(Source: Hart Energy; Shutterstock.com)

Antero Resources Corp. inched closer to its divestiture target for the year with the announcement of a transaction on Aug. 11 for cash proceeds of $220 million.

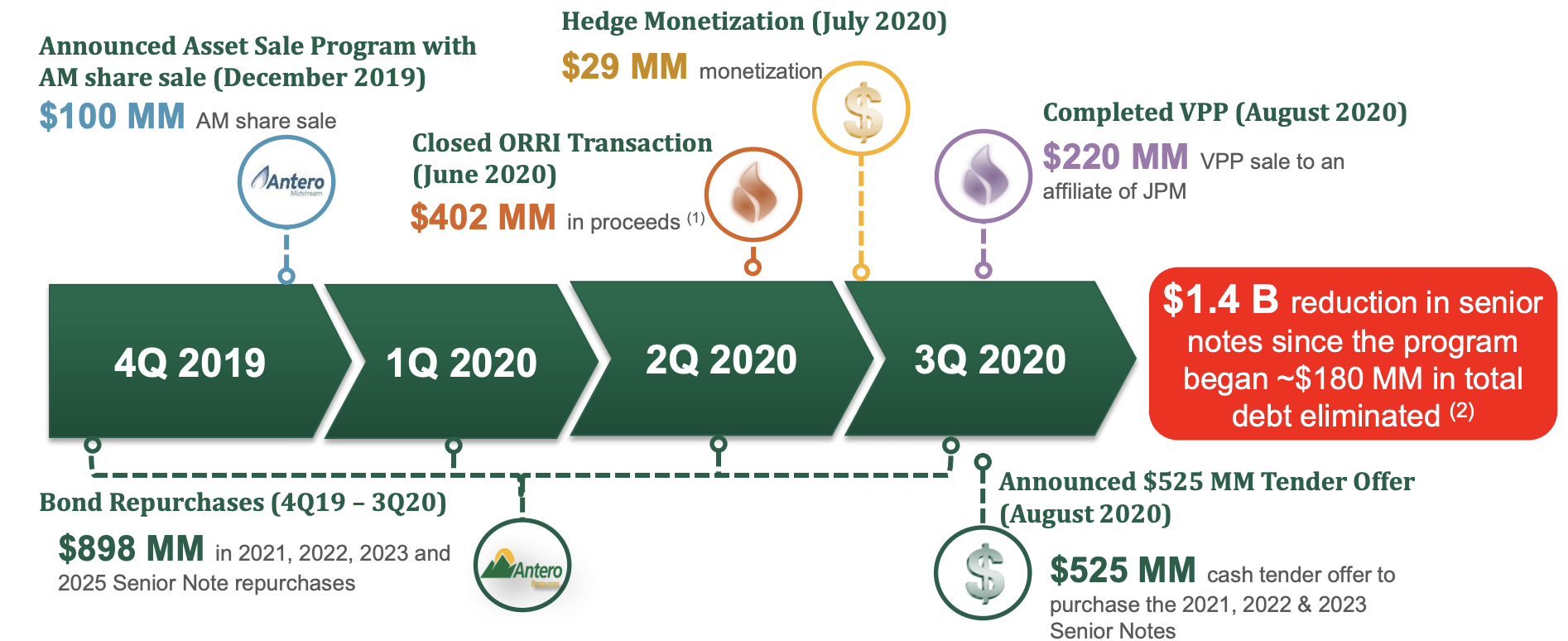

The transaction, with an affiliate of J.P. Morgan, is a volumetric production payment (VPP) through 2027 comprised of dry gas producing properties in West Virginia. The VPP deal follows Antero’s sale in June of overriding royalty interest (ORRI) in its Appalachia position with proceeds earmarked to pay down debt.

“This morning’s volumetric production payment transaction is another step towards de-risking the liquidity outlook,” Morgan Stanley & Co. LLC analysts wrote in an Aug. 11 research note.

However, with Antero’s leverage “still uncomfortably high,” Morgan Stanley’s rating of the stock remains Underweight despite recently improving investor sentiment for natural gas. Assuming the full tender amount of an offering of debt repurchases also announced Aug. 11, the analysts estimate the company’s pro-forma maturities would total about $1.4 billion, or roughly 70% of total debt outstanding.

“We maintain a cautious view of natural gas E&Ps and favor more defensive producers with relatively less leverage and stronger free cash flow profiles,” Morgan Stanley analysts wrote. “For [Antero], strong execution on cost savings and hedge coverage insulate near-term cash flow, though comes with significant execution risk ahead of a still onerous maturity schedule. Moreover, at strip commodity prices, we do not see a clear path towards leverage reduction and forecast meaningful downside to our intrinsic valuation.”

The effective date of the VPP sale is July 1 with a seven-year term ending June 30, 2027. Associated net production includes 60 MMcf/d in second-half 2020, 75 MMcf/d in 2021 before declining to 40 MMcf/d by first-half 2027 prior to termination.

The VPP transaction brings Antero’s asset sale proceeds for the year to $751 million, achieving the low end of its $750 million to $1 billion target range, according to Paul Rady, chairman and CEO of Antero Resources.

“The ability to monetize $751 million of assets in such a challenging market is a testament to the quality of Antero’s substantial producing properties and acreage,” Rady said in a statement.

1) Inclusive of $102 million of contingent payments to be received if certain volume thresholds are met.

2) Assumes full participation in $525 million cash tender offer. Includes $171 million in discounts captured through repurchases to date plus 2% discount for 2021s through pending tender offer.

Pro forma for the VPP sale and assuming $525 million of bonds are tendered and repurchased, CFO Glen Warren said Antero will have reduced near term bond maturities by over $1.4 billion since fourth-quarter 2019 when the divestiture target was first announced.

“We will continue to pursue additional asset sale opportunities and plan to use any future proceeds for debt retirement,” Warren said in a statement.

Vinson & Elkins led by partner Danielle Patterson advised Antero Resources on the VPP sale. Antero’s borrowing base under the credit facility remains unchanged at $2.85 billion following the VPP transaction, according to the company release.

Based in Denver, Antero Resources holds a position of about 536,000 net acres across West Virginia and Ohio in the core of the Appalachian Basin’s Marcellus and Utica shale plays. Prior to the ORRI sale, the company’s position included 84% net revenue interest.

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.

Strike Energy Updates 3D Seismic Acquisition in Perth Basin

2024-04-19 - Strike Energy completed its 3D seismic acquisition of Ocean Hill on schedule and under budget, the company said.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.