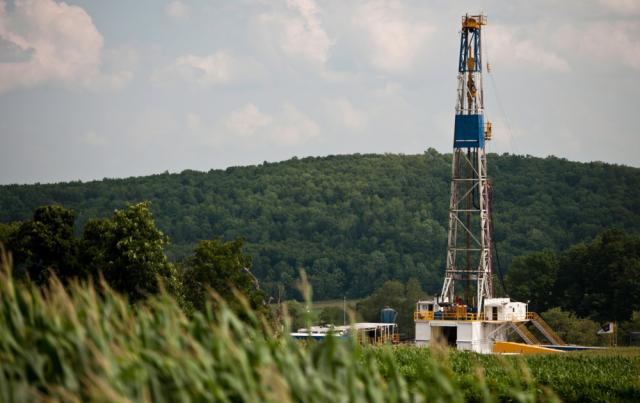

The acquisition represents the initial investment for IOGR II, the successor platform to IOG Resources LLC. (Source: Hart Energy photo library)

IOG Resources II LLC (IOGR II) said Nov. 22 that it acquired producing gas assets in the Appalachian Basin operated by Seneca Resources, an affiliate of National Fuel Gas.

The assets consist of nonoperated wellbores primarily located in Clearfield, Elk and McKean counties, Pennsylvania, with current net production averaging about 17 MMcf/d.

The purchase price was not disclosed.

The acquisition represents the initial investment for IOGR II, the successor platform to IOG Resources LLC. Both firms are Dallas-based energy investment platforms sponsored by First Reserve.

Following the November transaction, the IOG Resources platform now includes 13 discrete investments across six core basins in the U.S.

In March 2022, IOGR acquired producing oil and gas assets in the Delaware Basin from Tier 1 Merced Holdings LLC. The nonoperated wellbores were primarily located in Eddy and Lea counties, New Mexico.

The IOG group was established in 2017 and is focused on onshore producing nonoperated oil and gas investments and structured drilling capital in North America. In 2018, National Fuel Gas sold assets to IOG CRV – Marcellus LLC for $17.3 million through a joint development agreement, according to National Fuel Gas’ regulatory filings.

First Reserve is a private equity firm focused on investing across diversified energy, infrastructure and general industrial end-markets. The firm, founded in 1983, has raised more than $32 billion of aggregate capital since its inception. Its investment and operational experience have been built from over 725 transactions, including platform investments and add-on acquisitions, on six continents.

Kirkland & Ellis LLP acted as legal counsel for IOGR II.

Recommended Reading

PGS, TGS Merger Clears Norwegian Authorities, UK Still Reviewing

2024-04-17 - Energy data companies PGS and TGS said their merger has received approval by Norwegian authorities and remains under review by the U.K. Competition Market Authority.

Energy Systems Group, PacificWest Solutions to Merge

2024-04-17 - Energy Systems Group and PacificWest Solutions are expanding their infrastructure and energy services offerings with the merger of the two companies.

Marketed: KJ Energy Operated Portfolio in East Texas

2024-04-16 - KJ Energy has retained TenOaks Energy Advisors for the sale of its operated portfolio located in East Texas.

Exclusive: Pat Jelinek on Decarbonization Efforts, M&A Outlook

2024-04-16 - Oil and gas leader for EY Americas Pat Jelinek discusses trends in the Lower 48 like consolidation and why decarbonization is "more important" in the near term than the energy transition, in this Hart Energy Exclusive interview.

Marketed: Anschutz Exploration Six Asset Package in Wyoming

2024-02-26 - Anschutz Exploration Corp. has retained EnergyNet for the sale of six AFE asset packages in Campbell County, Wyoming.