Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Kinder Morgan Inc. and Brookfield Infrastructure Partners LP agreed to sell a 25% minority interest in jointly owned Natural Gas Pipeline Co. of America LLC (NGPL) to a fund controlled by ArcLight Capital Partners LLC for $830 million.

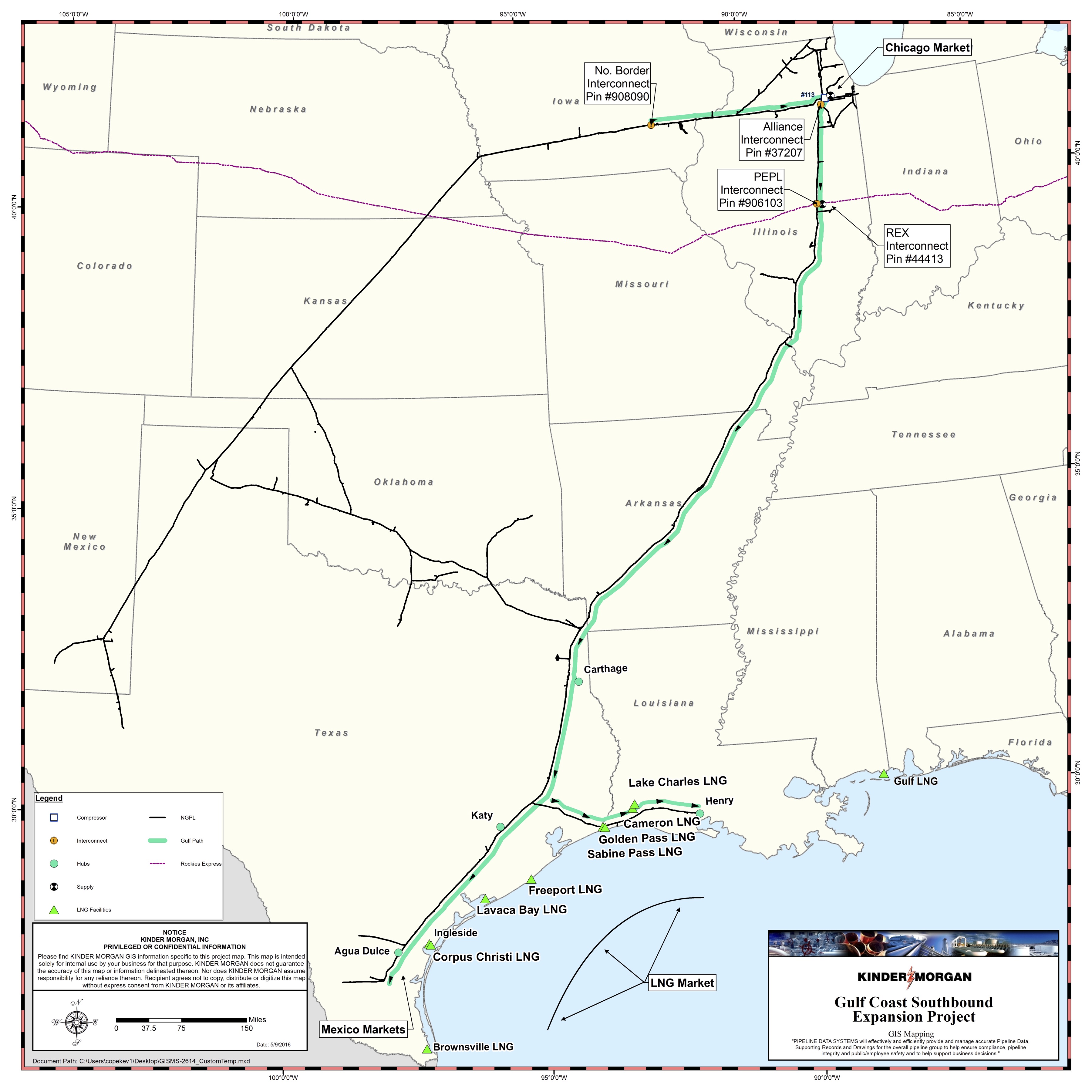

NGPL is the largest transporter of natural gas into the high-demand Chicago-area market as well as one of the largest interstate pipeline systems in the country. It is also a major transporter of natural gas to large LNG export facilities and other markets located on the Texas and Louisiana Gulf Coast.

The value of the 25% stake implies an enterprise value of approximately $5.2 billion for NGPL, which is roughly 11.2 times its 2020 EBITDA, according to a Kinder Morgan company release on Feb. 22.

Analysts with Tudor, Pickering, Holt & Co. (TPH) described the deal’s price tag as a “sizeable premium” to recent comparable transactions including last year’s roll-up of TC PipeLines by TC Energy Corp. and the acquisition of Dominion Energy Inc.’s gas business by Berkshire Hathaway Inc.

“Valuation premium likely attributable in part to high-quality demand-oriented counterparty list and the pipeline’s geographic position serving the Chicago market with north-south integration to Gulf Coast LNG facilities,” the TPH analysts wrote in a Feb. 23 research note.

NGPL has approximately 9,100 miles of pipeline, more than 1 million compression horsepower and 288 Bcf of working natural gas storage. The entity, which has a dedicated management team, is jointly owned by Kinder Morgan and Brookfield Infrastructure Partners.

“Kinder Morgan and Brookfield Infrastructure are pleased to welcome ArcLight into the NGPL joint venture,” said Kinder Morgan Natural Gas Pipelines President Tom Martin in statement on Feb. 22. “We believe this investment shows the value of natural gas infrastructure both today and in the decades to come.”

The proceeds from the NGPL sale to ArcLight will be shared equally between Kinder Morgan and Brookfield Infrastructure, the company release said.

After paying down “leverage-neutral debt” of about $170 million, TPH estimates Kinder Morgan will have $245 million remaining, which the firm expects to be largely allocated to further debt reduction. The analysts also noted the company has highlighted a willingness to repurchase shares contingent on valuation.

“While the transaction’s scale limits materiality to KMI, positive to see management actively looking for opportunities to realize portfolio value and pull forward cash to allocate toward the balance sheet,” the TPH analysts added in the note.

Barclays served as exclusive financial adviser to ArcLight for the transaction and has provided a committed debt financing to ArcLight to support the acquisition. Latham & Watkins LLP served as legal adviser to ArcLight.

NGPL is served by RBC Capital Markets as the exclusive financial adviser and King and Spalding as its legal adviser.

The transaction is expected to close in the first quarter of 2021.

Upon closing of the transaction, Kinder Morgan and Brookfield Infrastructure will each hold a 37.5% interest in NGPL. Kinder Morgan will continue to operate the pipeline.

Recommended Reading

Xerion CEO: Battery Industry Infrastructure Buildout Must be Holistic

2024-04-12 - John Busbee, CEO and co-founder of Xerion Advanced Battery Corp. tells Jordan Blum, Hart Energy’s editorial director, that the whole battery industry must advance at the same time in order to be successful.

Schneider Electric’s Heather Cykoski: Infused AI is Everywhere

2024-04-09 - Schneider Electric puts sensors in the technology it provides customers, creating the ability to gather data, predict operations and drive efficiency.

AI Copilot, Not Captain: Pragmatic Cybersecurity to Protect Grid

2024-04-01 - AI experts at CERAWeek by S&P Global issued a wake-up call for the energy sector, suggesting AI could help secure critical infrastructure in a hostile geopolitical landscape.

Gas Executives: US Pipe Dreams ‘Not Dead,’ but Challenging

2024-03-27 - Regulators could pivot as “market signals that may come may be worse than regulators are looking for,” Sempra Infrastructure’s president of LNG said.