(Source: Jim Parkin/Shutterstock.com)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

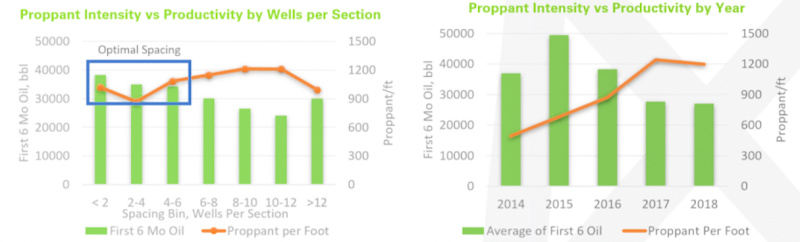

More wells drilled per section plus more proppant doesn’t necessarily equal greater productivity.

At least that was the case for an operator targeting the Mississippian in a normal-pressured window of the Stack play in Oklahoma’s Kingfisher County.

“The operator increased [its] well spacing from six to eight wells per section. At the same time, [it] increased proppant intensity about 40%,” Sarp Ozkan, a senior oil and gas market analyst and manager of upstream and crude market efforts for Drillinginfo (DI), said on a webinar this week. “However, that resulted in about a 30% loss in productivity. … An aggressive development plan of increasing frac intensity and downspacing at the same time can greatly impact productivity to the negative side.”

The case study focused on first six months of oil production, using DI’s spacing dataset, which has spacing metrics on neighbor, parent, child and co-completed wells as well as well density, EURs, production and completion data related to spacing among other data.

Analysis also pointed to a “noticeable degradation” in the productivity of child wells, compared to parent wells. The former had “roughly half of the productivity of those wells drilled in 2015-2016,” compared to 2017-2018, Ozkan said.

The talk took place as the number of child wells, or infill wells, across U.S. shale plays, continues to grow. The surge has brought concerns about spacing and impact on other nearby wells—particularly parent wells that could experience declining pressure.

The unfavorable impact could affect overall production and revenue potential not only for upstream players, but also for those down the pipeline.

“Lower productivity wells hurt returns for operators. That in turn will impact activity especially in an environment today where Wall Street is laser-focused on free cash flow and returns to shareholders,” Ozkan said.

“Even if these wells are still economic and activity remains strong, lower productivity also translates to less volume going through your system,” he said, referring to midstream players. “This is the main reason why the parent-child issue and spacing issues are going to be a focal point for the midstream industry moving forward as well.”

Falling Production

DI’s analysis focused on the Scoop/Stack play in the Anadarko Basin, where the U.S. Energy Information Administration (EIA) forecasts oil production will fall by 5,000 barrels per day (bbl/d) in August to 585,000 bbl/d. Gas production is also forecast to drop, sinking 54 million cubic feet per day (MMcf/d) to about 7.5 billion cubic feet per day.

The Anadarko Basin is the only one of seven top-producing U.S. regions expected to experience falling gas production next month and is one of two (the other being Eagle Ford) expected to see oil production fall, according to the Drilling Productivity Report released July 15 by the EIA.

Ozkan pointed out growing concerns about “how aggressive downspacing programs have negatively impacted oil productivity” in the Scoop/Stack. A jump in average per well productivity seen in 2014-2015 carried into 2016; however, well productivity declined the following year and in 2018, he said.

“When we look at those wells drilled in 2018 and look at the productivity of child wells in relation to parent wells we see that there is a 25% productivity decrease,” Ozkan said.

DI’s analysis shows that the number of child wells drilled in 2018 is more than five times that of 2016.

When analyzing data, it’s important to isolate core and noncore assets when trying to understand optimal downspacing and parent-child well interactions, he added.

Scoop/Stack operators have consistently spaced wells at an average of six to seven wells per section, according to DI. Wells drilled outside the core in emerging areas have smaller pads with four or fewer wells, compared to between eight and 12 wells per section inside the core, Ozkan said.

About 40% of the Scoop/Stack wells fall into the emerging or noncore areas, he added.

“They may not have interference issues but an operator may still be learning best practices in the area,” Ozkan said, or the area could have worse rocks. “Those will be contributing to the type curve degradation.”

The shift of drilling programs toward more child wells could also alter production forecasts.

The concerns aren’t unique to the Scoop/Stack. Companies have been tackling such issues in shale plays across the U.S.

Finding Solutions

So, what are companies doing to address well interference and parent-child issues?

“The real measures that are taking place are trying to understand what the optimal spacing is and taking measures to make sure development programs do not try to overdrill different units,” Ozkan said. “Additionally, we are hearing there is work, in the research phase, around mitigating frac interference and being able to make sure that when child wells are coming in that the fracs are fracking virgin rock vs rock that has already been crushed.”

RELATED

- DUG East: Attacking The Perils Of Longer Laterals, Parent-Child Well Intervention

- The Challenges Of Parent And Child Wells

To minimize the impact of parent-child well interference, some E&Ps shut in the parent well before fracking a child well nearby.

Some operators are utilizing a factory approach—tapping multiple layers of shale rock at one time. The approach has been called cube development by some, while others have given their development styles unique names.

QEP Resources Inc. uses “tank-style development” in the Permian Basin.

In April, QEP said in a presentation that tank-style development is “leading to consistent, repeatable, high-return wells” and “parent/child issues [are] not a concern with tank-style development.”

RELATED

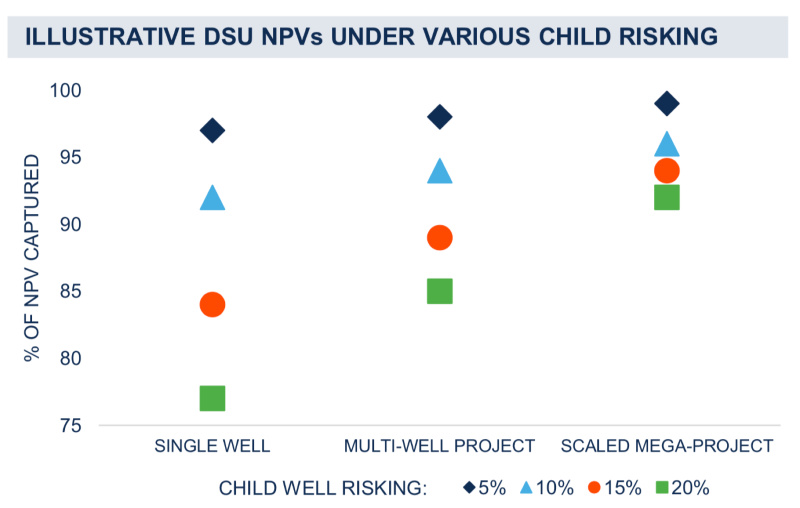

Callon Petroleum, which moved to acquire Carrizo Oil & Gas for $3.2 billion, is also looking to optimize development and reduce parent-child issues through use of what it calls SimOps (simultaneous operations) mega-pad development.

“Switching to mega-pad development designs significantly reduces the proportion of children wells within a given DSU [drill spacing unit],” the company said in a presentation July 15.

Continental Resources Inc.’s Project SpringBoard stacked development in the Scoop play focuses on the Springer, Sycamore and Woodford reservoirs. The company reported production is growing ahead of schedule, prompting it to increase the project’s growth target to 18,000 bbl/d in third-quarter 2019, from the initial 16,500-bbl/d target.

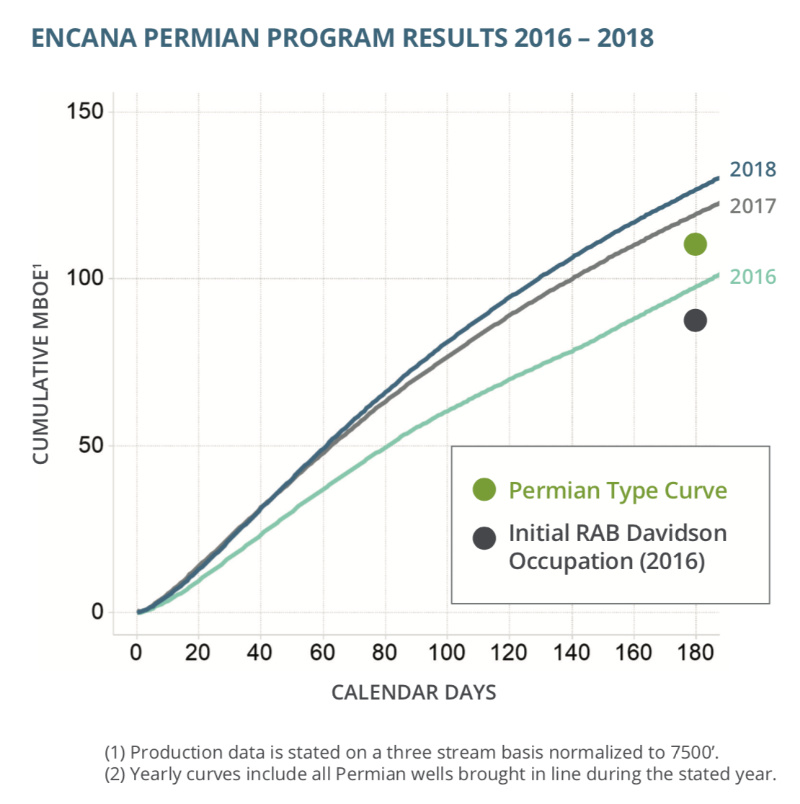

Encana Corp., which calls itself a pioneer in cube development, has also made progress with the method in the Permian Basin since 2016-2017 when its initial cube attempts produced more than its vintage wells of the same period but experienced steep declines.

“Encana’s 2017 and 2018 programs in the Permian show our continued progress in well productivity,” Encana said on its website. “Our first RAB Davidson occupation in 2016 was designed with tighter inter-well spacing than successive designs.”

Since then, evolving completion designs and optimized spacing have contributed to overall Permian production improvement for the company.

“Encana expects to deploy cube development to the Anadarko Basin assets starting in the second quarter of 2019,” the company said earlier this year. “The application of cube development is expected to reduce well costs by more than $1 million per well in 2019 compared to Newfield’s 2018 well costs.”

The Calgary, Alberta-based company said in November 2018 it would acquire Newfield Exploration Co., boosting its position in the Scoop/Stack.

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

E&P Highlights: March 15, 2024

2024-03-15 - Here’s a roundup of the latest E&P headlines, including a new discovery and offshore contract awards.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.