Apache workman climbs ladder to the top of storage tanks near the Adair San Andres field in the Permian Basin. (Source: Apache Corp.)

Apache Corp., one of the largest operators in the Permian Basin, is looking to narrow its portfolio in the prolific basin.

The E&P company is offering for sale producing properties, leasehold and related assets located in the Eastern Shelf of the Permian Basin. The transaction will represent a full exit from the Eastern Shelf for Apache, according to Houston-based Detring Energy Advisors, which is marketing the assets for the company.

So far in 2019, Apache has already completed roughly $560 million worth of asset sales through its exit from the Midcontinent region. Proceeds from the asset sales were used to reduce debt as the company’s focus this year is on capital discipline and shareholder returns.

When asked during the company’s earnings call in early August whether Apache had plans for any future asset sales, CEO John Christmann answered that the company is always looking to trim its portfolio.

“If there are things we’re not going to invest in, if there are areas that others would put, what we would view as, good value on our premium value,” Christmann said, “we’re not afraid to turn [those] things loose.”

Though, he characterized any potential asset sale at the time as nothing “major.”

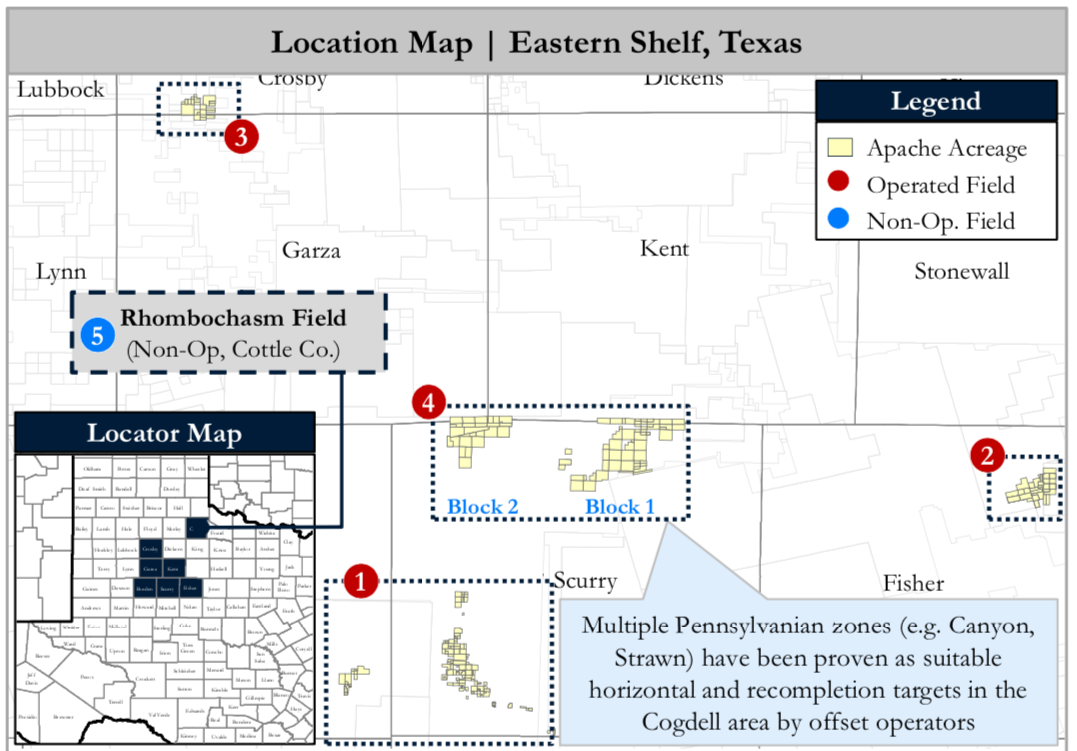

The Eastern Shelf sale includes assets in Borden, Cottle, Crosby, Fisher, Garza, Kent and Scurry counties, Texas. Oil major Chevron Corp. also has assets on the market in the area through a package being marketed by EnergyNet.

In total, Apache is offering working and net revenue interests in 35,826 net acres with about 1,410 barrels of oil equivalent per day (boe/d) of production, roughly 89% of which is oil. A majority of the production is on artificial lift with the opportunity for operational value-add projects, Detring said in a teaser of the package.

Based in Houston, Apache is an oil and gas E&P company with operations in the U.S., Egypt and the U.K. The company also launched exploration efforts offshore Suriname in South America earlier this year.

Even with the diversified portfolio, the Permian Basin is a key focus for the company. For the first half of this year, capital investment in the Permian represented about 70% of Apache’s total upstream budget. Though, Apache has prioritized its core Permian portfolio over its Eastern Shelf position, according to Detring.

During the second quarter, Apache operated an average of 12 rigs in the Permian Basin, averaging five rigs in the Alpine High area, four in the Midland Basin and three in the Delaware Basin outside of Alpine High. The company’s Permian production averaged 226,000 boe/d for the quarter.

RELATED:

Low Permian Gas Prices Bring Down Quarterly Profit For Apache

In August, Apache lowered its second-half production guidance for the Permian, reflecting delays in the Midland and Delaware sub-basins along with continued gas production deferrals at Alpine High due to weak Waha gas prices.

The company, however, also reiterated its plans for 2019 to invest $2.4 billion in upstream oil and gas capital, a reduction of 22% from 2018 levels.

“While oil price and sale proceeds helped create capacity for further capital return to investors, the combination of historically weak gas prices in the Permian, a result in production deferrals and now extremely weak NGL prices have more than offset the oil price benefit,” Apache CFO Stephen Riney said during the company’s earnings call. “We will monitor anticipated 2019 cash flows and will continue to prioritize returns to investors over increasing capital spend.”

Bids for the Eastern Shelf package are due the week of Nov. 18. According to Detring, Apache anticipates executing a purchase and sales agreement for the Eastern Shelf asset sale in mid-December, with closing occurring by Jan. 31.

For more information on the offering, visit detring.com or contact Melinda Faust at mel@detring.com or 713-595-1004.

Recommended Reading

Qnergy Tackles Methane Venting Emissions

2024-03-13 - Pneumatic controllers, powered by natural gas, account for a large part of the oil and gas industry’s methane emissions. Compressed air can change that, experts say.

Exclusive: Rebellion Energy Orphan Well Method Pinpoints the Particulars in Plugging

2024-03-01 - Rebellion Energy Solutions CEO Staci Taruscio dives into the company's methods when plugging for permanence in this Hart Energy LIVE Exclusive with Editorial Director Jordan Blum.

MethaneSAT: EDF’s Eye in the Sky Targets E&P Emissions

2024-03-07 - The Environmental Defense Fund and Harvard University recently launched MethaneSAT, a satellite tracking methane emissions. The project’s primary target: oil and gas operators.

CAPP Forecasts $40.6B in Canadian Upstream Capex in 2024

2024-02-27 - The number is slightly over the estimated 2023 capex spend; CAPP cites uncertain emissions policy as a factor in investment decisions.

SEC Adopts Climate Disclosure Rules in 3-2 Vote

2024-03-06 - The regulation requires companies to disclose Scope 1 and 2 emissions, weather-related risks and other climate-related data that could have a material business impact.