Source: Shutterstock.com

HOUSTON—Anyone wanting to know what could be ahead for U.S. shale in 2020 should look at what has happened lately, according to analysts.

“Next year will be a lot like the last few quarters of this year,” Todd Bush, head of North American unconventionals for Westwood Global Energy Group, said while delivering the firm’s shale outlook at a recent event.

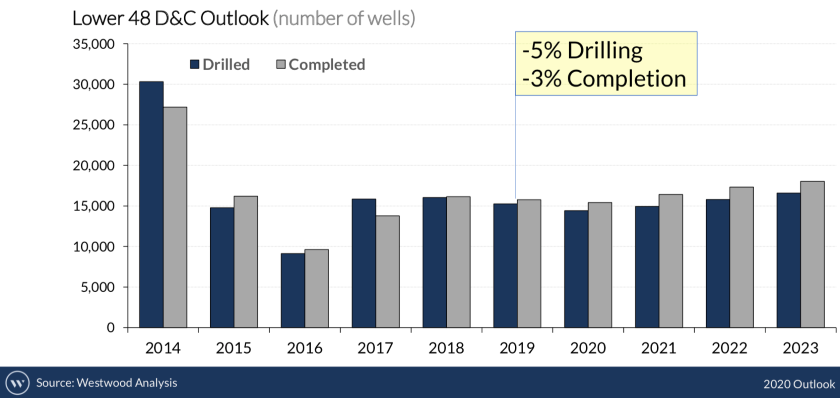

With the uncertainty of an election year, OPEC’s maneuvering and the direction of oil prices, the research consultancy forecasts drilling and completions activity will drop by 5% and 3%, respectively; a softening frac horsepower market; and a rebalancing of frac sand supply as demand rises by 12%, Bush said.

The consensus of a group of 20-25 analyst firms is that the price for a barrel of West Texas Intermediate crude oil will hover between $55 and $60 for the next 12 to 15 months, he added.

Through it all, the efficiency drive is set to continue throughout next year as operators and oilfield service companies strive to increase cash flow from operations. But the already present slowdown in production is expected to carry over into the new year. This includes in the Midcontinent’s Anadarko Basin, home of the resource plays such as the Scoop/Stack and Meramec, where Bush said production growth has been falling since January 2018.

Data from the U.S. Energy Information Administration’s (EIA) latest drilling productivity report shows oil production in the Anadarko Basin is forecast to drop by 15,000 barrels per day (bbl/d) to 553,000 bbl/d in January 2020 compared to December 2019.

Also seeing production drops is the Eagle Ford, where the EIA said oil production is forecast to fall by 9,000 bbl/d to 1.357 million bbl/d.

“The Permian is still in the growth trajectory,” Bush said, though production growth appears to have peaked in September 2018 at 44%.

In the last six months, 31% of the frac activity in the Permian’s Delaware sub-basin has come from EOG Resources Inc., Exxon Mobil Corp., Occidental Petroleum Corp., Concho Resources Inc .and Chevron Corp. The most active companies fracking in the Midland sub-basin are Pioneer Natural Resources Co., Endeavor Energy Resources LP, Encana Corp., Exxon Mobil and Parsley Energy Inc., accounting for 36% of the activity, Bush said.

While the rig count has fallen about 27% this year, the number of wells drilled have dropped by only about 5%, a feat attributable mainly to improved cycle times and footage drilled per day, Bush said.

Permian player Pioneer Natural Resources, for example, said it saw a 30% year-over-year improvement in cycle times during the third quarter. Its focus on lean manufacturing methods played a role.

Westwood gains insight by monitoring more than 21,000 well pads in major U.S. unconventional plays—including the Permian, Eagle Ford and Haynesville—every two to three days using data from regulatory agencies, news sources and satellite imagery. So far, the firm has captured more than 1.7 million images of wellsites since 2016 to monitor activity such as new pad construction.

Drilling and Completions: Westwood expects Lower 48 drilling activity to fall by 5% and completions by 3% with some basins declining faster than others. “As we get into 2020 we’re going to see more DUCs [drilled but uncompleted wells] being completed. The drawdown in DUCs is really happening now and moving into 2020,” Bush said, noting it will probably continue through first-half 2021.

“From a bullish scenario if oil gets up to the $62-$65 range for WTI then certainly there will be some healthy activity and increased cash flow; increased sentiment will come from that,” Bush said, “vs. more of a bear case where at $45 [per bbl WTI] we’d expect more pullback in the D-J, Eagle Ford and the Bakken, and still a healthy amount of activity in the Permian.”

The firm’s base case, which was used for the 2020 outlook, puts WTI at about $55 through 2020 with E&Ps maintaining current spending plans and limited expansion. Activity is expected to drop in fourth-quarter 2019 and increase in third-quarter 2020, according to the outlook.

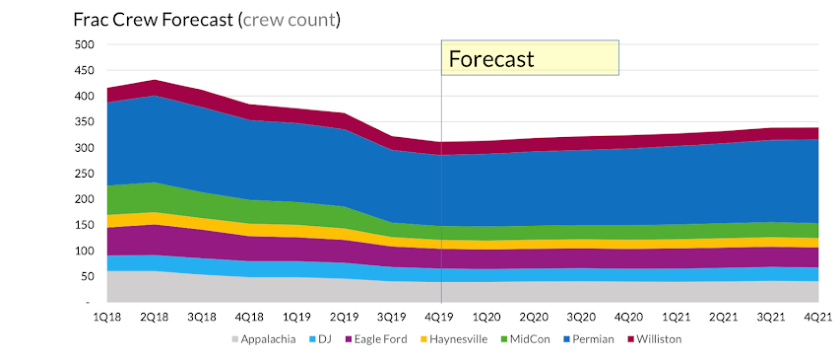

Frac Crews: In early December, there were 322 active frac crews in the Lower 48, down about 12% from fourth-quarter 2018, Westwood data show. “Some of the largest drops have been in Appalachia … but activity is still pretty strong when it comes to the Permian,” Bush said.

The count is expected to gradually increase throughout 2020, reaching about 340 frac crews in 2021.

“One thing that we’re pretty optimistic about is some of the public frac companies coming back and pulling equipment,” nearly about 1.2 million hydraulic horsepower off the market—notably in the Midcontinent. That makes for a “healthy supply and demand balance,” he added.

On the efficiency front, Bush said there are some new solutions from frac equipment suppliers coming to the market that could lead to gains. These include new layouts, designs and frac pumps, he said.

Frac Activity: Meanwhile, companies continue “doing more with less.” As the frac crew count has dropped, the number of stages per frac spread has jumped with more lateral feet drilled and more proppant pumped. Westwood data shows every major basin saw double-digit percentage increases in stages per frac spread during the third quarter compared to a year earlier. The exception was the Denver-Julesburg (D-J) Basin.

About 40% of the stages fracked were in the Permian, where Bush said several companies—including a 30% jump by Centennial Resource Development Inc. in the Delaware Basin—have increased stages per day. In 2020, the Permian is expected to account for 43% of stages fracked.

In all, total stages are expected to dip slightly—by 3%—in 2020 amid the activity slowdown before rising by 4% in 2021, Bush said.

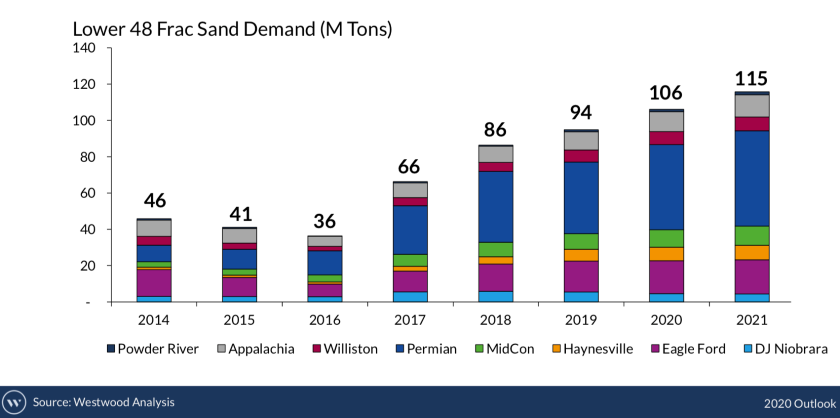

Frac Sand: Companies have been increasing the amount of sand used in fracking operations since 2017, but nowadays completions tailored for specific reservoirs are evolving with some areas seeing the amount of proppant and fluid per foot flattening over time.

Plus, today’s slowed pace of growth has put pressure on sand suppliers.

Westwood places frac sand demand at 94 million tons for 2019, which Bush said may be a “little optimistic.” Sand demand is forecast to rise to 106 million tons in 2020 and to 115 million tons in 2021 with the largest markets being the Permian Basin, Eagle Ford, Marcellus and Utica.

With supply outpacing demand, the rebalancing continues following a runup in sand supplies that hit 157 million tons in 2018, the firm said. Lower 48 frac sand supply is forecast to be about 140 million tons in 2019 and 112 million tons in 2020.

The frac sand supply is expected to rebalance with a 12% increase in demand in 2020.

The supply of Northern White Sand rebalanced in early 2019 through mine closures, according to Westwood. In the Permian, Westwood expects five to seven mines to lower production or close. But new mines are opening in the Rockies, Midcontinent and Haynesville, the firm said.

Recommended Reading

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

E&P Earnings Season Proves Up Stronger Efficiencies, Profits

2024-04-04 - The 2024 outlook for E&Ps largely surprises to the upside with conservative budgets and steady volumes.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

Exxon, Chevron Tapping Permian for Output Growth in ‘24

2024-02-02 - Exxon Mobil and Chevron plan to tap West Texas and New Mexico for oil and gas production growth in 2024, the U.S. majors reported in their latest earnings.