said. “They know they’re about to frac. They’re going to shut in the well. They’re going to pull all the tools because they could end up getting a bunch of sand or buildup from that frac. Better to just plug it off.”

During the current mass shut-in, communication takes on added importance, Mountford said, because a producing well can pull in water from neighboring shut-in wells. The process of shutting in changes the way fluids are sent from the reservoir toward whichever lower pressure zones are available to accept fluid. The first well in an area to come back online could pull water off adjacent wells or the formation for days, weeks or months.

“It could change the financial metrics of your well significantly just because the water cut may suddenly go up to 100%,” he said. “I think there’s going to be a need for personal communication between operators in areas.”

Nick Sharp, director of gas-lift operations with Endurance Lift, endorses talking first as well.

“It also goes to the production side when loading wells up,” he said. “It almost becomes a dewatering project if you’re not cognizant of who’s operating versus shutting in wells around you.”

Different types of equipment have varying levels of vulnerability to the downhole environment over time, Mountford said. Gas-lift valves, for example, are fairly resistant to some of the chemistry that may be downhole. Conversely, operators may experience issues with a sucker rod string sitting in a stew of H2S and CO2. When in contact with air and moisture, H2S forms sulfuric acid, which can corrode equipment. CO2, often injected into wells to induce EOR, does not corrode in its pure form. However, when it comes into contact with fluids that contain water, it creates the corrosive element carbonic acid. The combination of H2S and CO2 in the well results in iron sulfide, a significantly more hostile corrosive agent than either H2S or CO2 alone, according to research by the University of Stavenger in Norway.

“One of the things that we could see with wells shut in for a long period of time, especially in areas where there’s potentially corrosive chemistry, is that you could have some holes in your tubing, which will completely crater the gas-lift system,” Mountford said. “It’s not that the artificial lift equipment is bad; it may be holes in the tubing. This provides an opportunity to consider redesigning or pulling strings and checking tubing in that matrix.”

Another area to address during shut-in is the condition of lateral lines, Sharp said.

“There’s a certain amount of fillage of that lateral,” he said. “Once you shut in a well, everything that’s flowing at that time settles back. When you kick the gas-lift well back on, you may produce for a couple days until you lose communication with the toe in the lateral.”

Bacteria also can create problems in laterals drilled across multiple zones, Sharp said. When those zones stop flowing, the low-pressure zone takes in material from the higher-pressure zone. Bacteria can collect in that section of the lateral, resulting in corrosion issues.

Safely bringing back gas-lifted wells

- When starting up gas-lift systems after a significant shut-in period, it is important to follow the API unloading procedure to minimize erosional damage to the gas-lift equipment.

- It is recommended to monitor the surface casing pressures before and after startup to ensure the gas-lift valves are operating as designed.

- Once the well has begun to produce again, casing fluid level shots and flowing pressure/ temperature surveys are good tools to incorporate back into the field to help confirm the artificial lift system is working properly and the flowing bottomhole pressure has returned to the pressure that the well was being produced at before the shut-in.

(Source: Matt Young, Flowco Production Solutions)

Is your chemistry set?

When the well is ready to be brought back on, Young said, the producer simply chooses an artificial lift or reevaluates an earlier elected lift type, installs it into the well and brings it back on. But at an estimated cost of $75,000 or more to pull the equipment, according to Bloomberg, some producers might choose to leave the equipment in the well and adopt a maintenance schedule. That involves pumping corrosion inhibitors into the well, along with antibacterial agents to mitigate any kind of buildup during the static condition of a shut-in well. Treatments of that type are typically repeated every few weeks or months to ward off threats.

In a static well, oil, gas and water naturally separate with gas above, oil in the middle and water below. Gas is relatively benign for the most part unless it includes elements such as hydrogen disulfide or CO2, he said. Those can react with water to corrode production tubing or any kind of metal in the well. In the oil area, natural components of a hard hydrocarbon mixture like paraffin, wax and asphaltene can build up and plug production tubing and the artificial lift equipment.

Enemy No. 1 in a shut-in well is water because it is so welcoming to materials that prey on metals including sodium, calcium and potassium. Left alone, they will attach to production tubing and production casing in the artificial lift system. Treatment includes chemical flushes and freshwater flushes as well as the use of tools to isolate the gas/oil/water separation or keep it below the artificial lift.

The way it works, Young said, is that treated fluid or water is pumped down the production tubing, displacing the hydrocarbons. Another option resembles a gas well application, in which a plug is inserted into the tube and a specific depth, keeping the oil or gas from migrating above that level.

So how does a producer choose between pulling the equipment at shut-in or adopting a maintenance program? It is a matter of upfront cost versus later-life cost, Young said. Maintenance costs are relatively low and have a 90% success rate for those following the process. Another plus is that when it is time to restart the well, the artificial lift system is already in place with potential corrosion and buildup issues mitigated.

But there is a significant caveat. Artificial lift incorporates sophisticated technology in a complex system. Choosing maintenance of ESPs and sucker rod pumps promises a significantly lower rate of success than simply pulling that equipment out of the well, Young said. ESPs have a lot of moving parts and it takes relatively little—a small amount of sand or buildup of film—to interfere with their operations. Sucker rod pumps are similar, so they carry a higher risk of product failure when systems restart, even when the operator adheres to a good maintenance schedule. In the case of more complex artificial lift systems, the associated cost of pulling the equipment out of the well at the beginning is probably a safer, lower-cost route when compared to the maintenance option.

Ready for kickoff

What is happening in an inactive well during a prolonged shut-in might be unclear until restart, but there are numerous downhole interactions that could be occurring to various degrees. That is why monitoring casing and tubing pressure is so important. The entire process is not cheap and it is not easy. Attention to safety is not an extraneous detail when uncorking a natural resource that is meant to burn.

“When these companies are shutting a well in, it’s not an inexpensive fix, especially for the operator, because it’s going to cost … anywhere from $5,000 to even $15,000 to get a plunger lift well kicked off,” Taylor Arbaney, product line director of plunger lift with Endurance Lift, told E&P.

Bringing a well back to production involves a checklist and trained personnel. Samples must be taken from separators treated with chemicals, and flowlines are checked for leaks. Then the well undergoes about a day’s worth of pressure tests before the team even addresses the plunger lift.

“If the well is loaded, then we’re going to have to probably have some type of swabbing unit come out and kick the well off,” Rogers said. In that situation, a crew comes out to the well with a swabbing rig and, typically in a day, removes fluids to release bottomhole pressure and enable the hydrocarbons to flow.

Monitoring technology offers an idea of the extent of liquid load in the tubing and indicates if fluid under pressure for a long period has retreated to the wellbore. If that is the case in the static well, the well may not be able to kick off the plunger lift because the hydraulic pressure of the fluid is keeping it shut in.

Enter the swabbing unit, which is a small truck-mounted rig. It is less costly than a workover unit because it is not designed to pull pipe. Instead, it runs a braided-line into the well under what could be several hundred feet of fluid. Then, like a plunger, it quickly pulls the fluid to the surface. The goal is to kick off the well, and often it works for maybe 30 minutes. Then the line returns for another run and pulls up more fluid. There could be a significant amount of fluid collected in the time since the well was shut in.

“Keep in mind that fluid could be in the annulus as well as what is inside the tubing,” Rogers said. “So once we pull the fluid and begin to reduce the hydrostatic pressure level of the fluid, then the well will start to have flow capability.”

At that point, the plunger lift system can take over from the swab rig and run five to 50 cycles to clear the fluid out of the well and return it to production. The process, depending on a number of factors including depth and production, could take a week.

Hiring that swab crew can be costly. However, depending on the volume of fluid, less expensive options could be available.

“We may be able to do it by dropping soap sticks to try reducing some of the fluid up off the well, and then drop the plunger to get it to kick off,” he said.

Soap sticks can remove fluids like condensate and water, and they act to decrease hydrostatic backpressure that can hinder production.

If the wellbore is dry, then it could be a matter of choking back pressure to keep it under control so overly high IP doesn’t overwhelm the equipment.

“In a dryer condition, you’re going to have a lot of built-up energy, and we have to bring that back on a little slower [to] choke back the well,” Rogers said, “where we would normally be operating without a choke in the system.”

He also offers a piece of critical advice: automation is great but don’t try this from home.

“As a safety precaution, I would highly recommend members of the field team to monitor those systems. Obviously, we would not want to bring wells back on without some type of personnel on location,” Rogers said. “There’s good intelligence to be gained from having remote control and remote observation for pressures, but having that human intervention to kick off the wells is a preferred safety practice when returning wells to production.”

Separation equipment or flowlines that move oil to gathering pipelines can experience blockage as well. A plunger typically takes about a week to line out a well, and the process needs to be carefully monitored to keep velocity in check. If the wellhead chokes are not watched closely and fail to rein in excessive velocity on the plunger lift, equipment may be damaged. “We can design the systems for a certain amount of energy, but if they’re brought back on at a really high rate, obviously the energy has to dissipate somewhere,” Rogers said.

That pressure can induce higher levels of IP in a well shut in for long period of time.

“When they bring those wells back on, they’re going to get a lot more production with that formation just building up pressure when that well kicks on, even though we’re throttling at a certain percentage. But it’s at the highest flow rate that it can handle for 24 hours or longer, depending on the well,” Joe Irvin, Flowco’s area manager for the Permian Basin, told E&P.

The great unknown

If the effect of extended downtime on a well is an unknown, the equalizer is that even a short-term shut-in can impact the formation.

“I’ve been doing this about 20 years and I’ve seen a lot of companies have shut-in issues,” David Gilmore, technical account manager with Endurance Lift, told E&P. “Any time you shut in a well, you have the risk of disturbing or changing your formation. Previously, if everything is slow, good and smooth, and then you shut it in, you’ve built up this pressure. There’s always a risk whenever you shut in a well of causing some damage to the formation or changes to the formation. The well might not come back on as strong as it was before.”

Then again, the opposite could happen.

“There’s always the potential that operators can bring a well back on, and it performs better than it previously has,” Gilmore said.

Wells that restarted in May and June, mostly in the Permian where breakeven prices are relatively low compared to other basins, weathered the shut-ins fairly well.

“The wells that are being brought online right now are the ones that have really only been shut in for a short time,” Brian Arnst, product manager with Ambyint, told E&P in June. “I think the longer these shut-ins go, the more exacerbated these potential problems are going to be.”

There isn’t much published about what happens when unconventional wells are shut in for an extended period, said Endurance Lift’s Mountford. The gas-lift equipment itself, however, shouldn’t present problems with being shut in, Gilmore said.

“We have wells in which we’ll install gas lift, and upon completion, they just sit there covered with fluids for two to three years before they’re ever kicked on and used,” he said. “So the equipment is capable of withstanding being shut in. Your biggest concerns are really going to be corrosion, paraffin buildup, scale, the solids debris and related downhole conditions. And then making sure you bring these wells back online at a slower pace than you would if they were shut in for just a day or two.”

The data chase

A SCADA system and automation can link up a well or multiple wells and connect the user to a wealth of data online. They also provide an invaluable troubleshooting tool in terms of narrowing the search for problems.

“It gives us all the data that we can see on the wellhead: flow rate, injection rate, even fluid levels [and] how much fluid per day,” Irvin said.

A standalone controller at the well site is a lot less expensive, he acknowledged, but an automation solution provides data on how a plunger lift is functioning or well pressure on a 24/7 basis. When operators check their laptops or tablets, they are immediately updated on how plungers are running or if production on a particular well is coming up short on 50 bbl/d of oil. That enables an engineer to target a particular well for attention.

On the flip side, automation provides so many data to operators that they don’t always know what to do with all those data.

The company’s solutions acquire well data on site or via existing third-party systems, such as SCADA, and monitor well performance, tracking the kind of rapid well condition changes that are expected when the wells return to service. Their solutions adjust the set points of artificial lift systems to ensure the equipment can safely adapt to the changes until the well flattens out to its pre-shut-in levels.

If geology is complicating matters below the ground, much of the technology above the ground will have been dormant during the shut-in—a possibility that troubles operators.

Chris Robart, chief commercial officer with production optimization technology provider Ambyint, has heard concerns.

“One of the things [a large] customer mentioned is, ‘I’m expecting there will be a whole bunch of electronics issues and stuff that just isn’t working that failed in regular due course of operations,’” he told E&P.

The longer wells stay shut in, the more likely that operators will experience a deluge of issues that they will discover, both manually and remotely through their SCADA systems, one by one. Robart expects a higher-than-normal frequency of problems to solve when that happens.

View from midstream

When demand collapsed, dragging oil prices down with it in early March, crude oil and associated gas production collapsed too. That created the possibility of suddenly empty crude pipelines, which can be dangerous for system integrity.

Oryx Midstream’s McHale said his company swiftly reached out to its upstream partners and made plans to protect its equipment, including the measurement and pumping devices that would need to quickly return to work when wells began to restart. Oryx asked producers to maintain oil in the tanks so the company could be sure it would be able to pump into a pipeline in the event it was not ready to begin its chemical treatments before wells were shut in.

“It was a really good, collaborative exercise,” McHale said. “The producers get it. They want to make sure that they have a reliable midstream infrastructure to sell into, and we want to make sure we take care of the assets for the life cycle. So it was a good practice run for this short-cycle, volatile price environment.”

Oryx started by determining which chemical treatments were necessary to ward off wax or paraffin buildup in soon-to-be shut-in pipelines. Bacteria and corrosion were top priorities as well, just as they are for producers.

“We essentially went segment by segment across our system, over 1,200 miles, and did a risk ranking,” McHale said. “We mobilized our vendors. They dedicated some additional resources and equipment to go out there and physically treat some of these pipes that we thought were going to be shut in. And they were shut in.”

Oryx operates exclusively in the Permian Basin, a play that enjoys relatively low breakeven prices for crude, so for the company, the shutdown was relatively brief. About 80% of Oryx customers operate in the Delaware Basin, with the rest in the Midland Basin. While one or two customers still had shut-in wells by late June, the vast majority were back to pumping.

“Marginally, everything has been turned back on,” he said. “I think you see some pockets where producers took the opportunity during the downtime to do some well work or optimization work with the facility, but most of the economic deferrals or shut-ins have been turned back on. We went in with a base case that this was a two- to three-month phenomenon, but it didn’t last that long. Obviously, prices did a quicker recovery than everybody was expecting.”

Well restarts went smoothly as well, assisted by hot weather in the basin. The average high temperature in Midland, Texas, in May was 91 degrees, and on six days, highs were above 100 degrees. The heat helped keep wax and paraffin from building up.

“If this would have happened in the middle of winter, I would certainly expect to see some issues around that, but we were able to thread the needle on the paraffin and the water corrosion control and sediment,” McHale said. “We had a couple of tank batteries where we went out and did some flushing to clear out some things, but it was not as bad as we were expecting.”

Planning ahead of a crisis might not be possible, but in normal interactions, a midstream company like Oryx relies on communication and planning with its upstream partners.

“The planning upfront is critical,” he said. “You need good insight on where the production is, when it’s coming online and how much is going to be there. The better those plans are, the more static those plans are, allows us to build more efficiently, use our contract and internal resources more efficiently, not hopping around trying to follow a completion crew or a drilling line or a rig line.”

Producers vary in how they manage sales. From the midstream perspective, early production estimates make it easier to evaluate where restraints might lurk in the system, where there might be slack and what kind of flexibility might be available to move barrels around to avoid bottlenecks.

“It comes down to organization and planning to make sure there are no constraints,” McHale said. “When the Permian was running 400 to 500 rigs, that was tough. It was tough on everyone across midstream and service. You’re trying to figure out when a producer is going to go from an eight-well pad to a 16-well pad. We need to know that. We need to know that early on.”

Rainy day has arrived

An industry reeling from a cascade of harsh developments might also have found the rainy day it has been in search of to clean house in its operations and collect critical data about the nature of an unconventional well when pumping has ceased.

“Realistically, when you look at shale, we haven’t had these big shut-in opportunities yet,” Ambyint’s Robart said. “And when you do shut in wells, there are all sorts of additional data and information, reservoir-oriented, that you can collect that you otherwise don’t have the opportunity to collect.”

It is also a chance for operators to address matters that could not be touched during times of full-on production.

“If they were thinking about redesigning the gas-lift system, if they were having some issues before now, a shut-in period gives a chance for the well to stabilize,” Endurance Lift’s Gilmore said. “This is a good time for them to run a static downhole pressure survey, temperature survey, pressure survey [and] give them an idea of the bottomhole pressure that they have, their temperatures. It also gives them a chance to find out what their static fluid level is.”

For example, a well might be capable of maintaining fluid levels of 3,000 or 4,000 ft but be equipped with a valve designed for more than that, he said. The fluid is never going to be seen there and won’t be able to unload anything. The shut-in could provide the time to make changes to a gas-lift system and perform other well maintenance.

“During that shut-in process, you have a really benign environment to start to do some research [and] some data collection,” Young said. “You can do it as simple as putting a pressure transducer on the surface tubing and casing, and connecting that surface transducer into your automation system.”

The tool collects daily casing pressure and tubing pressure. The more data collected on pressure build that can be turned over to the reservoir and production engineers, the better the operator will be able to determine whether the artificial lift system for the well is the best choice or if a different system is more economical and efficient.

Some of the data, of course, will be left to the scholars.

“There are a ton of question marks out there that lots of people have guesses on, but no one really has data, no one really has analysis and empirical evidence that would back up a lot of speculation,” Robart said. “So I think there will be, potentially, a lot that we all learn as an industry over the course of the next three to six months as these wells restart. Next will come the hard work of analyzing the data and learning from it. So maybe you’ll start to see papers published that draw on some of the data that we’re going to acquire here over the course of the next few months. It’ll take a year, two years, three years, really, for some of the insights to be published.”

Prepare for the best

From its nadir at the close of April to midyear, the price of WTI rose by almost $80/bbl. In almost any era, that type of spectacular improvement would eventually result in complaints about an insufficient supply of Bentleys for sale in Midland, Texas.

Not in this era, in which the oil and gas industry is locked into survival mode. This is not a downcycle like 2015-2017, in which the U.S. upstream sector took on a market share challenge from Saudi Arabia and essentially produced its way to success. That strategy cannot work when storage levels are high and demand is low.

Still, oil and gas has been and remains a cyclical industry, meaning that this downcycle is also a prelude to the next upcycle. How companies use this time—for well workovers, technology upgrades and data collection—may not determine which entities survive the tough times, but it will likely play a key role in competitive advantage when prosperous times return.

Recommended Reading

US Gulf Coast Heavy Crude Oil Prices Firm as Supplies Tighten

2024-04-10 - Pushing up heavy crude prices are falling oil exports from Mexico, the potential for resumption of sanctions on Venezuelan crude, the imminent startup of a Canadian pipeline and continued output cuts by OPEC+.

US Could Release More SPR Oil to Keep Gas Prices Low, Senior White House Adviser Says

2024-04-16 - White House senior adviser John Podesta stopped short of saying there would be a release from the Strategic Petroleum Reserve any time soon at an industry conference on April 16.

Oil Broadly Steady After Surprise US Crude Stock Drop

2024-03-21 - Stockpiles unexpectedly declined by 2 MMbbl to 445 MMbbl in the week ended March 15, as exports rose and refiners continued to increase activity.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.

What's Affecting Oil Prices This Week? (March 25, 2024)

2024-03-25 - On average, Stratas Advisors are forecasting that oil supply will be at a deficit of 840,000 bbl/d in 2024.