LOGOS Resources II LLC built a large portion of its position in the San Juan Basin through a 2017 acquisition of WPX Energy’s assets for $169 million. (Source: LOGO Resources / Oil and Gas Investor)

Private-equity fund North Hudson Resource Partners LP purchased San Juan Basin operator LOGOS Resources II LLC from affiliates of ArcLight Capital Partners LLC for $402 million, according to a North Hudson news release.

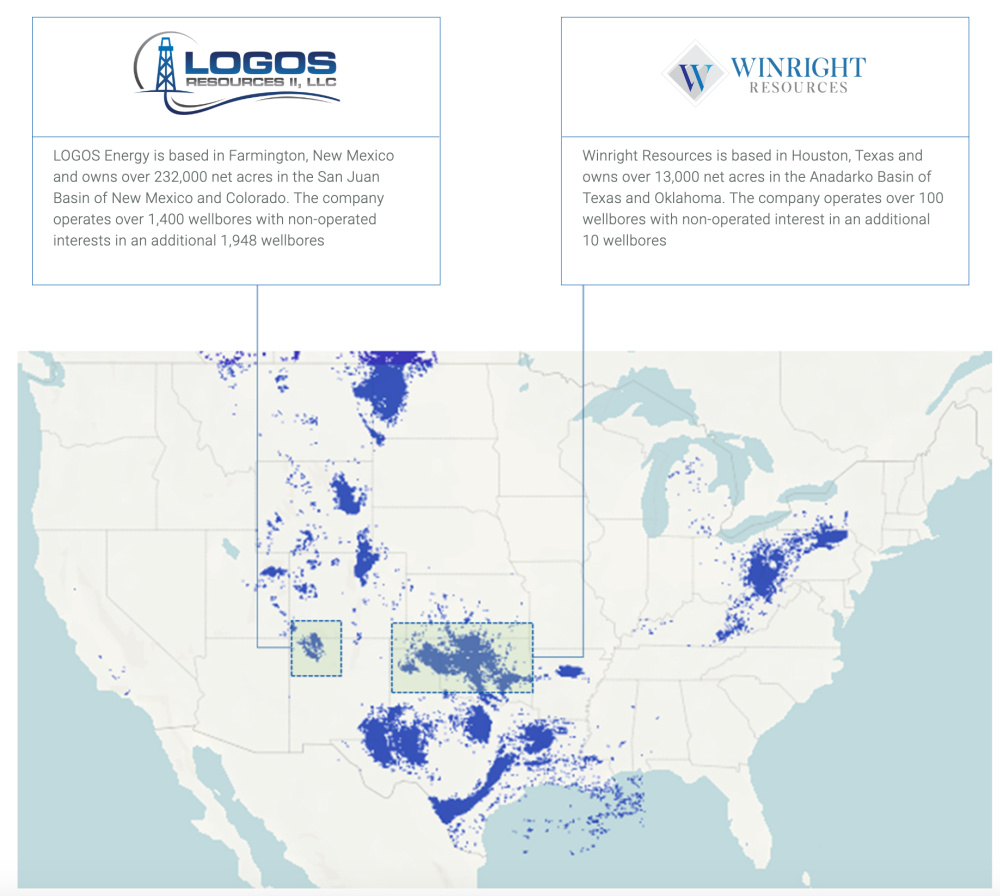

LOGOS’ net production averages 106 MMcfe/d across a 230,000 net-acre position in the San Juan Basin of New Mexico and Colorado. The company recently commenced its 2022 drilling program and anticipates increasing net production to about 130 MMcfe/day by year-end.

A long-time San Juan Basin operator, LOGOS has an “extensive inventory” of drilling locations in the Mancos Shale and Gallup oil play, North Hudson said in a June press release.

“Our operating and development track record, basin-leading ESG programs, and financial and strategic support provided by North Hudson, place LOGOS in an excellent position to execute on the next phase of value creation.”—Jay Paul McWilliams, CEO, LOGOS Resources II LLC

LOGOS built a large portion of its position in the San Juan Basin through a 2017 acquisition of WPX Energy’s assets for $169 million. The assets included 900 producing wells and 200 potential Mancos locations on 134,000 net acres in New Mexico and Colorado.

At the time of the WPX deal, LOGOS said its San Juan assets would consist of oil, gas and condensate that would average 112 MMcfe/d.

LOGOS will retain its existing management team led by CEO Jay Paul McWilliams following its sale to North Hudson.

McWilliams said North Hudson will enable LOGOS to accelerate the development of its Mancos and Gallup reserve base following a successful 2021 horizontal drilling program. The company holds 55,000 gross acres in the heart of the Mancos Shale.

“Our operating and development track record, basin-leading ESG programs, and financial and strategic support provided by North Hudson, place LOGOS in an excellent position to execute on the next phase of value creation,” he said.

North Hudson is a Houston-based energy investment firm focused “on opportunistic upstream and midstream energy investments in North America.” It has more than $850 million of assets under management.

Mark Bisso, managing partner of North Hudson, said LOGOS offers the firm a significant opportunity for its investors given the company’s “strong management team, significant and stable production base, and expansive undeveloped resource base.”

Kirkland & Ellis and Skadden served as legal counsel for North Hudson for the LOGOS transaction.

North Hudson’s current portfolio comprises both nonoperated and operated oil and gas assets in about 4,500 wells primarily located in the Permian, Denver-Julesburg and San Juan basins as well as the Haynesville Shale.

In January, North Hudson’s affiliate, Split Rock Resources LLC, acquired nonoperated Permian Basin oil and gas assets from a private seller for $97.5 million cash. The acquisition primarily consisted of assets in the Delaware and Midland basins.

Recommended Reading

New Fortress Starts Barcarena LNG Terminal Operations in Brazil

2024-03-01 - New Fortress’ facility consists of an offshore terminal and an FSRU that will supply LNG to several customers.

Imperial Expects TMX to Tighten Differentials, Raise Heavy Crude Prices

2024-02-06 - Imperial Oil expects the completion of the Trans Mountain Pipeline expansion to tighten WCS and WTI light and heavy oil differentials and boost its access to more lucrative markets in 2024.

Majors Aim to Cycle-proof Oil by Chasing $30 Breakevens

2024-02-14 - Majors are shifting oilfields with favorable break-even points following deeper and more frequent boom cycles in the past decade and also reflects executives' belief that current high prices may not last.

Exclusive: Andrew Dittmar Expects Increased Public M&A in 2024

2024-02-15 - In this Hart Energy LIVE Exclusive, Andrew Dittmar, Enverus Intelligence's senior vice president, compares 2023 consolidation to what he expects in 2024, including more public to public deals.

Exxon, Vitol Execs: Marrying Upstream Assets with Global Trading Prowess

2024-03-24 - Global commodities trading house Vitol likes exposure to the U.S. upstream space—while supermajor producer Exxon Mobil is digging deeper into its trading business, executives said at CERAWeek by S&P Global.