While demand will stay relatively flat from 2022 to 2024, a ramp-up in demand will kick start the “wild ride” East Daley foresees as there will be a call for more gas into the market. (Source: Hart Energy)

HOUSTON—The energy industry in the U.S. is in for a “wild ride,” according to Zack Van Everen, senior capital markets analyst at East Daley Capital Analytics.

Van Everen, speaking during a presentation at Hart Energy’s America’s Natural Gas Conference, cautioned the audience of changes on the horizon in the oil and gas industry, believing that gas markets will become oversupplied very soon.

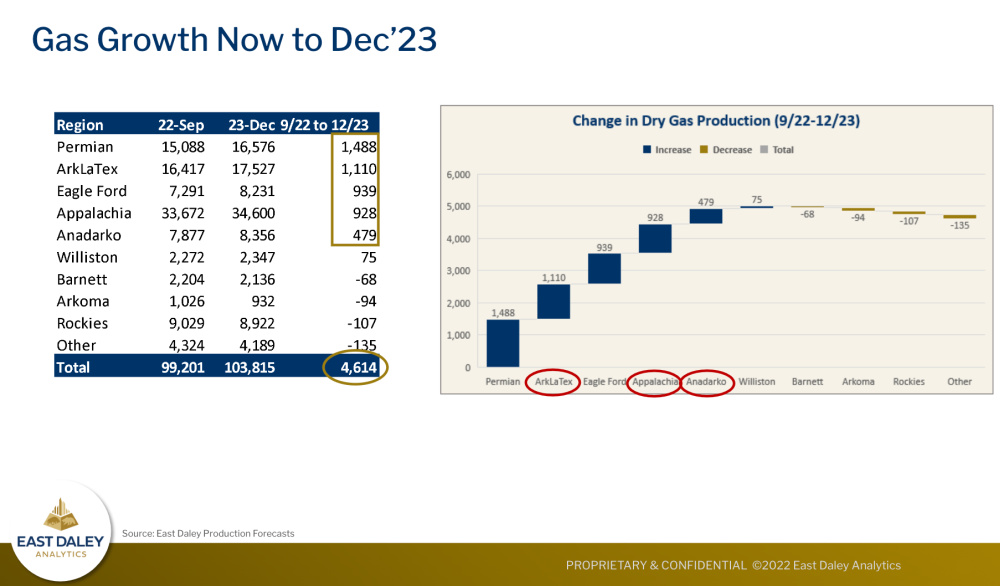

“East Daley forecasts a significant amount of dry gas hitting the U.S. markets from now until the end of December 2023. Around 4.6 Bcf/d is what we currently have forecast from September 22 through December 2023,” Van Everen said.

The past year has been a turbulent one for the energy sector. The Russian invasion of Ukraine, combined with oil scarcity within the U.S. caused a price jump in WTI crude during the first quarter, with the price rising as high as $115. In response to high prices, U.S. producers added over 100 rigs across the six major basins—the Permian, Anadarko, Eagle Ford, Ark-La-Tex, Appalachia and Williston.

“East Daley forecasts a significant amount of dry gas hitting the U.S. markets from now until the end of December 2023.”—Zack Van Everen, East Daley Capital Analytics

While the main purpose of adding to the number of rigs was to increase oil production within the states, gas production also grew due to associated gas. The influx of associated gas has caused more gas to come online than can be stored, according to Van Everen.

“The capacity of storage is capped. It’s never been that high,” he said.

“What we want to highlight here,” he continued, “is when we let our models run based on current and future strip prices, current activity in all these basins and the current demand, assuming a relatively normal winter and normal summer, what you get is storage filling and markets becoming unbalanced. Once this happens, you’re most likely going to see some deferred growth in those three basins highlighted, mostly gas-centric basins [Ark-La-Tex, Appalachia and Anadarko]. If the price drops significantly, you’ll likely see producers building a DUC inventory, shutting in wells until gas prices improve.”

Longer term, at least until demand returns, he said, East Daley forecast overall rigs to decline in the three highlighted gas-centric basins.

“Together, this will rebalance the market as the free market generally does,” he added.

A surplus of natural gas in the short term isn’t the only thing that East Daley forecasts. Due to the energy crisis in Europe and the invasion in Ukraine, they also see LNG exports in the U.S. taking over globally and driving production growth for decades.

“Even before the invasion of Ukraine, you can see a lot of contracts are being signed,” said Van Everen. “We believe this is just the realization of the world that natural gas isn’t going away. It’s actually the best transition fuel while we sort out the renewable side of things. … From 2025 and beyond, you have a significant call for gas.”

While demand will stay relatively flat from 2022 to 2024, a ramp-up in demand will kick start the “wild ride” East Daley foresees as there will be a call for more gas into the market. Prices are predicted to “come down and then in the outer years come back up as there’s a call for production to feed this 12+ Bcf of gas.”

Regulatory, economic and geographic constraints could cause less gas than needed to be produced from the six major basins in the U.S. However, East Daley views the Tier 2 basins as a solid hedge for these possibilities, so analysts expect growing demand will be met.

Despite Van Everen admitting that his predictions are bullish, he remains confident in East Daley’s forecasting methods.

“Since we come from an infrastructure lens, we follow the molecule all the way through the midstream. So, we’re able to look at the wellhead production and then we flow it through a G&P (gathering and processing) system and then we actually flow it through egress pipes out of every single basin,” Van Everen said. “So, between all those data points, we’re able to watch production pretty closely in various different points.”

The gas market looks to be heading on an interesting journey in the near future. He added that while things might start off slow, they will undoubtedly pick up and the U.S. will be a leading exporter of natural gas.

“We believe based on current activity, current production models on the natural gas and crude side, that the markets will see a significant amount of supply hitting the markets in the next, call it 12 to 18 months, to take this supply in the short term,” he said. “There’s not a significant amount of demand… Longer term, we will see a new demand source coming online throughout the years, 12 Bcf and new LNG on the conservative side, which will be a call for all the gas and oil basins out of the U.S. to feed the global demand for gas as that continues to increase throughout the years.”

Recommended Reading

US Interior Department Releases Offshore Wind Lease Schedule

2024-04-24 - The U.S. Interior Department’s schedule includes up to a dozen lease sales through 2028 for offshore wind, compared to three for oil and gas lease sales through 2029.

Utah’s Ute Tribe Demands FTC Allow XCL-Altamont Deal

2024-04-24 - More than 90% of the Utah Ute tribe’s income is from energy development on its 4.5-million-acre reservation and the tribe says XCL Resources’ bid to buy Altamont Energy shouldn’t be blocked.

Mexico Presidential Hopeful Sheinbaum Emphasizes Energy Sovereignty

2024-04-24 - Claudia Sheinbaum, vying to becoming Mexico’s next president this summer, says she isn’t in favor of an absolute privatization of the energy sector but she isn’t against private investments either.

Venture Global Gets FERC Nod to Process Gas for LNG

2024-04-23 - Venture Global’s massive export terminal will change natural gas flows across the Gulf of Mexico but its Plaquemines LNG export terminal may still be years away from delivering LNG to long-term customers.

US EPA Expected to Drop Hydrogen from Power Plant Rule, Sources Say

2024-04-22 - The move reflects skepticism within the U.S. government that the technology will develop quickly enough to become a significant tool to decarbonize the electricity industry.