Oil rigs shown in West Texas. (Source: Mike Irvin/Shutterstock.com)

U.S. light tight oil’s base decline is almost half that seen pre-COVID, Rystad data show.

Before COVID, the base decline—defined as the difference between legacy production and the sum of legacy and new production in the previous month—was very high due to many new wells being drilled, which accelerated decline, Per Magnus Nysveen, head of analysis for Rystad Energy, said on a recent webinar.

“That contributed to base decline passing 600,000 barrels, but now we have seen some months with 300,000 barrels in base decline. Going forward, we think that … you need only half as many new wells as in the end of 2019 to keep the production level flat,” said Nysveen. “This is important to understand the potential of shale to grow.

The analysis was given as the shale sector continues to rebound from a year that saw the global coronavirus pandemic squash demand, wreaking havoc on the oil market and slowing U.S. shale activity. Operators focused on core areas during the downturn and targeted drilled but uncompleted wells as conditions improved.

U.S. oil prices have since bounced back to about $65/bbl, compared to about $20/bbl a year ago, helped by moves by OPEC+ to calm the oversupplied market with production cuts and vaccine rollouts as travel picks up in parts of the world.

Rystad data show U.S. light tight oil activity—comprising horizontal wells in the Permian Basin, Eagle Ford Shale, Bakken, Niobrara and Anadarko Basin—is now about 15% above maintenance requirements. “There is potential for shale to continue growing through the year,” Nysveen said. He pointed out that unlike supermajors, which have not begun adding rigs, some public independents have joined smaller private E&Ps in increasing rig counts.

Production, however, is expected to remain flat over the summer months, he added, noting there is also a typical dip in September as hurricane season impacts Gulf of Mexico production.

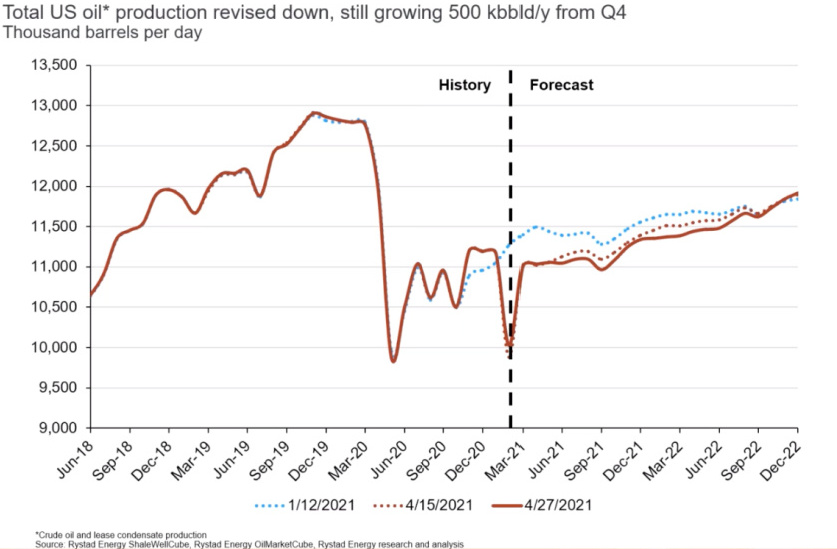

Though Rystad revised down its total U.S. oil and lease condensate production forecast in wake of the Texas freeze, which impacted production in the Permian Basin, the firm still sees production growing by year-end.

“I think this is fairly much in line with consensus,” he said. However, “we think that the potential is a little higher given oil price and given activity level than some other analysts.”

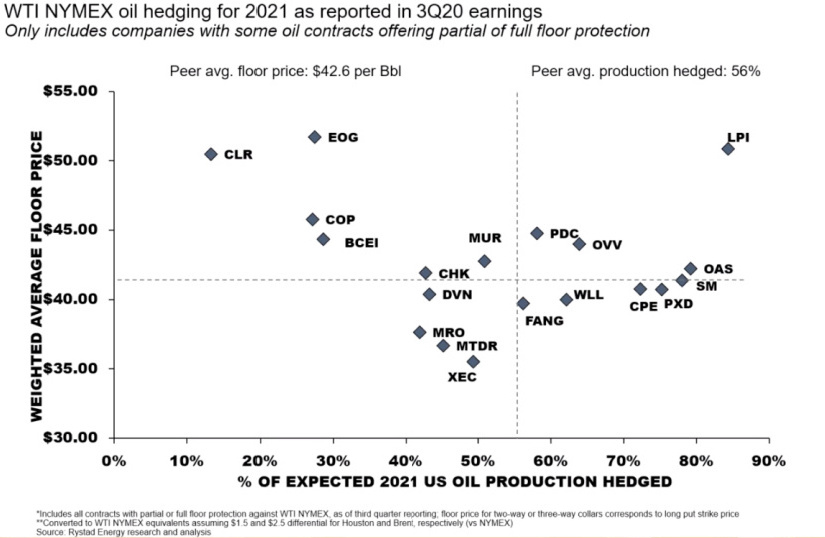

Higher oil prices, however, likely won’t lead to a significant ramp-up in spending by most producers who remain focused on efficiency with investors watching closely. Hedging is also a factor, according to Alisa Lukash, a senior analyst for Rystad. Hedging is beneficial, particularly if a company wants to secure new financing, as it reduces investors’ exposure to some risks.

“However, the floors are on $43 per barrel and the ceiling is closer to $50,” Lukash said. “So that is one of the reasons why for this year we won’t see a huge overspending trend because many companies have ceilings or they kind of locked into a particular price.”

RELATED

Oil Hedges to Crimp US Shale Producers’ First-quarter Profit

E&Ps Seen Hedging Oil Production Farther Out than Before

“Most of them actually have swaps. Some of them have three-way collars and two-way collars, which allow a little bit more flexibility,” Lukash said. For most, “it doesn’t make sense from the cash flow perspective to significantly ramp up spending if you’re still generating or securing your cash flow at $45 WTI.”

Analysts also noted some other trends.

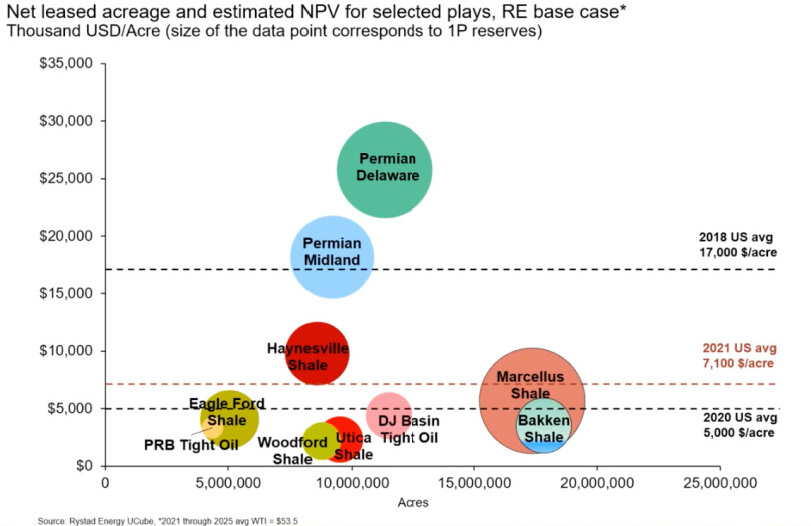

Consolidation continues, especially in Permian Basin. “And it’s still a year when transactions are relatively cheap,” Lukash said. Data show the U.S. average price per acre dropped to about $5,000 in 2020 from $17,000 in 2018.

RELATED: Who’s Selling What to Whom?

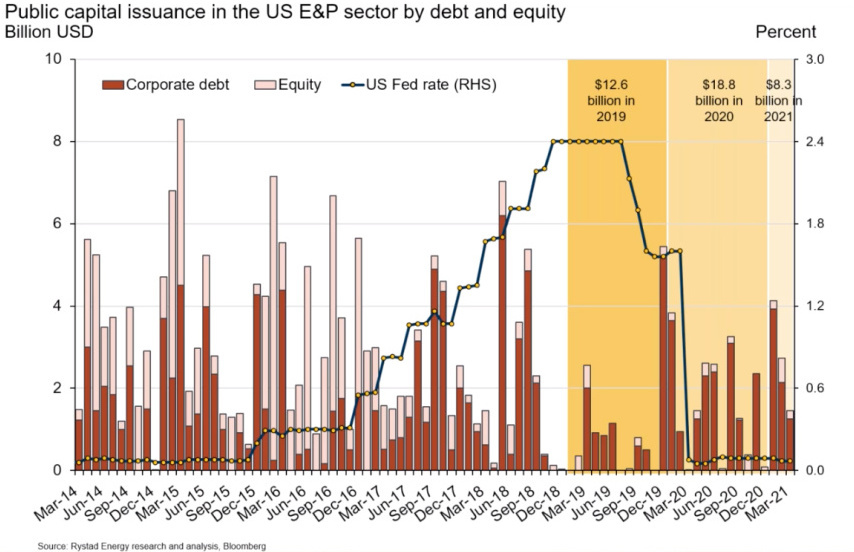

Deleveraging also continues. Historically, the U.S. shale industry had attracted $37 billion annually through debt or equity financings, Lukash said. That, however, dropped to less than $13 billion in 2019 but rose to nearly $19 billion in 2020. It’s about $8.3 billion so far this year.

“Some companies actually needed capital for drilling activities, while most usually did it for refinancing purposes,” Lukash said. “In 2021, we noticed some companies actually issuing debt for transactional activity. So that’s a little bit of a new trend here. ... But overall, the industry is still highly leveraged and companies are still focusing to not just refinance into the future, but reduce their total debt.”

Recommended Reading

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.