Growing frac demand could lead to a tighter market for hydraulic horsepower this year. (Source: Anton Foltin/Shutterstock.com)

Following a rough end to 2018 as bottlenecks and delayed completions by some shale players slowed activity in the Permian Basin, the U.S. pressure pumping market is set to rebound later this year, according to analysts at Westwood Global Energy Group.

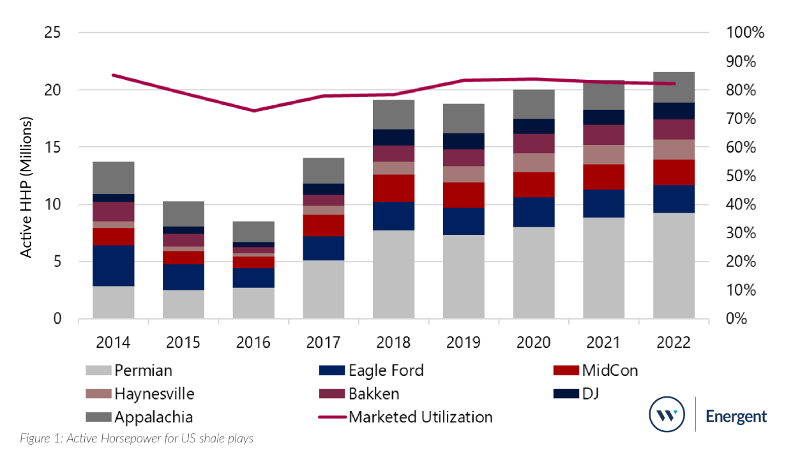

Hydraulic horsepower (HHP) demand is forecast to rise by 9% by fourth-quarter 2019, compared to a year earlier. Pressure pumpers are expected to return 1.6 million HHP to U.S. shale plays this year after removing more than 4% of frac horsepower in fourth-quarter 2018.

Analysts said growing demand, however, could lead to a tighter HHP market with certain regions possibly facing undersupply.

But “Westwood expects frac supply constraints to be a short-term issue, closing out of 2019 and moving into 2020, as pumpers relocate and activate frac crews,” Todd Bush, head of unconventionals for Energent, a Westwood Global Energy Group company, told Hart Energy in a statement. “With crude [WTI] near $60/bbl and midstream constraints easing during 2H 2019, expect to see demand in tight oil regions like the Eagle Ford and Midcon stabilize. We’re forecasting higher marketed utilization out of the Eagle Ford until Q1 2020.”

Some regions are already seeing gains.

Highlighting Haynesville

More proppant plus more HHP equal big pump jobs in the Haynesville, the primarily dry gas play that is taking another turn in the shale spotlight. Frac jobs in the shale play, which lies in East Texas and Louisiana, require 40% more proppant than the national average, Westwood said in a report released this week.

“The basin currently averages the highest proppant/completion in the U.S. at roughly 9,000 tons/completion,” Westwood said the report authored by analyst Tyler Webb. The Haynesville is expected to account for more than 35% of total active horsepower growth in second-quarter 2019.

Activity is in the play is picking up as demand grows for natural gas, though producers still await higher prices. Gas production in the Haynesville, where formations reach depths of 14,000 ft in some areas, is expected to grow by 182 million cubic feet per day to more than 10.5 trillion cubic feet per day in April, according to the U.S. Energy Information Administration (EIA).

Like other shale plays, lateral lengths have grown as well as the number of fracturing stages as operators increase proppant loads, driving up production. Haynesville could see roughly 28%, or 330,000 HHP, growth from fourth-quarter 2018 to fourth-quarter 2019, according to Bush.

“Pumpers in the Haynesville have witnessed healthy utilization rates and pricing, given more intense and deeper frac jobs and increased demand from operators,” Bush said. “Indigo Minerals, BPX and Rockcliff Energy are running two frac crews each, while XTO has three active frac crews based on Q1 2019 Haynesville frac activity. As of Q1 2019, the basin had 26 active fleets.”But Haynesville is among the regions Westwood believes could be undersupplied during second-half 2019 with 1.45 million active HHP in the basin.

Permian Pick Up

Pressure pumping availability has already fallen 5% in first-quarter 2019 in the Permian Basin, which accounts for about 40% of HHP supply and demand in the U.S., according to Westwood. Analysts also forecast Permian active supply will fall about 9% from its second-quarter 2018 peak by second-quarter 2019.

The fall was triggered in part by bottlenecks, which prompted some operators to redirect rigs to other basins.

“We’ve heard pumpers moving fleets to Oklahoma and South Texas from Q3 2018- early Q1 2019, likely given the relatively close proximity to the Permian,” Bush said. “However, this isn’t occurring much at all during most of 2019.”

The turnaround is seen starting in the third quarter as more infrastructure headaches are alleviated and operators chop down the backlog of drilled-but-uncompleted wells. Westwood said it anticipates a 15% ramp-up in previously deferred completions in the Permian for the second half of the year, sending frac demand up 14% and tightening the market.

Westwood predicts Permian demand will rise by 1.3 million HHP this year, closing out the 2019 with about 6.67 million HHP.

“Top pressure pumpers are securing contracts with key accounts, especially the majors that are doubling-down in the Permian,” Bush said in a news release. “ExxonMobil and Chevron are running 14 total frac crews in the Permian as of Q1’19. Both companies have ambitious plans that require more horsepower in the Delaware and Midland basins.”

Looking Forward

Utilization rates are forecast to improve throughout the year, given pressure pumpers were expected to stack more than 1 million HHP between third-quarter 2018 and first-quarter 2019, Westwood said in the report.

Lower completion costs and higher well returns are forecast to push up demand in the DJ-Niobrara, according to the report. “Additional gas processing plants and the alleviation of pipeline constraints will bolster future completion growth heading into 2019,” the report said. “Total wells completed in 2019 are expected to be 28% greater than wells completed in 2018.”

In the Eagle Ford, demand is expected to grow 19% this year compared to 2018, likely the result of an “influx of capacity additions in 2019 in response to the Permian slowdown, before tapering off in 2020,” according to the report.

Stability could be in store for the Midcontinent, where pressure pumpers anticipate a pickup in 2019. A rebound is also forecast for the Williston’s Bakken, where Westwood said completions could grow 15% in 2020 with added pipeline and refinery capacity. “Pumpers will activate nearly 165,000 HHP in 2020 to match the demand growth,” the report said, noting winter weather makes the area more volatile regarding HHP utilization.

In Appalachia, “additional pipeline infrastructure will spur steady demand increases in the U.S. Northeast in 2019 with sufficient HHP capacity to accommodate,” the report said.

Looking forward, the greatest challenge facing pressure pumpers won’t be meeting growing demand. It’ll be “delivering cost-effective frac solutions for unconventional reservoirs,” Bush said. Operators continue keeping close taps on costs and efficiency.

“To adapt to E&Ps capital discipline, pressure pumpers will look to zipper fracs, multi-well pad development, increased completion intensity, and contracts to improve horsepower utilization and maintain revenue per horsepower metrics,” Bush said. “Some less disciplined pressure pumpers may cut back on maintenance to reduce costs, but that move will impact the company's ability to return frac horsepower to the market, given the more than 1 million HHP that’s been stacked since the back half of 2018.”

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.

EIG’s MidOcean Closes Purchase of 20% Stake in Peru LNG

2024-04-23 - MidOcean Energy’s deal for SK Earthon’s Peru LNG follows a March deal to purchase Tokyo Gas’ LNG interests in Australia.

TotalEnergies to Acquire Remaining 50% of SapuraOMV

2024-04-22 - TotalEnergies is acquiring the remaining 50% interest of upstream gas operator SapuraOMV, bringing the French company's tab to more than $1.4 billion.

TotalEnergies Cements Oman Partnership with Marsa LNG Project

2024-04-22 - Marsa LNG is expected to start production by first quarter 2028 with TotalEnergies holding 80% interest in the project and Oman National Oil Co. holding 20%.

Is Double Eagle IV the Most Coveted PE-backed Permian E&P Left?

2024-04-22 - Double Eagle IV is quietly adding leases and drilling new oil wells in core parts of the Midland Basin. After a historic run of corporate consolidation, is it the most attractive private equity-backed E&P still standing in the Permian Basin?