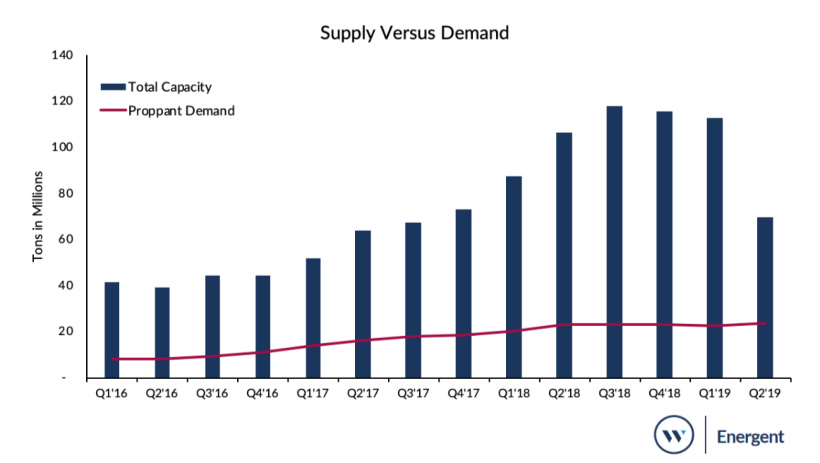

Frac sand demand was 84 million tons in 2018. (Source: Westwood Global Energy Group)

The demand for frac sand is expected to grow at a slower rate this year as E&Ps make progress in stabilizing the amount of proppant used to complete wells in U.S. shale plays, though recipes are still being optimized.

This, according to analysts at Westwood Global Energy Group, follows a period in which frac sand supplies rose by 116% on what the firm described as overstated market demand by industry analysts between 2017 and 2018, contributing to an overbuild of mines. To balance the market, the firm believes between an estimated 30 to 50 million tons needs to be removed over the next 12 to 18 months.

“The industry must now face the consequences of ‘sunshine pumping’ and market exuberance that occurred in 2017 and 2018,” Todd Bush, head of unconventionals for Westwood Global Energy Group, said in a statement. “Balance needs to be restored to the market with frac sand supply reductions.”

The recently released report was delivered as some E&Ps slow down spending and drilling and completions activity as larger players like Exxon Mobil Corp. and Chevron Corp. step up activity.

Overall, forecasts are pointing to slower production growth from U.S. shale players as focus shifts more to shareholder returns, cash flow growth and paying down debt instead of higher output.

Lowering costs and exercising financial discipline also remain at the forefront of agendas amid continued commodity price volatility.

“Under a macroeconomic scenario with $50 to $60 per barrel West Texas Intermediate (WTI) crude oil, Westwood estimates the frac sand market to grow 10% in 2019 and 12% in 2020,” the report said. “Even with a temporary slowdown in activity in 2019, we anticipate 5,100 completions in 2019 compared to 5,300 in 2018, a 4% decline in activity.”

Demand: This year, frac demand is expected to increase by about 10% to 95 million tons.

The percentage of year-over-year demand growth is less than the 30% the industry experienced in 2018 when the frac sand market grew to 86 million tons and far below the 82% seen in 2017 when proppant amounts soared from 36 million tons to 66 million tons, the report said.

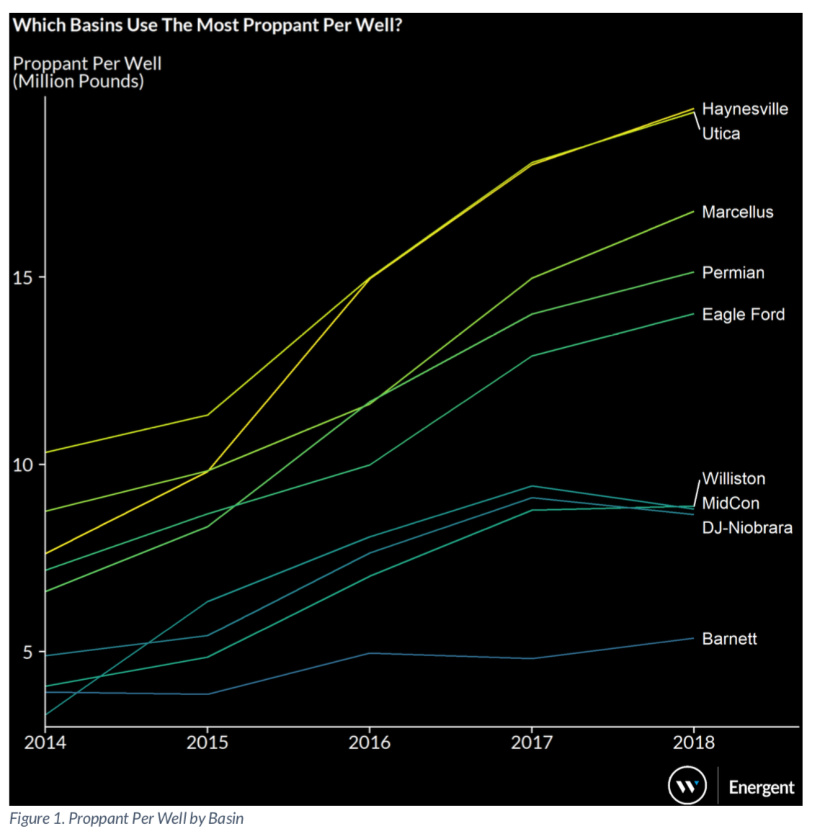

Using on average 13 million pounds, or 7,000 tons, of sand per well completion last year, the Permian Basin dominated demand at 42%.

But companies are packing more sand into Utica and Haynesville wells, which each utilize about 18 million pounds of frac sand, according to the report.

Completion intensity metrics are starting to plateau, however, even decreasing in some U.S. basins, Westwood said.

Supply: Frac sand supply could jump to nearly 143 million tons, assuming 70% utilization of facilities, though they are capable of producing more, in 2019.

“The growth in frac sand supply from Q2’17 through Q3’18 placed substantial pricing pressure on frac sand. As new entrants and industry leaders brought new mines online during this time, an oversupplied frac sand market became more and more evident,” the report said. “Frac sand companies are now in a position where many companies must lower production, abandon mine operations, or restructure their business in order to last through this cycle.”

Analysts expect to see the frac sand supply and demand imbalance—particularly for finer grain sand due to in-basin sand usage—throughout this year and into 2020.

As a result, “Pricing will fluctuate as sand mines pull frac sand supply from the market,” Westwood said in the report. “Over the next 12 to 18 months, we expect 30 to 50 million tons of frac sand to come off the market.”

Meanwhile, frac sand miners are seeing more business from the oil and gas sector. In July, for example, U.S. Silica Holdings said it sold 3.9 million tons of sand to oil and gas companies in the second quarter. That was 13% more than the same quarter a year earlier as its West Texas capacity increased.

But it wasn’t enough to result in a higher net income, which fell to $6.2 million from $17.2 million a year ago. Reuters reported U.S. Silica, which aims to expand its use in oil field and non-oil field industries, expects volumes in its oil and gas unit to rise by about 10% sequentially in the third quarter and projects annual capex of about $125 million.

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

Solar Panel Tariff, AD/CVD Speculation No Concern for NextEra

2024-04-24 - NextEra Energy CEO John Ketchum addressed speculation regarding solar panel tariffs and antidumping and countervailing duties on its latest earnings call.

NextEra Energy Dials Up Solar as Power Demand Grows

2024-04-23 - NextEra’s renewable energy arm added about 2,765 megawatts to its backlog in first-quarter 2024, marking its second-best quarter for renewables — and the best for solar and storage origination.

BCCK, Vision RNG Enter Clean Energy Partnership

2024-04-23 - BCCK will deliver two of its NiTech Single Tower Nitrogen Rejection Units (NRU) and amine systems to Vision RNG’s landfill gas processing sites in Seneca and Perry counties, Ohio.

Clean Energy Begins Operations at South Dakota RNG Facility

2024-04-23 - Clean Energy Fuels’ $26 million South Dakota RNG facility will supply fuel to commercial users such as UPS and Amazon.

Romito: Net Zero’s Costly Consequences, and Industry’s ‘Silver Bullet’

2024-04-22 - Decarbonization is generally considered a reasonable goal when presented within the context of a trend, as opposed to a regulatory absolute.