Analysts are skeptical that Aethon’s assets on the Louisiana side of the Haynesville Shale are worth $6 billion. (Source: Hart Energy; MVelishchuk, shurkin_son/Shutterstock.com)

Presented by:

This article appears in the E&P newsletter. Subscribe to the E&P newsletter here.

Here is the definitive value of Aethon Energy Management LLC’s northern Louisiana assets: whatever somebody is willing to pay. Don’t forget that you read it here first.

In early January, Aethon let slip that it was exploring a sale of its acreage on the Louisiana side of the Haynesville Shale. There was also a hint that an offer of $6 billion, including debt, should do the trick. Worth it? That depends.

Read: A Peek Inside Haynesville’s Aethon

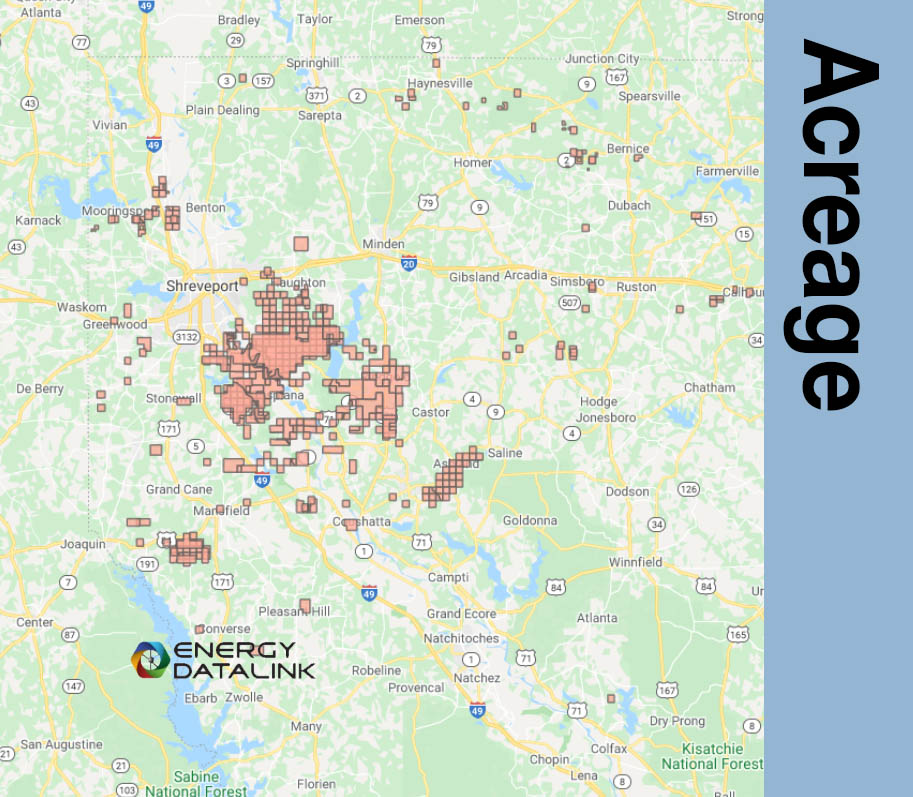

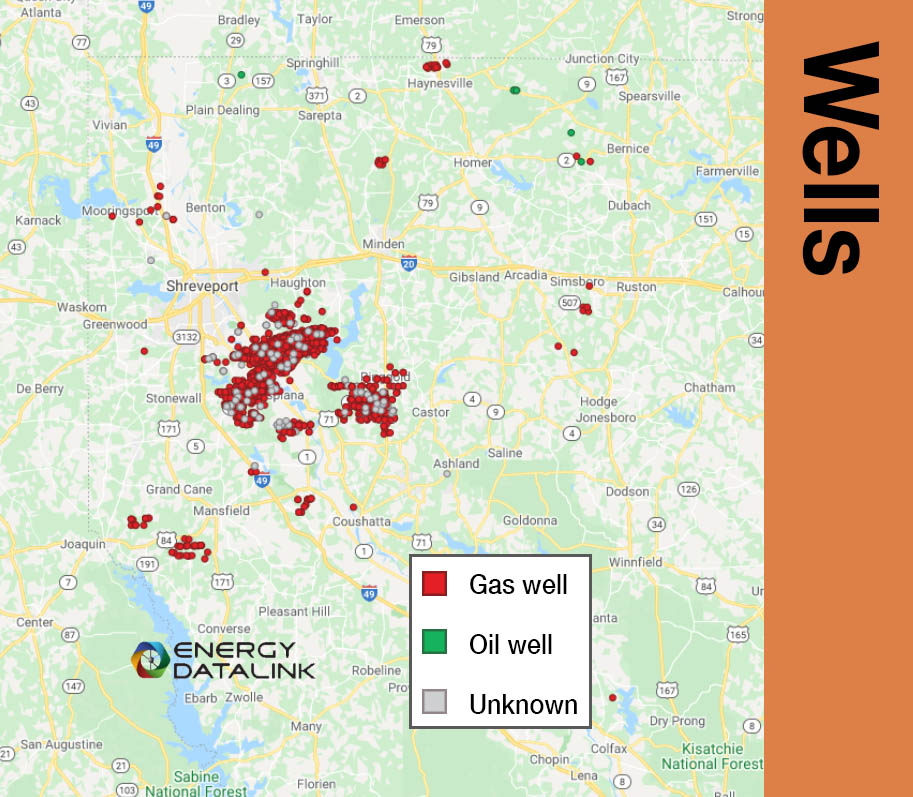

Rextag’s DataLink shows Aethon’s Louisiana presence at 390,000 acres, the bulk of it in clumps due south and southeast of Shreveport. That total jumps to more than 630,000 when its Texas position is included. A little more than 1,000 wells are active in the region.

Wells Fargo noted in an early January research report that, despite the company’s aggressive completion campaign, its well productivity has not fared as well as public producers in the area, nor as well as recent acquisition targets such as Vine Energy Inc.—bought by Chesapeake Energy Corp. in November 2021 for $2.2 billion—and Indigo Natural Resources LLC—bought by Southwestern Energy Co. in September 2021 for $2.7 billion.

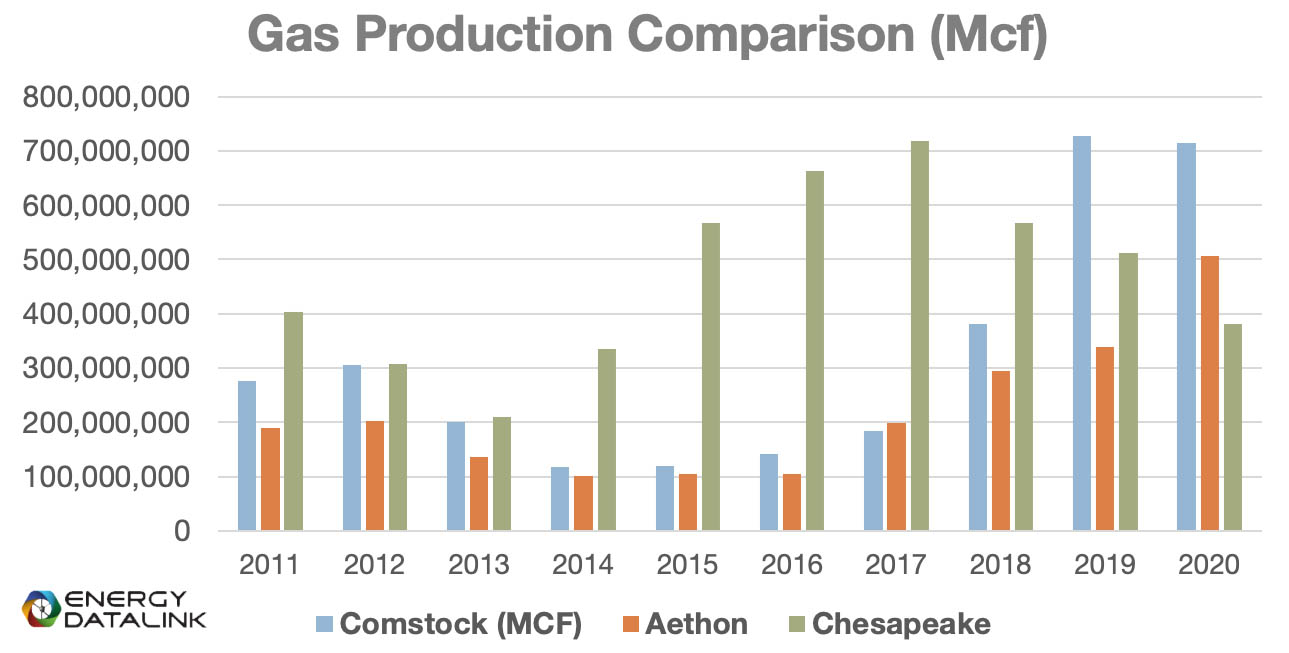

A historical comparison, however, shows Aethon’s production increasing each calendar year since 2014. Its drawback is the lack of acreage in the sweetest spots of the prolific De Soto Parish. Wells Fargo examined a three-month stretch of 2020 production and found Aethon lagging the basin average by about 18%. The gap began to narrow, however, 12 months out.

Aethon’s advantage, however, is a shallow decline curve compared to other acquisitions targets in the region. Wells Fargo estimates a proved developed producing (PDP) decline in the range of 38% to 23% for Aethon’s wells. Vine’s rate, however, was in the 46% to 39% range.

“The smaller declines will require a smaller reinvestment ratio in the near term to maintain production levels, which could be attractive to a potential buyer,” Wells Fargo said in the report.

Aethon operates seven rigs in the Louisiana side of the Haynesville (with another seven on the Texas side). Were a potential buyer to ease up on drilling, the purchase could contribute to the longer-term supply-demand balance for natural gas, particularly in the Haynesville.

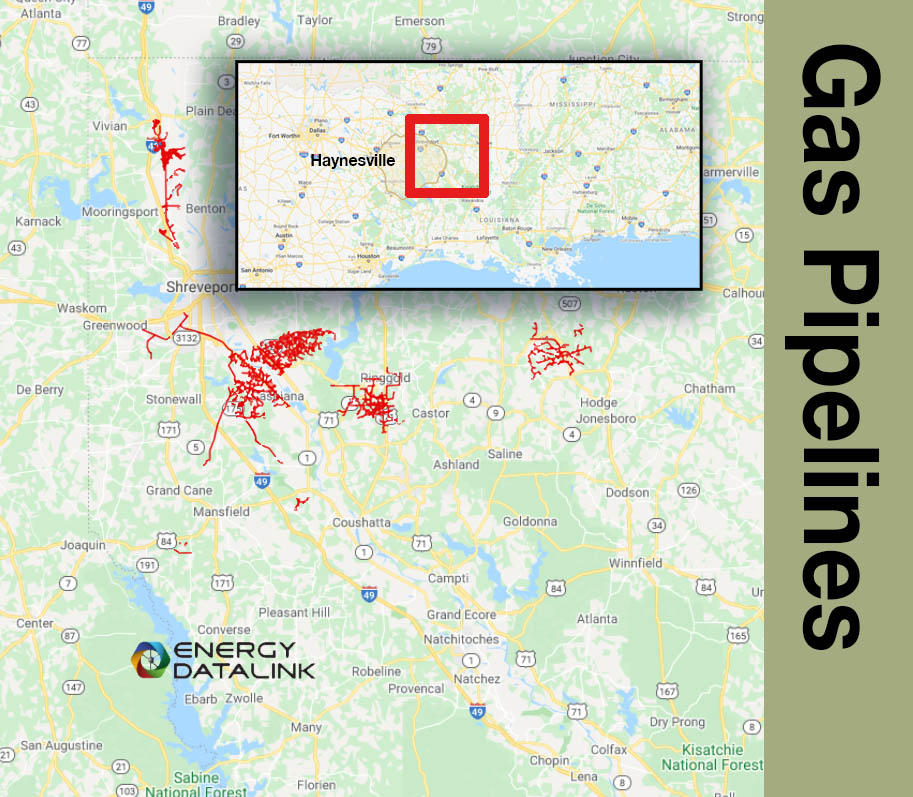

Wells Fargo’s analysts were skeptical that a buyer could justify ponying up $6 billion, but they also noted that it was unclear if Aethon’s midstream assets would be part of the offerings. Aethon owns about 830 miles of natural gas pipelines in northern Louisiana and about 360 Mcf/d of processing capacity.

The assessment comes out to this: $6 billion implies a price of $22,000 per undeveloped acre, and that’s assuming that all of the acreage is undeveloped, which it obviously is not. That is way out of alignment with valuations for recent purchases of Vine ($7,000 per undeveloped acre) and Indigo ($11,000 per undeveloped acre).

Based on a $3.25/MMBtu Henry Hub strip price, Wells Fargo values Aethon’s northern Louisiana assets at about $2.26 billion. The analysts were careful to note “in the current price environment.”

The price of gas, of course, has been hovering just under $5/MMBtu and briefly eclipsed $6 near the end of January. If this price level proves to be sustainable, would that entice a buyer? It depends…

Recommended Reading

Less Heisenberg Uncertainty with Appraisal Wells

2024-03-21 - Equinor proves Heisenberg in the North Sea holds 25 MMboe to 56 MMboe, and studies are underway for a potential fast-track tieback development.

TPH: Lower 48 to Shed Rigs Through 3Q Before Gas Plays Rebound

2024-03-13 - TPH&Co. analysis shows the Permian Basin will lose rigs near term, but as activity in gassy plays ticks up later this year, the Permian may be headed towards muted activity into 2025.

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.

Gibson, SOGDC to Develop Oil, Gas Facilities at Industrial Park in Malaysia

2024-02-14 - Sabah Oil & Gas Development Corp. says its collaboration with Gibson Shipbrokers will unlock energy availability for domestic and international markets.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.