Midstream companies with improved balance sheets and excess cash flow allowed that cash to flow out during an extended year-end shopping spree. (Source: Hart Energy photo-illustration; Shutterstock.com)

Midstream companies with improved balance sheets and excess cash flow allowed pipeline operators to go on an extended year-end shopping spree. The prices, however, were not bargain basement.

“There have been a number of smaller, bolt-on acquisitions and non-core asset sales in the midstream space in recent months for pipelines and other infrastructure assets,” Stacey Morris, head of energy research at VettaFi LLC, told Hart Energy. “Companies that have perhaps wanted to sell assets may be seeing better valuations today than in the recent past, providing opportunity.”

While the timing of the deals lumps them together, little else does.

“Deals have varied geographically and by type of asset. Each transaction seems to have some nuance to it and unique motivations,” Morris said. “It is hard to paint in broad strokes in discussing recent transactions.”

The recent transactions are more situational, she said, and can’t be seen as a trend away from operations in the Permian Basin.

“Some of these companies that have bought assets [like Tallgrass and Williams] aren’t big Permian players anyways, so I don’t think recent deals being outside of the Permian says much about the Permian itself,” Morris said.

The big deals

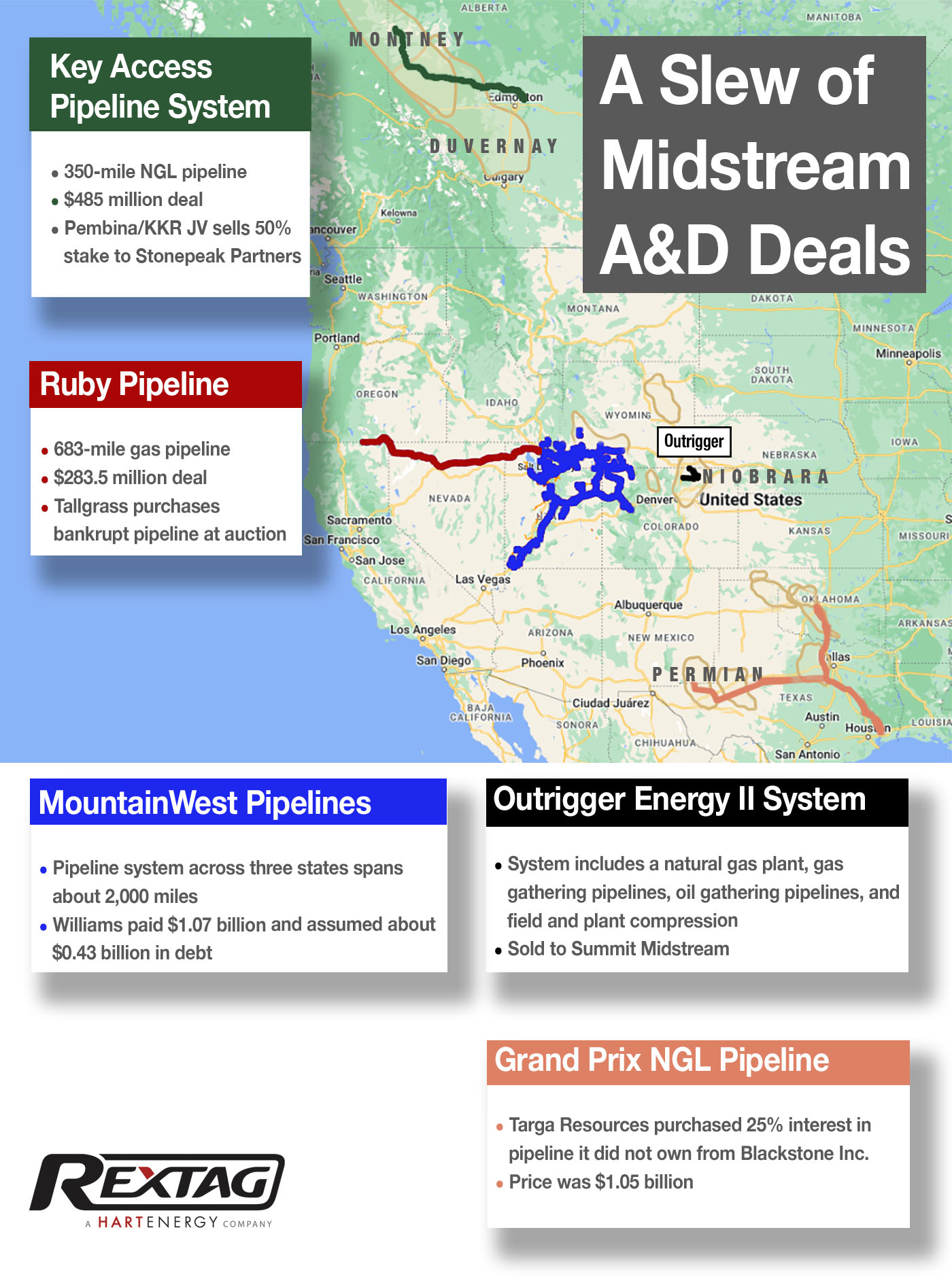

MountainWest Pipeline System: The Williams Cos. paid $1.07 billion in cash and assumed $430 million in debt to acquire MountainWest from Southwest Gas Holdings Inc. in December. The sprawling natural gas system, known as Questar Pipelines before its 2021 sale to Southwest from Dominion Energy, extends into Utah, Colorado and Wyoming with a capacity of 8 Bcf/d.

“The acquisition gives WMB further midstream reach in the Rockies, and in our view is a long-term play on Rockies gas supply growth,” Zack Van Everen, senior capital markets analyst at East Daley, wrote in a research note. He added that the Rockies could become key to long-term supply as demand grows for LNG.

The system includes the MountainWest and Overthrust pipelines; the White River hub, a joint venture with Enterprise Products Partners, in the Piceance Basin in northwest Colorado; and storage of 56 Bcf, almost all in the Clay Basin in the Rockies.

Key Access Pipeline System (KAPS): Stonepeak Partners gained access to NGL processing facilities for export to Asia in this mid-December deal for Pembina Pipeline Corp.’s 50% stake in the system. The transaction cost a little less than $500 million and means that Stonepeak will share ownership with Keyera Corp., which will operate the system still under construction. Completion is expected in 2023.

KAPS is a 350-mile twin pipeline system that will transport NGL and condensate western from the Canadian Montney and Duvernay fields to Keyera’s processing facilities in Fort Saskatchewan, Alberta, Canada.

Grand Prix NGL Pipeline: On the first business day of 2023, Targa Resources Corp. announced its deal to acquire the 25% interest it did not own for $1.05 billion. The purchase of the stake in the 220-mile NGL pipe from Blackstone Energy Partners will be funded by a combined public offering of $1.75 billion in senior notes due in 2053.

The 1 MMbbl/d pipeline connects Targa’s operations in the Permian Basin, southern Oklahoma and North Texas to its fractionation and storage facility in Mont Belvieu. Targa’s transaction with Stonepeak in 2022 landed it the other 75% stake in Grand Prix, along with 100% interest in its Train 6 fractionator in Mont Belvieu and a 25% equity interest in the Gulf Coast Express Pipeline.

Outrigger II system: Summit Midstream’s $305 million deal for the Denver-Julesburg Basin assets frees Outrigger to focus on its midstream system in the Williston Basin. Summit gains connections to multiple midstream systems in the basin with this transaction. As part of the deal, Summit also purchased infrastructure from Sterling Energy Investments LLC, Grasslands Energy Marketing LLC and Centennial Water Pipelines LLC.

Summit’s new assets include a 60 MMcf/d cryogenic natural gas processing plant with product distribution to the Cheyenne Plains gas pipeline and DCP Midstream LP’s NGL system. The company also gets 70 miles of low-pressure natural gas gathering pipelines, 90 miles of high-pressure natural gas gathering pipelines, 12,800 hp of field and plant compression and 30 miles of crude oil gathering pipelines with transportation to the Pony Express Pipeline.

Ruby Pipeline: The $282.5 million price paid by Tallgrass for the natural gas pipeline was a fair one, East Daley said, falling at the midpoint of its pre-bankruptcy forecast range of $205 million (base case) to $370 million (premium case). The winning bid beat the $276 million submitted by EP Ruby LLC, a unit of Kinder Morgan Inc.

The pipeline, which began service in 2010, runs to gas markets in Nevada, Oregon and northern California. The 42-inch pipe stretches 683 miles with capacity of about 1.5 Bcf/d. Struggles to compete with TC Energy’s expanded Gas Transmission Northwest and NovaGas Transmission Line pipelines led to Ruby’s bankruptcy in March 2022.

“East Daley views Ruby Pipeline as an essential asset that will continue to see contracting,” Van Everen said in a research note. “Based on current contract prices, the pipeline’s cash flow will likely break even or be slightly positive once PG&E’s contracts roll off.”

And the rest…

Morris noted several other deals of importance prior to the December rush. Among them:

• Navitas Midstream Partners LLC: Purchased by Enterprise in January for $3.25 billion;

• Lucid Energy Group: Targa purchased for $3.55 billion in June;

• Cactus II Pipeline LLC: In November, Western Midstream Partners sold its 15% stake in the pipeline to Enbridge Inc. (10%) and Plains All American (5%) for a total of $265 million;

• Keyera Fort Saskatchewan JV: Plains sold its 21% share in the facility to Keyera for $365 million; and

• Elba Liquefaction Co.: Kinder Morgan sold half of its 51% stake to an undisclosed buyer for $565 million.

Recommended Reading

Orange Basin Serves Up More Light Oil

2024-03-15 - Galp’s Mopane-2X exploration well offshore Namibia found a significant column of hydrocarbons, and the operator is assessing commerciality of the discovery.

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.

CNOOC Sets Increased 2024-2026 Production Targets

2024-01-25 - CNOOC Ltd. plans on $17.5B capex in 2024, with 63% of that dedicated to project development.

CNOOC Finds Light Crude at Kaiping South Field

2024-03-07 - The deepwater Kaiping South Field in the South China Sea holds at least 100 MMtons of oil equivalent.

Sinopec Brings West Sichuan Gas Field Onstream

2024-03-14 - The 100 Bcm sour gas onshore field, West Sichuan Gas Field, is expected to produce 2 Bcm per year.