(Source: Shutterstock.com)

Streamlining operations, pushing technology and using data to drive decisions are among the steps the oilfield services (OFS) community could take to weather current market volatility, energy experts say.

Consolidation among OFS players, however, seems inevitable as the oil and gas industry faces continued headwinds amid weak yet strengthening oil prices. Expectations are for the sector to shrink over the next one to three years, something seen a bit during the 2014-2016 trough, according to Mark Chapman, vice president of Enverus’ intelligence team.

The drive toward efficiency and lower costs also picked up during the previous downturn, making marginal plays profitable for E&Ps, Chapman added. The gains did not translate to much benefit in terms of profitability for the OFS sector as E&Ps successfully sought discounts.

This time, without much margin built compared to six years ago, some service companies may not be able to lower prices.

“We’re going have to stick to our guns a little bit and not push equipment to work until it can actually be at a price that’s going to be profitable and generate free cash flow,” Chapman said during a recent webinar.

“Most areas just aren’t going to make sense, in general, to do activity in,” he added, noting a 25% discount is not going to solve today’s problem. “We’re going to have to be a healthier industry.”

Companies that emerge the healthiest from the latest downturn could be those able to reduce the cost of goods sold the most and those able to gain market share.

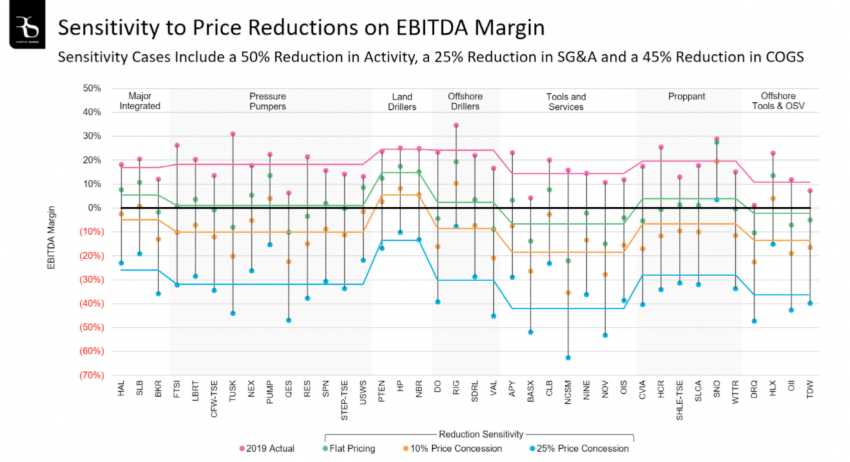

Certain parts of the service sector will suffer more than others, added Akash Sharma, senior petroleum engineering analyst and consultant for Enverus. He pointed out different sensitivities of land drillers, pressure pumpers and tool manufacturers, which each have varying cost and contract structures, to changes in selling, general and administrative expenses.

“I think the biggest driver of that is land drillers are fairly consolidated and have had pricing power,” Chapman said.

“The challenge we’ve had in [a segment] like pressure pumping is it’s very segmented still,” and there are major players plus many smaller companies not far off in scale, he added. “We’ve been somewhat oversupplied with pressure pumping. That doesn’t help that pricing power either.”

Consolidation within the sector is needed, Chapman said. However, it won’t be easy given the oversupply and unattractive balance sheets.

“Some Chapter 11 might have to happen before some of these mergers look palatable to really consolidate that down and increase the pricing power,” he said.

Strategic Steps

Technology is one of the levers OFS players can pull to help it through volatile times, according to the analysts.

Automate field level activities when possible to lower costs and increase efficiency, Chapman said. Another move is to streamline operations, focusing on the most profitable parts of the business.

“If you do 10 things and you know you do three things really well, it’s important to focus on those three things right now,” Sharma added.

Let external data drive decisions to help determine risk, Chapman said. As situations turn around, consider who is returning to work and where.

“So, using data to make those decisions to understand where your target should be and then go after them is going to be hugely important,” he said. “In a world where we can’t go out and shake everybody’s hand right now, you have to approach things from a little bit different angle and I really think that data can tremendously help to drive up that.”

Economic Levers

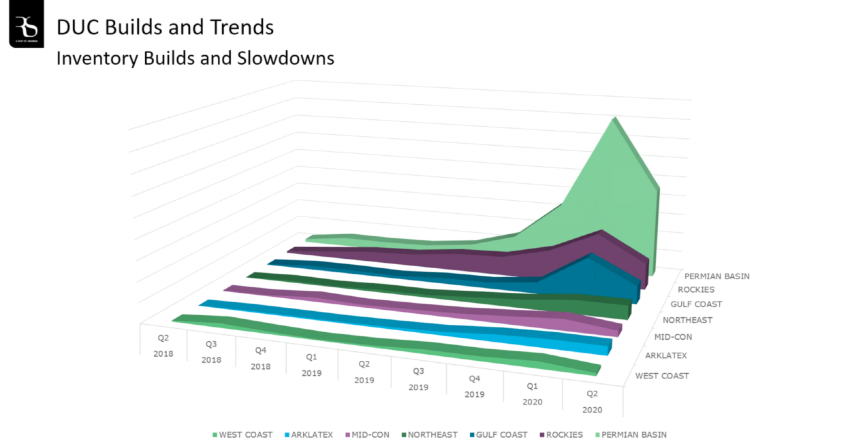

As U.S. shale players move to recover from weak oil prices, with some already bringing wells previously shut in back online, a drawdown in their inventory of drilled-but-uncompleted wells (DUCs) could follow along with recompletions and workovers. These levers make the most economic sense to pull, according to Jonathan Godwin, senior associate for Enverus.

“The lifting cost is going to be relatively small to turn a shut-in around. The next thing that’s going to make sense is probably to start burning down your DUC inventory,” Godwin said. “If a lot of these DUCs push into next year, you’re really looking at drilling costs as a sunk cost, and you’re coming into next year almost on a quarter cycle basis.”

That’s very economic, Chapman added.

“We also have some wells that were part of that natural inventory drilled in the fourth quarter of 2019 that are already sunk costs for this year. They should have been completed already. But they’re not and they’re part of that growing wedge of true DUCs,” he said.

Analysts see this as an opportunity to bring some frac fleets back sooner.

However, the longer the recovery takes, the harder it will be to get employees back to get equipment running.

The downturn has resulted in salary reductions, deep budget cuts and widespread layoffs. Some yards have been shut or consolidated with others. The moves have helped, Chapman said. “The question is does it carry over for a little longer term as this correction comes around.”

Will employees return, if asked, or move onto different industries that are less cyclical, closer to home or have better hours.

Enverus data show the rig count has dropped by 60%-65% since the beginning of the year, while frac fleets have plummeted by more than 85%.

“In a balanced market you generally have about two rigs for every frac fleet, and that ratio today looks like it’s about six to one,” Godwin said, adding this leads to a large build in DUCs. “We believe that that DUC build will continue through the end of the third quarter this year. At that point in time, we think that we’re going to turn things around a little bit and maybe even begin to burn some DUCs.”

Enverus forecasts completions will fall by 55% year-over-year.

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.

Strike Energy Updates 3D Seismic Acquisition in Perth Basin

2024-04-19 - Strike Energy completed its 3D seismic acquisition of Ocean Hill on schedule and under budget, the company said.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.