“With the impending transformation of [American Midstream], I believe the timing is right for me to step aside and let ArcLight manage the company in a private setting,” Lynn Bourdon said in an April 26 statement. (Source: Shutterstock.com)

The head of American Midstream Partners LP, Lynn Bourdon III, is set to resign, the Houston-based company said April 26.

Bourdon, chairman, president and CEO of American Midstream, notified the company of his decision to resign. His resignation, effective May 3, follows the company’s buyout by private-equity firm ArcLight Capital Partners LLC announced last month.

“With the impending transformation of [American Midstream], I believe the timing is right for me to step aside and let ArcLight manage the company in a private setting,” Bourdon said in a statement.

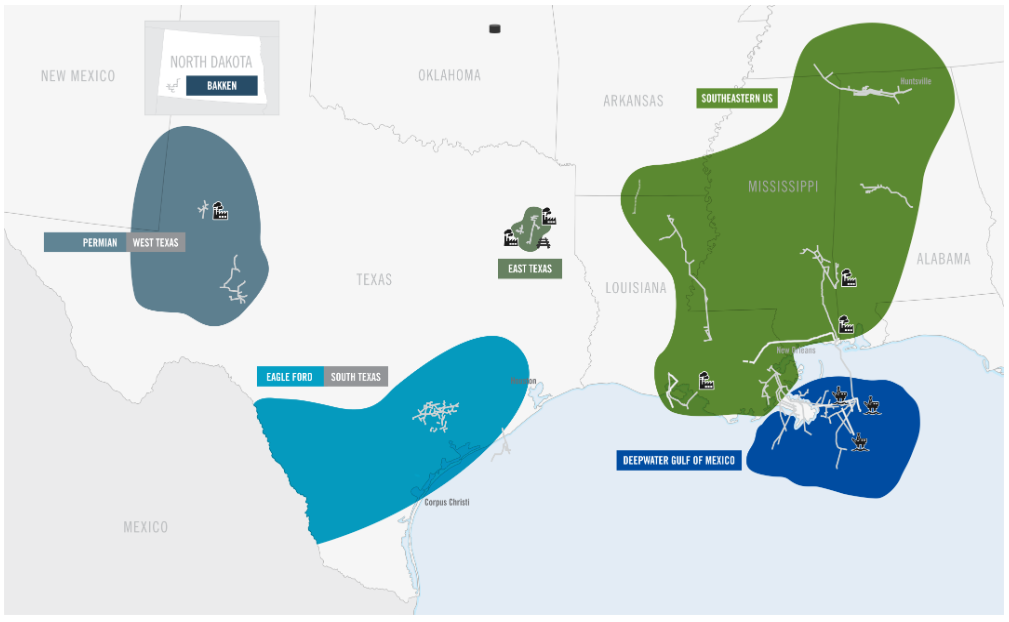

American Midstream is an MLP formed in 2009 to own, operate, develop and acquire a diversified portfolio of natural gas midstream energy assets. The company’s assets are located in offshore and onshore basins in the Permian Basin, Eagle Ford, East Texas, Bakken and Gulf Coast.

On March 18, ArcLight agreed to acquire, in a merger transaction, all outstanding common units of American Midstream at $5.25 per unit in cash, which comes out to roughly $284.6 million.

Affiliates of ArcLight already owned about 51% stake in American Midstream prior to the merger agreement, according to a company press release.

“The past few years have been challenging for small capitalization MLPs, and the exceptional support ArcLight provided has been critical to [American Midstream’s] successes during this time,” Bourdon added.

Bourdon joined American Midstream in 2015 from Enable Midstream Partners LP, where he served as president and CEO. He also previously held leadership positions with Enterprise Products Partners LP, En*Vantage, PG&E Corp. and Valero Energy Corp.

Jake Erhard, partner at ArcLight Capital Partners, said in a statement regarding Bourdon’s resignation, “On behalf of ArcLight and the entire board of the general partner, I would like to thank Lynn for his leadership and numerous contributions to [American Midstream] during a difficult environment over the past four years. It has been a pleasure to work with Lynn and gain from his industry knowledge and management expertise. As [American Midstream] transitions to private operatorship, we understand Lynn's desire to move on and wish him success in his future endeavors.”

The ArcLight buyout is expected to close second-quarter 2019. Gibson, Dunn & Crutcher LLP is acting as legal counsel to American Midstream for the transaction. Evercore is financial adviser and Thompson & Knight LLP is legal counsel to the company’s conflicts committee. BofA Merrill Lynch is ArcLight’s financial adviser and Kirkland & Ellis LLP is the firm’s legal counsel.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Imperial Expects TMX to Tighten Differentials, Raise Heavy Crude Prices

2024-02-06 - Imperial Oil expects the completion of the Trans Mountain Pipeline expansion to tighten WCS and WTI light and heavy oil differentials and boost its access to more lucrative markets in 2024.

What's Affecting Oil Prices This Week? (Feb. 5, 2024)

2024-02-05 - Stratas Advisors says the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted.

McKinsey: US Output Hinges on E&P Capital Discipline, Permian Well Trends

2024-02-07 - U.S. oil production reached record levels to close out 2023. But the future of U.S. output hinges on E&P capital discipline and well-productivity trends in the Permian Basin, according to McKinsey & Co.

Veriten’s Arjun Murti: Oil, Gas Prospectors Need to Step Up—Again

2024-02-08 - Arjun Murti, a partner in investment and advisory firm Veriten, says U.S. shale provided 90% of global supply growth—but the industry needs to reinvent itself, again.

Venture Global, Grain LNG Ink Deal to Provide LNG to UK

2024-02-05 - Under the agreement, Venture Global will have the ability to access 3 million tonnes per annum of LNG storage and regasification capacity at the Isle of Grain LNG terminal.