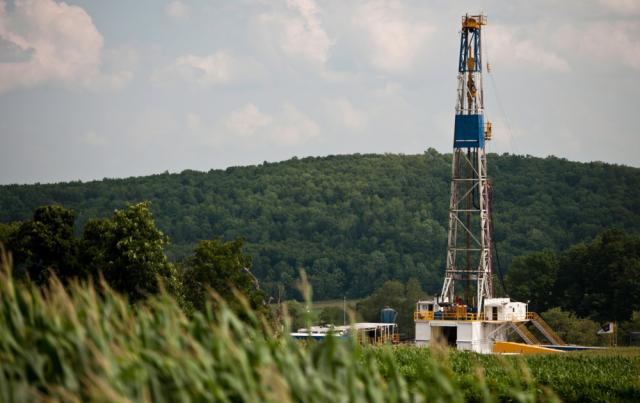

The acquisition represents the initial investment for IOGR II, the successor platform to IOG Resources LLC. (Source: Hart Energy photo library)

IOG Resources II LLC (IOGR II) said Nov. 22 that it acquired producing gas assets in the Appalachian Basin operated by Seneca Resources, an affiliate of National Fuel Gas.

The assets consist of nonoperated wellbores primarily located in Clearfield, Elk and McKean counties, Pennsylvania, with current net production averaging about 17 MMcf/d.

The purchase price was not disclosed.

The acquisition represents the initial investment for IOGR II, the successor platform to IOG Resources LLC. Both firms are Dallas-based energy investment platforms sponsored by First Reserve.

Following the November transaction, the IOG Resources platform now includes 13 discrete investments across six core basins in the U.S.

In March 2022, IOGR acquired producing oil and gas assets in the Delaware Basin from Tier 1 Merced Holdings LLC. The nonoperated wellbores were primarily located in Eddy and Lea counties, New Mexico.

The IOG group was established in 2017 and is focused on onshore producing nonoperated oil and gas investments and structured drilling capital in North America. In 2018, National Fuel Gas sold assets to IOG CRV – Marcellus LLC for $17.3 million through a joint development agreement, according to National Fuel Gas’ regulatory filings.

First Reserve is a private equity firm focused on investing across diversified energy, infrastructure and general industrial end-markets. The firm, founded in 1983, has raised more than $32 billion of aggregate capital since its inception. Its investment and operational experience have been built from over 725 transactions, including platform investments and add-on acquisitions, on six continents.

Kirkland & Ellis LLP acted as legal counsel for IOGR II.

Recommended Reading

US Gas Rig Count Falls to Lowest Since January 2022

2024-03-22 - The combined oil and gas rig count, an early indicator of future output, fell by five to 624 in the week to March 22.

US Drillers Cut Oil, Gas Rigs for Fourth Week in a Row-Baker Hughes

2024-04-12 - The oil and gas rig count, an early indicator of future output, fell by three to 617 in the week to April 12, the lowest since November.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

US Drillers Cut Oil, Gas Rigs for Second Time in Three Weeks

2024-02-16 - Baker Hughes said U.S. oil rigs fell two to 497 this week, while gas rigs were unchanged at 121.

US Drillers Cut Oil, Gas Rigs for Third Week in a Row

2024-04-05 - The oil and gas rig count, an early indicator of future output, fell by one to 620 in the week to April 5, the lowest since early February.