(Source: Shutterstock.com)

Coming off a year of landmark legislation strengthening the U.S. clean energy market and roadmaps to lower emissions elsewhere, the outlook for the next year of renewable energy appears favorable.

However, analysts expect some challenges, especially when it comes to the supply chain.

Renewable power generation capacity is forecast to continue rising in 2023 as investment pours in, boosted by government incentives, on the road to net-zero by 2050.

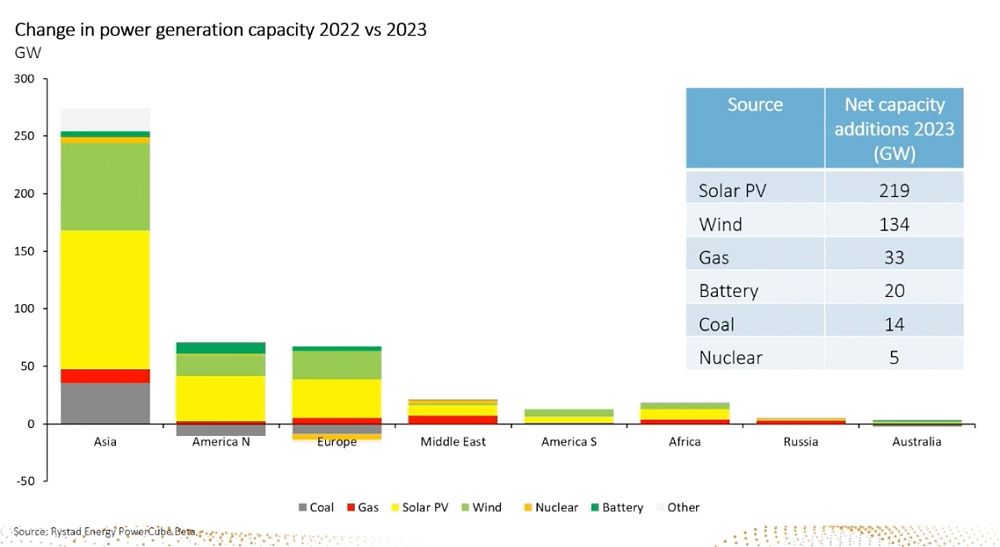

“In total, we’ll be seeing around 219 gigawatts of solar PV [net capacity additions] across the world and close to 134 gigawatts of wind also across the world,” Carlos Torres Diaz, senior vice president and director of power and gas market research for Rystad Energy, said on a recent 2023 outlook webinar.

“Gas-fired capacity will continue to increase,” Diaz added, with data indicating net capacity additions of 33 GW globally, “and this will help keep the balance in power generation across the world.”

Energy security and climate concerns have led many to embrace renewables in an effort to reduce reliance on fossil fuels, particularly in wake of Russia’s invasion of Ukraine. Though the year 2022 saw setbacks—such as coal made a strong comeback with more capacity additions anticipated (mainly in Asia)—momentum builds for renewables.

Renewables in Europe

Added renewable generation capacity in 2023 could also improve the energy situation in Europe, where the power sector has been rocked by not only skyrocketing gas prices due to a decline in supplies from Russia but also less nuclear and hydropower generation.

“These two sources erased close to 200 terawatt hours [TWh]of power supplies from the market,” Diaz said.

“There were some new solar and wind generation coming online, and this helped at around 80 terawatt hours, which helped compensate for some of the decline in nuclear and hydro,” he added. “But then despite this, we needed more coal and gas power generation throughout 2022, and these sources increased by around 40 terawatt hours in combination.”

Will the situation improve in 2023?

Nuclear is not expected to add substantial supplies in Europe because of more scheduled decommissioning and planned maintenance, Diaz said. However, hydro generation—down in 2022 due to drought conditions—is already back in major-producing regions such as Norway and France. Rystad’s outlook shows about a 20% increase in hydropower generation.

Plus, the commissioning of new solar and wind capacity is expected to continue with onshore and offshore wind adding nearly 30 TWh, utility-scale solar adding 10 TWh and rooftop solar close to 20 TWh.

“If we take into consideration the additional hydro and potential for demand destruction, then Europe could likely depend less on coal and gas power generation. This could range in between 60 to 350 terawatt hours,” Diaz said. “So, this definitely will be helping the situation across Europe and will be leading to a decline in gas demand, which will help the global balance for gas supplies and could gradually lead to a decline in power prices.”

Growing and growing

Total renewable capacity growth is set to nearly double worldwide in the next five years, accounting for more than 90% of global electricity expansion, the International Energy Agency (IEA) said earlier this month. With nearly 2,400 GW of growth, equivalent to the entire installed capacity of China, renewables are on track to surpass coal to take biggest share of the power mix.

“Electricity from wind and solar PV more than doubles in the next five years, providing almost 20% of global power generation in 2027,” the IEA said. “These variable technologies account for 80% of global renewable generation increase over the forecast period, which will require additional sources of power system flexibility.”

China, the U.S. and India could each double their renewable capacity expansion during the next five years, according to the IEA. Together, the countries make up two-thirds of the global growth. Policy guidelines, especially in the U.S. with the passage of the Inflation Reduction Act and Bipartisan Infrastructure Law, are accelerating developing.

Looking at global installations seen in 2022, the biggest winner was pumped storage and battery projects as projects stalled during the global pandemic either started construction or came online, said Francesca Bjørnflaten, senior analyst of renewables research for Rystad.

“When it comes to the pumped storage projects, 70% out of all of these projects are in China,” she said. China aims to grow its installed battery energy storage capacity to about 30 GW by 2025.

“The main installers for these big utility-scale batteries happened in the U.S. and in China,” Bjørnflaten said. “Five battery projects were connected to the grid every week during the course of 2022.”

Challenges ahead

Overall, investments in renewables continued to rise in 2022. Rystad analysts forecast investment in renewables will reach $494 billion, outpacing that of oil and gas’ $446 billion, this year. Investment, however, is being influenced by cost inflation alongside rising activity.

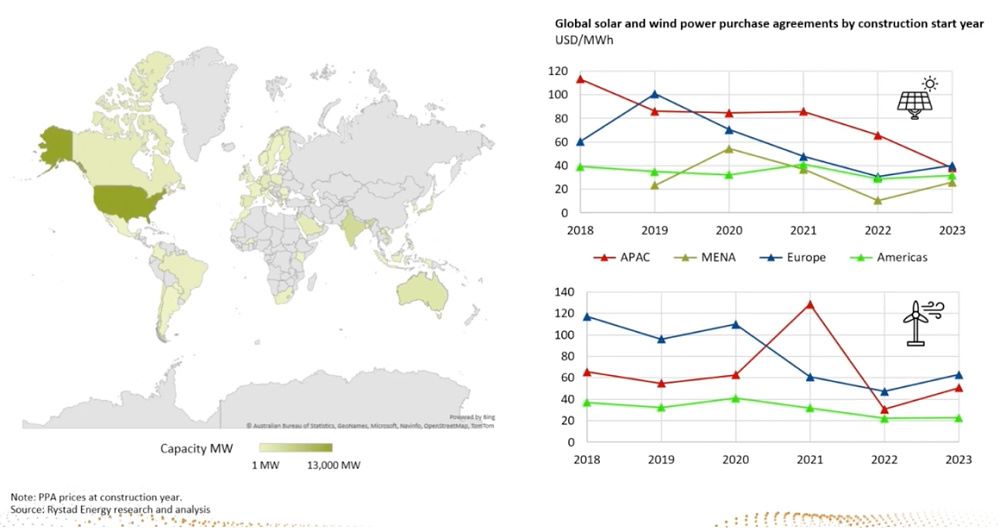

Also expected to rise are average prices in power purchase agreements (PPA), which dominate the U.S. and are expanding into other regions. PPAs are long-term contracts to buy renewable energy such as wind and solar at volumes and prices agreed upon by the producer and consumer.

“What we’ve seen the final months of this year is that the PPA prices are starting to rise,” Bjørnflaten said. “For those projects starting construction in late 2023, 2024, 2025 and onwards, we will expect the PPA prices to increase. This really further emphasizes the challenging environment that the developers are working under and the cost inflation. They’re really signaling here that we cannot expect the PPA prices to remain at the level that we’re seeing today.”

There could also be some constraints on the solar photovoltaic supply chain ahead.

“Currently, we’re seeing that the lead time for inverters are really pushing out. So, that will almost definitely be a hiccup. But also getting hold of transformers will be a constraint in the supply chain,” Bjørnflaten said.

She added there are also workforce challenges, particularly in Europe where there are not enough qualified people to install solar panels to meet demand.

Recommended Reading

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.

Mexico Pacific Appoints New CEO Bairstow

2024-04-15 - Sarah Bairstow joined Mexico Pacific Ltd. in 2019 and is assuming the CEO role following Ivan Van der Walt’s resignation.

Global Partners Declares Cash Distribution for Series B Preferred Units

2024-04-15 - Global Partners LP announced a quarterly cash dividend on its 9.5% fixed-rate Series B preferred units

W&T Offshore Adds John D. Buchanan to Board

2024-04-12 - W&T Offshore’s appointment of John D. Buchanan brings the number of company directors to six.