The sun sets behind a pair of pumpjacks along Texas 349 in the Midland Basin just north of Midland, Texas. (Source: Tom Fox/Hart Energy)

The booming Permian Basin has been the largest source of production growth in the U.S., with a pace that pushed domestic production past 13 million barrels per day of oil in 2019. However, some oil and gas executives are saying they’re reluctant to invest in the basin in the New Year, according to a recent study by BDO’s energy practice.

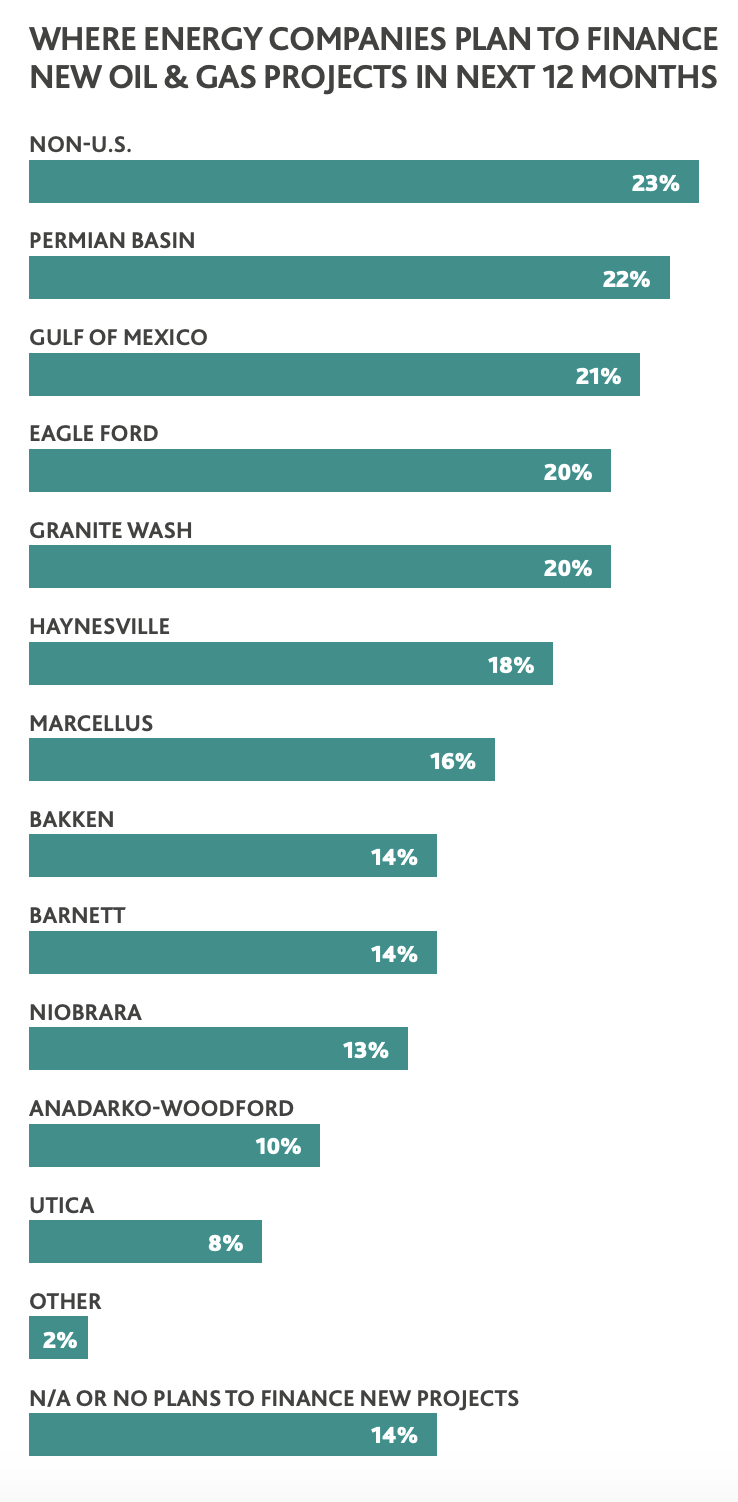

In a CFO outlook survey, BDO said 86% CFOs of oil and gas companies plan to finance new projects in 2020 and, even though the Permian Basin remains a focus, nearly a fourth of energy companies (23%) are looking elsewhere to break new ground—even outside of the U.S.

“While the Permian Basin remains a focus for oil producers, smaller companies are clearly looking elsewhere for new opportunities as oil majors have taken over Permian operations,” Clark Sackschewsky, national leader of BDO’s energy practice and global leader of oil and gas, told Hart Energy.

Sackschewsky pointed out that the study recorded a huge interest from investors to finance new projects in the Gulf of Mexico (GoM). According to the study, which polled 100 CFOs at U.S. energy organizations with revenues ranging from $250 million to $3 billion, the GoM ranks second to the Permian Basin out of projects in the U.S.

“Although there are large upfront costs of operation in the GoM, there are also a large amount of recoverable reserves available in the region,” he said. “For oil producers, this means that there is more certainty around the costs associated with drilling and returns, which is important in a low-price environment. In addition, it is easier to get funding when investors know the payoff is between three to five years.”

BDO’s study also forecast the industry this year will contend with fierce competition, regulatory uncertainty, low oil prices and a lack of available new capital amid increased market volatility and a potential economic downturn. Therefore, energy companies will be forced to live within their means, either by cutting costs or discovering new operational efficiencies—or else, risk insolvency.

Most energy CFOs in the survey said even though their businesses are currently thriving (71%), they’re worried about regulatory uncertainty (21%). The concern is in large part due to continued trade policy turbulence and the 2020 U.S. presidential election—the outcome of which will determine how the industry is regulated for the next four years.

In addition, CFOs said their biggest workforce challenges in 2020 include increasing labor costs, training and development and a skilled worker shortage. Increased overall demand for labor in high-production regions like the Permian Basin drives up salaries for workers across the supply chain, which can lead to substantial cost increases for businesses operating in those areas, the study added.

The study also addressed the issue of climate change, calling it “the biggest long-term threat,” which is existential and extends beyond industry and country borders.

As Sackschewsky pointed out, “climate change isn’t just a business issue; it’s a national security emergency that requires a long-term commitment to reducing human impact on the environment and ensuring the earth is livable for generations to come.”

Energy CFOs in the survey agreed that solar energy will be the most dominant type of alternative energy in the U.S. by 2023. Further, by 2024, almost 33% of the world’s electricity is forecast to come from renewables.

Companies are also facing hurdles when trying to build new infrastructure, particularly around the potential environmental impacts of projects. Almost a quarter of energy companies reported a climate change dispute in the last 12 months.

The study also showed that trade tensions and tariffs are intensifying the negative financial headwinds facing energy companies with 30% of oil and gas CFOs saying tariffs have had an unfavorable business impact.

Another major, persistent issue for the industry is low oil prices. Aside from a brief rise in prices following the drone attacks on Saudi oilfields, oil prices have hovered between $50-$70 a barrel in the last few years—and energy CFOs aren’t confident they’ll rise much higher any time soon.

A majority of the CFOs surveyed said low oil prices are having at least some impact on their business—including a slowdown of technology investments new projects, M&A as well as declining profits. These conditions are likely to persist unless oil prices rise and remain steady at a higher level.

Recommended Reading

Galp Seeks to Sell Stake in Namibia Oilfield After Discovery, Sources Say

2024-04-22 - Portuguese oil company Galp Energia has launched the sale of half of its stake in an exploration block offshore Namibia.

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.

Texas Earthquake Could Further Restrict Oil Companies' Saltwater Disposal Options

2024-04-12 - The quake was the largest yet in the Stanton Seismic Response Area in the Permian Basin, where regulators were already monitoring seismic activity linked to disposal of saltwater, a natural byproduct of oil and gas production.

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

NAPE: Chevron’s Chris Powers Talks Traditional Oil, Gas Role in CCUS

2024-02-12 - Policy, innovation and partnership are among the areas needed to help grow the emerging CCUS sector, a Chevron executive said.