Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Natural gas production is primed to boom in 2023 and beyond, but prices will endure an extended rough patch, East Daley Analytics says in its annual Dirty Little Secrets forecast for energy markets and the midstream sector.

A lack of infrastructure is the culprit, Ajay Bakshani, a senior energy analyst at East Daley, told Hart Energy prior to the Dec. 12 release of the report.

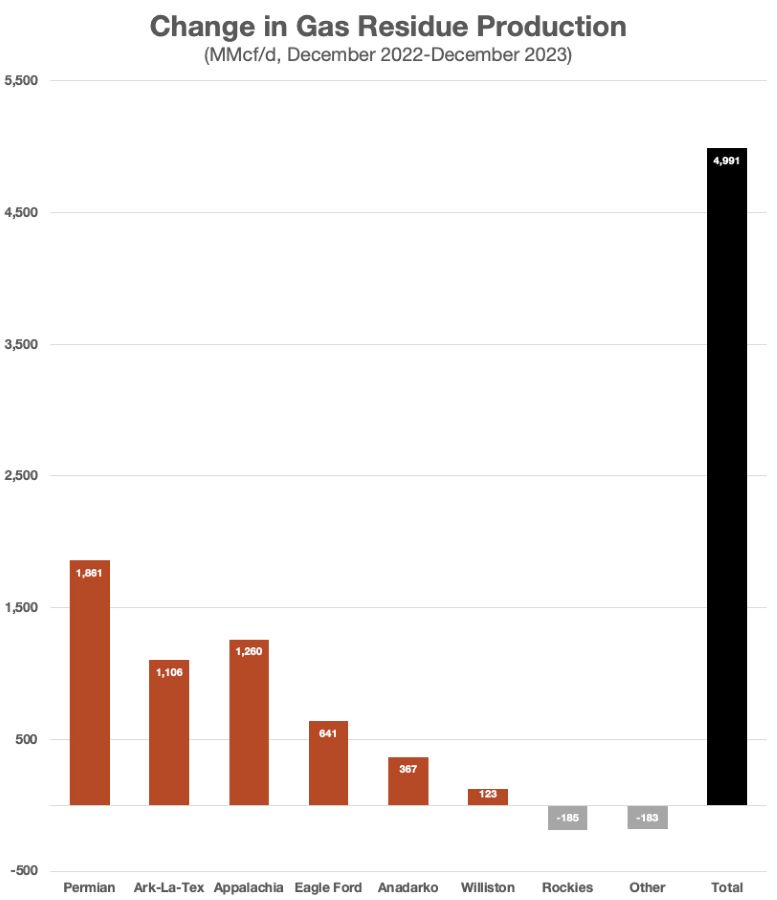

“We’re forecasting a pretty big increase in production, especially because of associated gas from the Permian, as well as increased drilling in the Ark-La-Tex,” Bakshani said. “The theme here is short-term pain, but long-term gain.”

East Daley estimates U.S. natural gas production to grow by 5 Bcf/d during 2022, assuming that a stable price of $80/bbl for WTI sustains increased oil and associated gas production in the Permian Basin. Unless there is a substantial change in the Russia-Ukraine war that leads to a lifting of sanctions on Russian crude exports, that price will likely remain high, he said.

The robust supply from high oil production will result in gas sinking into the price range of $3-$4/MMBtu, Bakshani said. The near-month price was $6.309/MMBtu on Dec. 9. The near-month price of WTI was $72.58/bbl.

The depressed gas price will last until the second half of 2024 or even early 2025, Bakshani said, when a slew of projects will come online to spur demand. Among them:

Golden Pass LNG: The $10 billion project from QatarEnergy and Exxon Mobil is slated to start operations in 2024. Capacity for the Sabine Pass, Texas, terminal will be about 2.4 Bcf/d.

Plaquemines LNG Phase 1: Venture Global LNG announced final investment decision (FID) for the project in 2022. The facility’s capacity will be about 1.8 Bcf/d. It is expected to start operations in 2024.

Corpus Christi LNG Stage 3: Cheniere Energy announced FID for the project in June. Anticipated to start operations in 2025, the facility’s capacity will be about 1.5 Bcf/d.

Less gas demand

East Daley expects natural gas demand to decline in the coming year if only because it is unlikely that power demand will set a record for a second year in a row.

“We also had very high industrial demand this year and, given the overall economic outlook, are we going to see record industrial demand next year again? That might not be the case, especially if we have a recession, and so we have a lot of supply growth and not enough demand to absorb it,” Bakshani said.

East Daley expects that producers will need to rein in production targets and goals, especially in the Haynesville and Anadarko, as they are the most gas-sensitive basins right now. There will probably be a rebuild in DUC inventories as well, he said.

Who gets the crude?

The market has ignored crude oil infrastructure for some time, Bakshani said, because it has been overbuilt. Oil pipelines, however, are filling up, especially those connecting the Permian to the Gulf Coast. New infrastructure will be needed, he said, and the key issue is which export facility will be awarded the connection.

The Port of Houston is a popular choice, but the Houston Ship Channel is burdened with heavy traffic.

“So, is it time for [the Port of Corpus Christi] to rise up and start stealing barrels? And for those pipes that go to Corpus to start getting more volumes?” he asked. “That’s another dynamic that we’re exploring. We expect those pipes to start filling up and that spread to get wider for that asset class to really start growing.”

Corpus Christi is the leading crude oil export facility. In October, the port averaged exports of 2.2 MMBbl/d, constituting a market share of about 60%. Exports in the third quarter exceeded those in the second quarter by 5%.

NGL

The challenge facing the booming NGL market is finding a place for the products to go. Petrochemical plants are beginning to ease up utilization rates in response to fears of lower demand if the economy sinks into a recession in 2023, he said. That makes it tougher to justify building new fractionators.

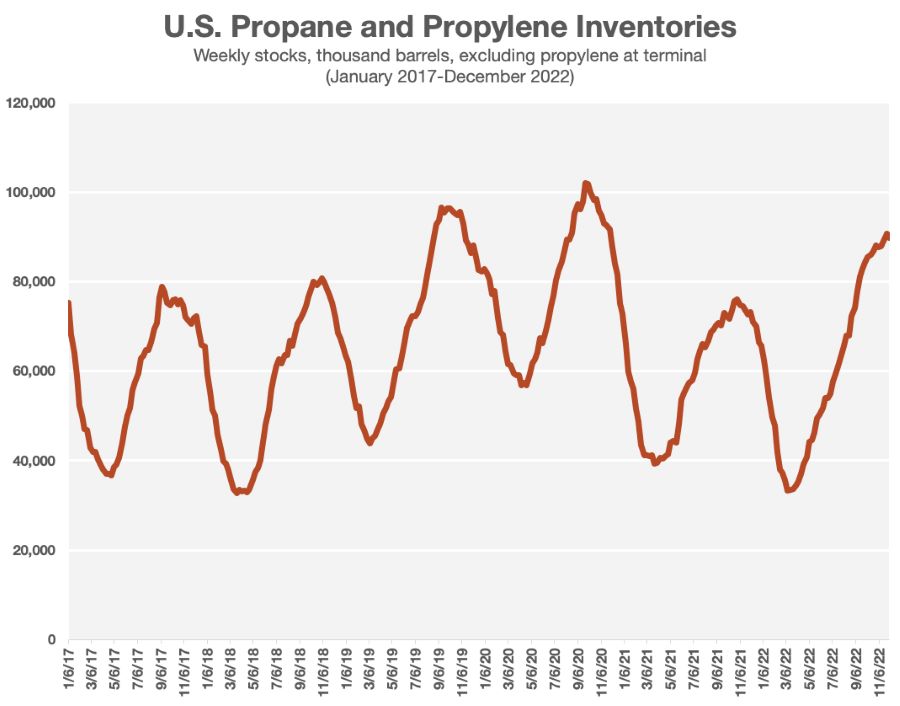

“If you have high production but you can’t fractionate these NGL, they’re going to go into inventories and we’re already seeing inventories build up in a massive pace,” Bakshani said.

“Longer term, you might see some good amount of pressure on NGL prices, specifically propane,” he said.

The ratio of propane pricing to WTI is typically 40%-60% but has elevated to 60%-70% in the last couple of years, Bakshani said. As storage continues to increase, however, that ratio will likely sink into the 40%-50% range. And it could take the market a while to recover.

“These inventories can take a year or two to really pull back down,” he said. “You might see some significant pressure on NGL prices for the next 12 to 24 months.”

Recommended Reading

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

US Drillers Add Oil, Gas Rigs for Second Week in a Row

2024-01-26 - The oil and gas rig count, an early indicator of future output, rose by one to 621 in the week to Jan. 26.

Second Light Oil Discovery in Mopane-1X Well

2024-01-26 - Galp Energia's Avo-2 target in the Mopane-1X well offshore Namibia delivers second significant column of light oil.

CNOOC Sets Increased 2024-2026 Production Targets

2024-01-25 - CNOOC Ltd. plans on $17.5B capex in 2024, with 63% of that dedicated to project development.

E&P Highlights: Jan. 29, 2024

2024-01-29 - Here’s a roundup of the latest E&P headlines, including activity at the Ichthys Field offshore Australia and new contract awards.