(HartEnergy.com, Shutterstock.com)

It seemed impossible at the time, but the impossible eventually happened on April 20 when the rolling contract for U.S. West Texas Intermediate (WTI) benchmark crude oil futures price for May physical delivery plunged into negative territory for the first time ever on concerns of limited space to store oil at the main hub in Cushing, Okla. Since then, U.S. crude futures have since rallied about 150% to nearly $25/bbl. In fact, prompt WTI oil futures prices for June delivery are up over $30/bbl, or 55%, in the last week due to storage builds slowing, an indication that well shut-ins are having an impact.

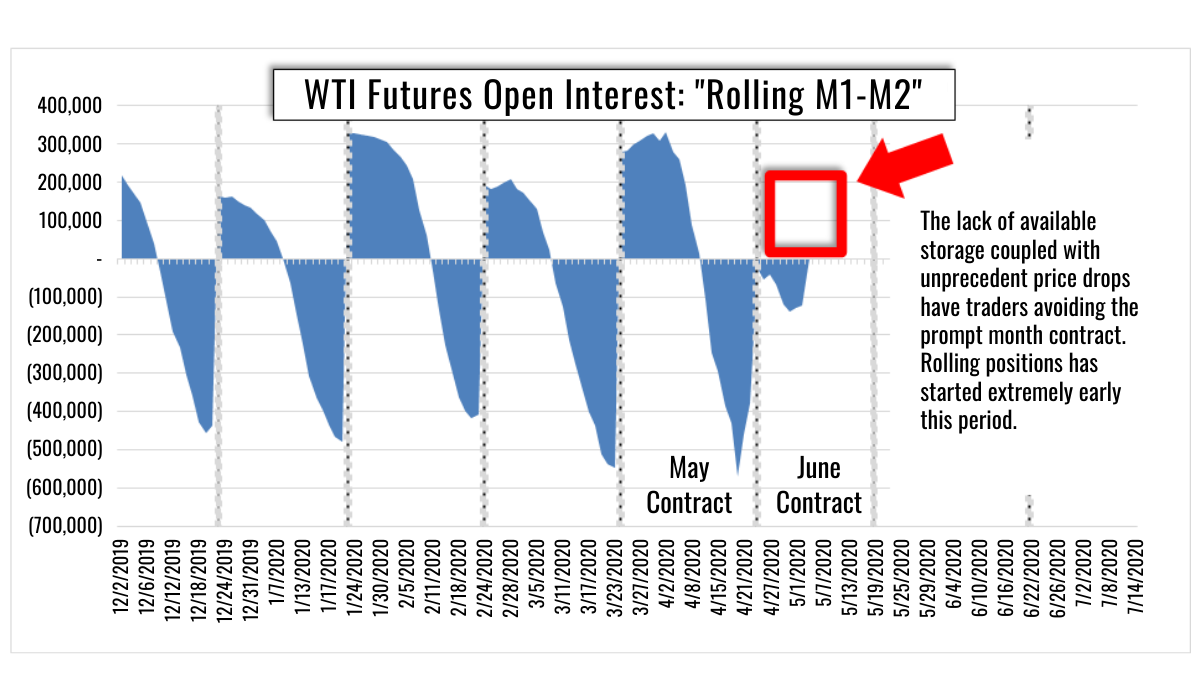

The lack of available storage coupled with unprecedented price drops have traders avoiding the prompt month contract. This limited liquidity becomes the catalyst for increased volatility.

The chart above tracks the “Open Interest” or the number of open contracts for NYMEX CL futures. By taking the difference between the first two contracts’ open interest, you can visualize what happens as the contract goes to expiry. We typically see a large build of open interest just prior to expiry and the first few days of the new contract period. This process is a result of traders “rolling their positions” (selling the expiring contract and buying the next available contract). As you can see above in the empty red box, that typical build of new contracts did not occur this month.

So, What Happened?

After last month’s wild ride into negative territory, traders have become very aware of downside risk. To the surprise of many, including my own, zero is not the floor! The CL futures contract requires the owner to take physical delivery of oil at expiry. This means many financial speculators, such as hedge funds, ETFs (like the U.S. Oil Fund, or “USO”) and banks, must close out their positions rather than allow them to go to settlement like a typical financial contract. With limited physical options across the board, traders are trying to steer clear of this potential pitfall by clearing out early.

Why is This Important?

Physical limitations have made it riskier to hold futures contracts. There are only a limited number of buyers capable of taking the contract to delivery. Therefore, with financial speculators’ early exit from the current months contract, liquidity is rapidly withering away and creating the perfect recipe for an extreme surge in volatility.

What am I Looking For?

As stated earlier, physical market conditions and lack of liquidity are expected to be the catalyst for a strong move in either direction. Currently, I’m tracking two possible scenarios as the market closed exactly on the tipping point of $25.28/bbl on Tuesday, May 5.

The Short Squeeze

Being forced to shut-in production requires the hedge portfolios of E&P companies to be rebalanced. Managing the timing of those volume cuts creates a dynamic hedge position that can easily be overlooked and out of balance. Management may be forced to unwind or buy back hedges in order to stay in compliance with lenders. In a hostile market environment (like we’re currently in), this could easily trigger a wave of hedge re-positioning. These purchases in a thinly traded market can quickly drive up prices.

A break above $25.28/bbl could result in upward movement targeting $41.50/bbl-$43.00/bbl before ultimately grinding lower over the long term.

Producers are under immense financial pressure to retain as much cash as possible. In fact, I can see a scenario in which hedges are unwound prior to expiry. Watching hedge values wither away daily in this rising market could compel management teams to act and re-evaluate their hedging programs in order to align to market realities. These purchases could perpetuate a move up and increase overall market momentum.

Range Bound

Under this scenario, the market will continue to go sideways. Although this is currently a combustible environment, last month’s plunge into negative territory is still fresh on traders’ minds and precautions are being taken. The physical situation will stay static allowing time and increased demand to work down the existing stockpiles of crude.

Failure to break $25.28/bbl could result in downward pressure targeting $12.67/bbl and then potentially testing (zero) $0/bbl. I would expect the $25.28/bbl price level to remain the high throughout the third quarter of this year.

What Can We Expect Going Forward?

Commodity markets are infamous for being extremely volatile. A negative $38/bbl WTI crude price is proof of that. My belief is that we will overcompensate and this upward trend could continue to climb to over $40/bbl. Just like late April, I believe this will also be a function of how the market operates rather than a fundamentally bullish outlook. Unfortunately, I think this low-price environment will persist for quite some time.

Ryan Dusek is a director in Opportune's commodity risk advisory group.

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.