The industry mood was subdued going into the annual National Association of Publicly Traded Partnerships’ (NAPTP) MLP Investor Conference compared to the same meeting during the previous year.

The conference opened with an announcement from Mary Lyman, NAPTP’s director, that the association would change its name to the Master Limited Partner Association, or MLPA.

This change kicked off a conference full of discussion about major changes— many of which have provoked some anxieties about the future of the MLP landscape. From new proposed regulations by the U.S. Internal Revenue Service (IRS) as to what is considered qualifying income under the MLP structure, to Kinder Morgan Partners’ and potentially Williams Partners’ exits as MLPs, the future of the space seemed uncertain.

However, regardless of concerns attendees brought with them to the conference, they likely left with a spring in their step—and not just because the Hyatt Regency Orlando, where the conference took place, is only a stone’s throw from some of the world’s most famous amusement parks. Both speakers at the conference and analysts in attendance insisted that MLPs remain a good bet for investors.

“A majority of the midstream players reported better than expected earnings for the first quarter,” Sunil Sibal, managing director and senior MLP analyst at Global Hunter Securities, said in an “MLPs/Energy Infrastructure Industry Update” following the late-May event.

Most of the midstream players Sibal spoke to at the NAPTP conference “offered guarded optimism that U.S. production growth could continue at the rapid pace it has enjoyed in the last few years,” he said.

MLP downside protection

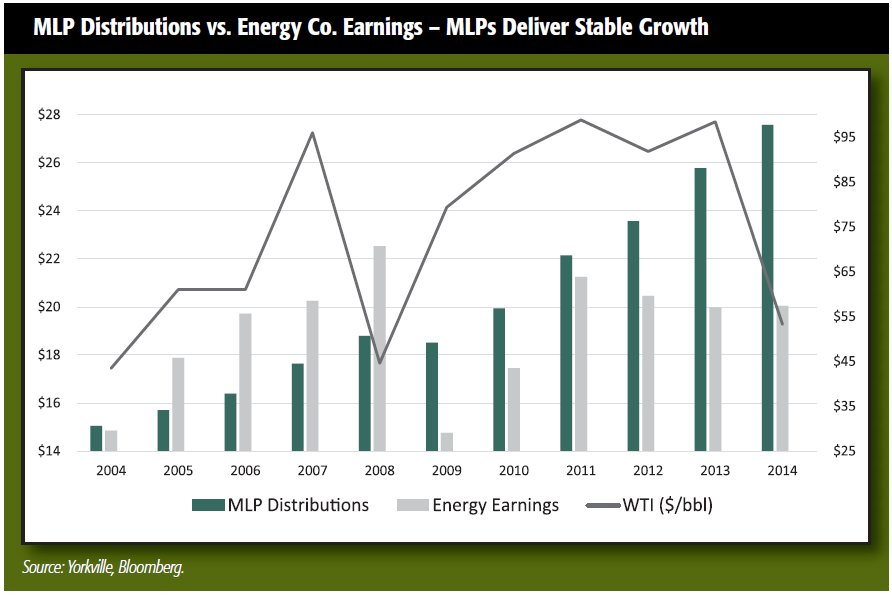

Darren Schuringa, founder of Yorkville Capital Management, said during a panel on “The View from the Buy Side” that during the downturn, MLPs provided downside protection compared to other structures.

“MLPs, as we have told people over and over again … it’s not an energy business model, generally speaking,” he said. “It is a model that is not ‘volume- times-commodity price-equals revenue.’ It’s a leasing business, generally speaking. The leasing business model provides protection against commodity price erosion, against market cycles, economic cycles, interest rate cycles.”

Schuringa compared the current drop in energy commodity prices to the 2008 price decline to illustrate the resilience of MLP distributions.

“In ’08 you had a drop in oil from over $100 down to $40, and the MLP distrubutions were basically flat.

Schuringa said. “They were actually down 9%, and another statistic is 75% of all partnerships maintained or increased their distributions over this period.”

That trend has continued into second-quarter 2015, as 88% of all MLPs either maintained or increased their distributions, according to Yorkville.

“Investors today, in selling off MLPs in the fourth quarter—in the first quarter not so much but into the first quarter a bit—are really looking at MLPs as a different business model, as an energy business model,” Schuringa added. “And that’s not the case across the asset class.”

A taxing issue

Though the optimistic outlooks from presenting companies were enough to inspire confidence in investors and analysts, issues affecting MLPs in general— including the proposed regulations from the IRS—were on the minds of many attendees. Questions surrounding the IRS proposal were addressed by a panel of tax experts during the second day of the conference.

Generally, the proposed regulations define what the IRS will consider qualifying income for MLPs. According to Robert McNamara, partner at Andrews & Kurth LLP and conference panelist,

“People have different views on how they’re going to affect our world. But basically the rules lay out an exclusive list of enumerated activities we had before, and they’ll explain what is in that activity that’s more for our purposes.”

If an activity from which an MLP receives income isn’t on the list, McNamara said the question is, “is it perhaps an intrinsic activity—what we used to think about as integral?”

This view of qualifying income is a significant departure from the previous system of seeking individual private letter rulings from the IRS. Before the proposed guidelines were issued, “we didn’t really care where it fell within those activities, just as long as it was in there somewhere,” McNamara said.

Not quite there

The panelists were not entirely satisfied with the current proposed rules, however. This is mainly because, as analysts Marshall Adkins and Praveen Narra said in a Raymond James Energy note, “While there was much chatter and speculation regarding the possibility of tighter restrictions of MLP-able ‘qualifying income’ leading up to the formal proposal earlier this month, the actual standards laid out in the guidance (again, only a proposal as of now) remain somewhat unclear,” so that “there could be a range of outcomes for many of the activities that now appear to sit in the gray area of this new definition for ‘qualified income.’”

Panelist Michael Bresson, partner at Baker Botts LLP, said, “There’s stuff there that God knows ought to be on the list if you have an exclusive list, and it’s not on that list.”

However, that isn’t necessarily a problem, the panelists said, because there is still plenty of time for the IRS to add items to the list.

“They started a 90-day comment period, so we would expect the interested parties to gather and submit comments that are relevant to them,” said Brian Meighan, partner, Pricewaterhouse Coopers LLP. “That’s a pretty normal time period. They will do a public hearing if requested, so anyone can submit comments, ask to testify.”

Trendspotting

Another topic that generated plenty of buzz at the conference was the future of the MLP now that some of the biggest players were exiting the field. When The Williams Cos. Inc. announced it would follow Kinder Morgan Inc.’s lead by rolling its MLP up into the parent C corp, the question had to be asked: Was a trend emerging?

Perhaps, was the answer during a panel on “The Rating Agency View of MLPs.”

“After the Kinder transaction, we really thought the details behind Kinder were unique,” said Kathleen Connelly, director at Fitch Ratings. “We didn’t really think that would be a trend.”

“Certainly, we have seen things change. Commodity prices have really been weak since then. We’ve also seen that a lot of MLPs have really seen an increase in their cost of capital. In addition, we’ve had MLPs that have burdensome IDRs—incentive distribution rights— which are paid to the general partner.”

According to Connelly, Williams’ plans to absorb its MLP and simplify its corporate structure were mainly aimed at improving its cost of capital.

“Previously, we had taken Williams Partners and put them and the rest of the family in a negative outlook,” she added.

“We were just really concerned about their leverage, where they were, where we thought they were going. Since then, this transaction has prompted us to take Williams Cos. and put that in a positive outlook.”

As to whether other large MLPs may be contemplating a similar transaction, “we think that given the positive response from the equity markets, given the increased cost of capital for some of these MLPs, we could see other transactions happen,” she said.

The IDR millstone

Pete Speer, senior vice president at Moody’s Investor Service Inc. and Connelly’s fellow panelist, agreed that ultimately, these transactions are driven by a high cost of capital.

“Really, to me, the common theme is less a C corp vs. MLP,” Speer said. “To me, the common theme is how burdensome IDRs are to a company’s cost of capital.”

IDRs work very well for smaller MLPs, particularly while the larger parent company can drop down assets, Speer clarified.

“But once that’s run its course, the IDRs become a millstone, if you will, around the neck of the cost of capital for the MLP.”

Consolidating MLPs into the C corp offers additional benefits to companies, Raymond James Energy said in an “Energy Stat of the Week” note. Removing IDRs “enhances the long-term growth profile of the entity,” while the consolidation itself creates “taxable events for underlying limited partner unitholders, but … also a significant amount of tax depreciation benefit,” the note said.

“So while several MLPs … in the past have decided to buy-in their respective GPs [general partners] in years prior in order to reduce the GP burden on LP equity cost of capital … the new strategy appears to be consolidating in the other direction—upwards.”

Remaining bullish

It may be too early to say confidently that the natural MLP life cycle includes eventual consolidation into the parent, but analysts were less hesitant in declaring the strong long-term outlook for the MLP structure overall.

“We remain bullish on the idea that the necessary fundamental, structural, and financial drivers for outperformance of the asset class over the long term (on a total return basis) remain intact—the high attendance level suggests we aren’t alone,” analysts Adkins and Narra said in a Raymond James Energy “Daily Update.”

“While the debate surrounding where MLPs are within the energy infrastructure build-out cycle has taken on a new twist now that U.S. oil supply has begun to roll over, it is important to keep in mind that the investor appetite for yield appears to be strong as ever, as evidenced by continued increases in fund flows,” the note continued. “The current 123 energy-focused MLPs now represent ~$500 billion in market capitalization, down only slightly from year- end 2014.”

Though the broader Alerian index on the basis of price-return is down about 15% for the year as of July 17, “the actual market capitalization of the group has remained stable as many MLPs have opportunistically raised capital since the start of the year,” the note said.

Wunderlich Securities Inc.’s Jeff Birnbaum’s takeaway from the conference was that “companies under our coverage are broadly feeling that macro conditions are stabilizing, although doubts remain on the sustainability of the recovery in crude prices,” he said in a research note, adding that mergers and acquisitions could still ramp up during the second half of 2015.

As to how the continuing crude oil and natural gas oversupply will affect MLPs going forward, Ethan Bellamy, senior research analyst, gave readers a word of guidance after the conference.

“We are demand constrained, not supply limited, and those MLPs that dominate the next decade will be those MLPs that are long volumes and fees, not price or margin,” he advised in a Baird Equity Research note. “Invest accordingly.”

Recommended Reading

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.