On Oct. 11, Diamondback announced a $1.6 billion deal announced to buy FireBird Energy LLC, which is backed by RedBird Capital and the Ontario Teachers’ Pension Plan (OTPP). (Source: Hart Energy art library)

Diamondback Energy Inc.’s first E&P acquisition since March 2021 is a reminder that even one of the Permian Basin’s largest independents—the company was Texas’ second-largest oil producer in 2021—is constantly on the lookout for replacement inventory.

On Oct. 11, Diamondback announced a $1.6 billion deal to buy FireBird Energy LLC, which is backed by RedBird Capital and the Ontario Teachers’ Pension Plan (OTPP). The deal follows a torrid M&A stretch for Diamondback in which, over two and a half years beginning in 2018, the company paid more than $13.7 billion for rivals QEP Resources ($2.2 billion), Ajax Resources ($1.2 billion) and Energen Corp. ($9.2 billion) among others.

“The challenge for public E&Ps in the M&A market is adding inventory while keeping the valuation on deals in line or less than their own cash flow multiples and free cash flow yields,” said Andrew Dittmar, director at Enverus Intelligence Research. “Diamondback appears to have just managed that. While the 3.0x 2023 EBITDA multiple and 15% free cash flow yield paid for FireBird aren’t as cheap as production-heavy deals outside the Permian, it does keep the deal accretive to Diamondback’s own trading multiples.”

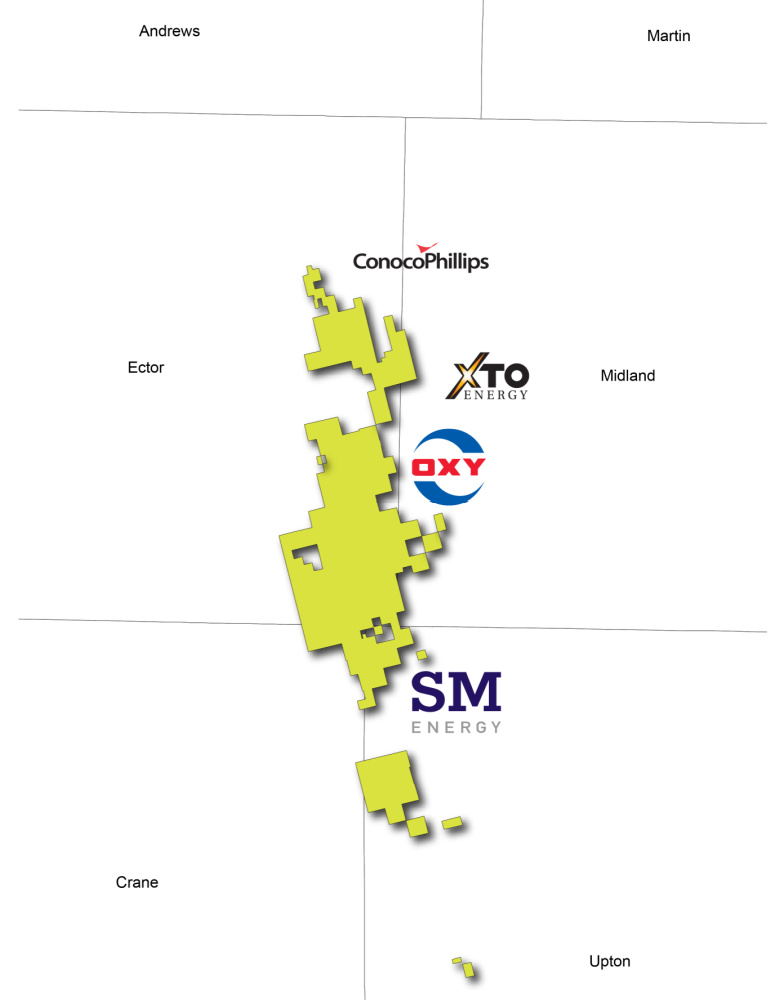

Mark A. Lear, an analyst at Piper Sandler, favorably likened FireBird’s assets to Diamondback’s Spanish Trail assets. Diamondback is acquiring 68,000 contiguous net acres along the southwestern Midland Basin and southeastern Ector County, Texas.

Diamondback management “suggests that the northern third of the acquired assets is an analog to Spanish Trail, and incorporates 40% of the undeveloped inventory,” Lear said.

Diamondback’s FireBird Acquisition Key Metrics |

|

| Acres (net: | 68,000 |

| Valuation ($B): | $1.6 |

| Horizontal locations (net): | 316 |

| Cost per location ($MM): | $1.7 |

| Funding (stock): | 5.86 million shares |

| Funding (cash): | $775 million |

| Current production, oil (bbl/d): | 17,000 |

| Average lateral length (ft): | 11,400 |

| Average working interest: | 92% |

| HBP acreage: | 84% |

| Primary formation targets: | Middle/ Lower Spraberry; Wolfcamp A/ B formations |

Much of FireBird’s development has been concentrated in the southern portion of the acreage position, leaving much of the northern position undeveloped, Lear said. Diamondback expects production of 25,000 boe/d, including 19,000 bbl/d oil in 2023 and expects to be able to maintain that level of production with a one-rig drilling program.

“We looked at recent vintage performance of FireBird operated horizontal wells, and while there has been some variability, the four Wolfcamp producers that were brought on production in 1H22 have delivered oil volumes in line with our FANG Midland Wolfcamp type curve,” he said.

David Deckelbaum, in research published Oct. 12 by Cowen, said that well results in southeast Ector County, Texas have shown oil productivity per foot of 16.5 bbl/ft of lateral in the first 12 months of production and 22.3 bbl/ft in the first 24 months during the past 4 years, “roughly in line with the respective productivity observed for all of Diamondback’s Midland activity” focused in Martin County, Texas.

“We anticipate greater focus on the Spraberry v. Wolfcamp in initial development but note that adjacent well productivity shows encouraging potential,” he said.

But Diamondback will initially stand down two of FireBird’s three rigs to preserve the estimated 316 net horizontal locations “in primary development targets” that Stice said are adjacent to Diamondback’s current Midland Basin position.

The company expects FireBird’s assets to add more than a decade of inventory at their planned development pace, Goldman Sachs analyst Neil Mehta wrote in an Oct. 12 report.

The deal was viewed positively by analysts who see FireBird’s assets shoring up potential weak spots in Diamondback’s portfolio and, based on strip prices, adding cash flow in 2023.

“For Diamondback, the deal looks to be about increasing the development life of its core inventory runway and boosting overall production and scale,” Dittmar said. “RedBird brings to the table hundreds of drilling locations that break even with oil prices in just the mid-$30/bbl range. That adds additional quality inventory to Diamondback’s portfolio while allowing the company to sustain production from the new asset for more than a decade.”

Diamondback Notable E&P Transactions, 2018-21 |

||

| Closed | Acquired Entity | Value ($MM) |

| 2018 | Energen Corp. | $9,200 |

| 2018 | Ajax Resources | $1,200 |

| 2018 | ExL Petroleum | $312.5 |

| 2021 | Guidon Energy | $862 |

| 2021 | QEP Resources | $2,200 |

| Total: | $13,774.5 | |

Deckelbaum suggested that Diamondback is conservatively accounting for potential locations and that the deal works out to about $1.7 million per location—“attractively in line with per location values observed over the last 6 years and well below acreage multiples paid.”

“Even overall flowing valuation of $72k/Flowing BOED is 13% below FANG’s last implied valuation, and management estimates they are paying 3x 2023E EBITDA at strip [pricing], taking advantage of FANG’s closing valuation at strip at roughly 4.7x 2023E,” Deckelbaum said. “In total, the deal should be viewed as a classic, accretive bolt-on for quality acreage with high working interest.”

Goldman Sachs noted that Diamondback currently trades at 5x EBITDA with a 15% free cash flow (FCF) yield at strip pricing, Mehta said.

Mehta sees “the potential for incremental cash flow toward capital returns (~75% of FCF) along with further balance sheet improvement.”

Diamondback management on Oct. 11 noted the company plans to sell at least $500 million of noncore assets by the end of 2023.

Recommended Reading

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

Technip Energies Wins Marsa LNG Contract from TotalEnergies

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.

Galp Seeks to Sell Stake in Namibia Oilfield After Discovery, Sources Say

2024-04-22 - Portuguese oil company Galp Energia has launched the sale of half of its stake in an exploration block offshore Namibia.

Aker BP’s Hanz Subsea Tieback Goes Onstream

2024-04-22 - AKER BP’s project marks the first time subsea production systems have been reused on the Norwegian Continental Shelf.

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.