The clampdown on final investment decisions since the downturn began in 2014 means that “concerns regarding perpetual tightness and dwindling spare capacity will be the overarching narrative for at least the next 18 months,” RBC Capital Markets analysts said in a recent report. (Source: Hart Energy and Shutterstock.com)

Changing supply and demand fundamentals have led the team of commodity strategy analysts at RBC Capital Markets to shift from an oil view of “calculated optimism” to one that is “structurally bullish.”

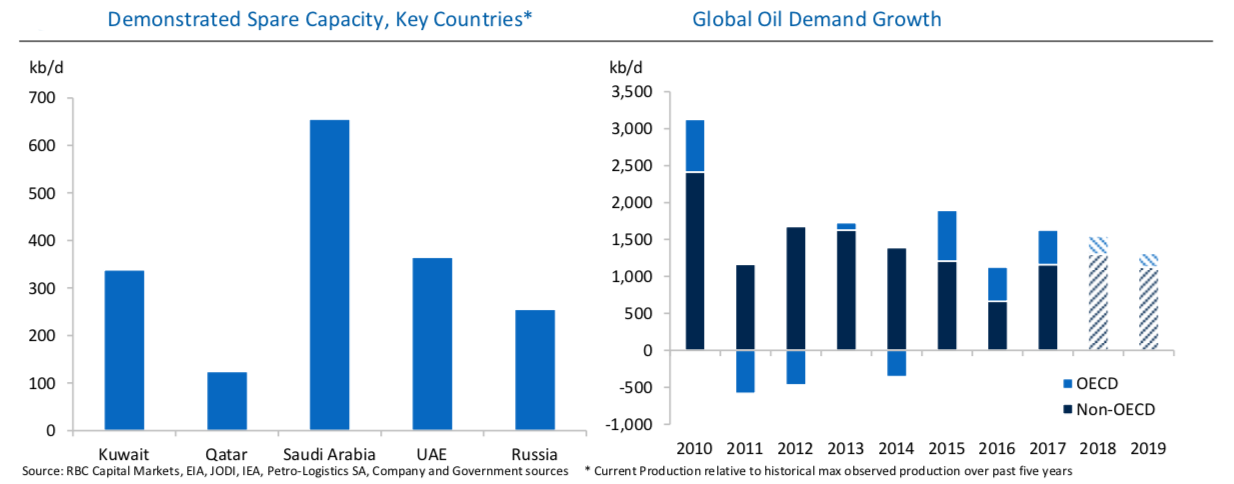

RBC issued a report in late June outlining the factors at work that for oil markets that could be “the most constructive in years.” Behind the increasingly positive market response is OPEC’s return to 100% compliance and a resulting focus on spare capacity, according to the report.

“First, it highlights the market’s lack of concern around cheating and second, it potentially questions whether OPEC will be challenged to even reach full compliance if production losses continue to mount over the back half of the year,” RBC analysts said.

RELATED: OPEC Reaches Deal For Modest Oil Output Increase

RBC looks for oil prices to average $68 for West Texas Intermediate (WTI) and $76 for Brent this year, moving to $76 and $85.50, respectively, in 2019. Price spikes could be layered into this scenario because storage levels are expected to become “perilously low” late next year.

The clampdown on final investment decisions since the downturn began in 2014 means that “concerns regarding perpetual tightness and dwindling spare capacity will be the overarching narrative for at least the next 18 months,” according to the report. If these concerns stimulate the forward curve in oil prices, then investors could once again begin to fund projects, on a larger scale with longer timelines.

Among key near-term market indicators to monitor when ascertaining the health of the global oil market, the RBC analysts zero in on Atlantic Basin physical crude differentials, the effect of sanctions on Iranian crude production and Chinese imports of U.S. crude oil.

“We have often suggested that the best physical proxy of the market’s ability to absorb barrels are the physical crude pricing differentials stemming from regions like the North Sea and West Africa,” the analysts said. “The Atlantic Basin is the first region to reflect loosening fundamentals and the last to emerge from oversupply.”

As for Iranian exports, the analysts suggested that recent hikes in those official selling prices for light crude into Asia may result in Iran “potentially pricing itself out of the market.” The Chinese import situation, on the other hand, carries the risk that tariff discussions could result in U.S. crude esports being muscled out, with “clear read-throughs for the near-term WTI-Brent spread.”

Demand is another major piece in the outlook for oil prices and the progress toward balanced markets.

U.S. gasoline demand for driving is less predicated now on prices than in the past, because of a stronger economy. Additionally, the report said, the U.S. is approaching its capacity for discretionary driving, and consumers now hold onto their vehicles longer, so the gas-guzzling SUVs and trucks favored in recent years mean demand is less affected by gasoline prices.

In China, the “engine” of emerging markets and global oil demand, disruption is already at work from government regulations and policy developments, according to the RBC research. The analysts don’t see consumers immediately moving to electric vehicles, but Chinese oil demand growth could be significantly decreased by “mass migration to regions with large-scale electrified public transit options,” they concluded.

Recommended Reading

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.

ARM Energy Sells Minority Stake in Natgas Marketer to Tokyo Gas

2024-02-06 - Tokyo Gas America Ltd. purchased a stake in the new firm, ARM Energy Trading LLC, one of the largest private physical gas marketers in North America.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

Vital Energy Again Ups Interest in Acquired Permian Assets

2024-02-06 - Vital Energy added even more working interests in Permian Basin assets acquired from Henry Energy LP last year at a purchase price discounted versus recent deals, an analyst said.

DNO Acquires Arran Field Stake, Continuing North Sea Expansion

2024-02-06 - DNO will pay $70 million for Arran Field interests held by ONE-Dyas, and up to $5 million in contingency payments if certain operational targets are met.