(Source: Shutterstock.com)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Top U.S. gas plays have added horizontal rigs recently but not enough to lead to a sustainable recovery for the sector, analysts say, as companies keep purse strings tightened.

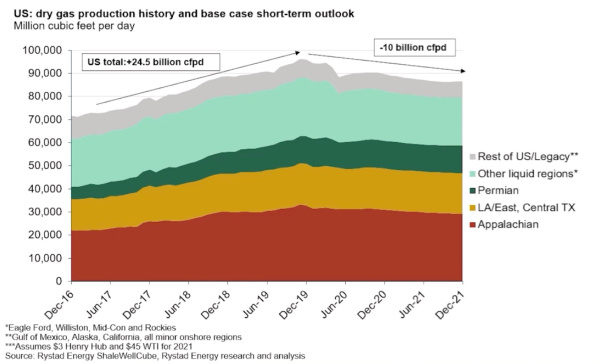

The optimism seen by some gas producers when the COVID-19 pandemic hit demand for oil, leading to a slowdown in oil production along with associated gas, was short-lived. With production at about 90 Bcf/d, oversupply remains.

The “growth story is over for the Appalachian Basin, at least in [the] short-term,” according to Artem Abramov, head of shale research for Rystad Energy.

Appalachia, the biggest natural gas-producing region and home to the prolific Marcellus and Utica shale formations, overcame massive infrastructure obstacles to add nearly 12 Bcf/d in 2017-2019, Abramov said during Rystad’s virtual summit this week. However, producers are now in maintenance mode as base production matures.

Sequential declines could be ahead.

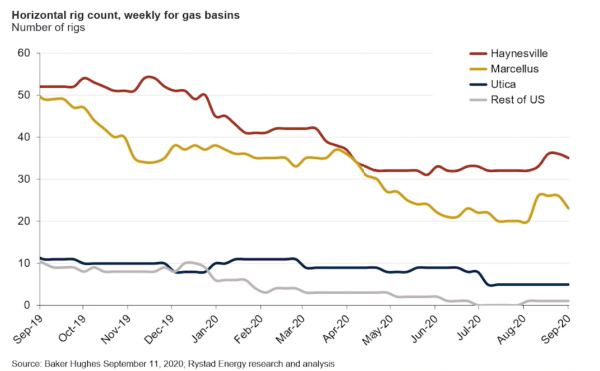

“We actually need 40 rigs now to see production maintenance next year,” Abramov said. “We are slightly below that level, which basically means that the rig activity has to increase already in the next few weeks, couple of months, if you want to avoid production declines in Appalachia next year.”

In the Haynesville region, where Rystad data show about 4.5 Bcf/d was added over the last three years, production can be held flat with 30 rigs. “We might even see some production additions next year if operators prioritize sweet spots and the best locations,” Abramov said, though he called the significance uncertain.

Basking in the spotlight again was the Permian Basin, where associated gas production was described as “resilient” this year. Associated gas from the basin, the biggest oil producer in the U.S., accounted for the largest share of gas production growth from 2017 to 2019. Though the Permian is also in maintenance mode, activity in parts of the basin is recovering. Such areas include the gassier parts of the basin, including the western Delaware sub-basin’s Culberson County in Texas, where Abramov said has some of the country’s most productivity gas wells.

“Contrary to the gas basins where these can be viewed as a negative story and pretty expected development this year, the Permian actually impressed the markets a little bit during the oil curtailment periods” with “dry gas not that far from 12 Bcf a day level where it peaked early this year.”

Rystad sees the Permian as a major driver for production growth in the medium term. How much growth will depend on how much oil and gas prices improve.

“If we assume that WTI prices recover to mid to high 40s next year or in 2022, such price environment will immediately trigger continuous activity expansion in the Permian,” the analyst said. “But even with declining oil production, gas output in oil basins tends to stay relatively flat.”

Looking at the entire U.S., he said gas production is set for a gradual sequential decline in 2021, following three years of growth that saw production rise by around 25 Bcf/d to about 90 Bcf/d today. That’s down about 6 Bcf/d from fourth-quarter 2019, Rystad data show.

About 60 to 65 total rigs are currently running in gas basins, he said.

“If we look at the strip for 2021, it is kind of back to the normal level, averaging roughly at $3 per MMBtu,” Abramov said.

However, the price is not high enough to “trigger a substantial recovery and increase in the activity in the gas basins,” he added, noting it is already sufficient to continue maintenance programs. “Most companies still maintain pretty conservative budgets and prioritize their balance sheets and free cash flow generation.”

Recommended Reading

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

Trio Petroleum to Increase Monterey County Oil Production

2024-04-15 - Trio Petroleum’s HH-1 well in McCool Ranch and the HV-3A well in the Presidents Field collectively produce about 75 bbl/d.

Trillion Energy Begins SASB Revitalization Project

2024-04-15 - Trillion Energy reported 49 m of new gas pay will be perforated in four wells.