(Source: Hart Energy; Shutterstock.com)

At the height of the U.S. shale boom, buying almost anything Permian-related seemed like a good investment. As the boom slowed, the Permian Basin retained a star rating. But today even the Permian requires a focused approach—how can investors play it today?

Overall, the outlook for M&A in the Permian Basin has shifted, according to a recent report from Bernstein Research updating the firm’s thoughts on deal making opportunities in the basin.

In the past, the Bernstein analysts, led by Bob Brackett, suggested that small- to mid-cap Permian M&A “was a tough way to win,” and the large-cap theme was preferable.

“That clearly worked for holders of [Anadarko Petroleum Corp] in 2019,” the report said. Anadarko Petroleum was acquired by Occidental Petroleum Corp. in a stock-and-cash transaction, which closed August 2019.

But the March 5 note also said that going forward, the investment case for large caps “must rest on intrinsic, stand-alone business models, versus an M&A premium.” This is based on analysis of 2019 full-year-results for the integrateds.

Bernstein looked at 36 public Permian E&P names last year and noted that of those:

- Three companies went bankrupt (EP Energy Corp., Approach Resources Inc. and Halcón Resources Corp.);

- Three were acquired (Anadarko Petroleum Corp., Jagged Peak Energy LLC and Carrizo Oil & Gas Inc.); and

- Four were acquirers (Occidental Petroleum Corp., Parsley Energy Inc., Callon Petroleum Co. and WPX Energy Inc.).

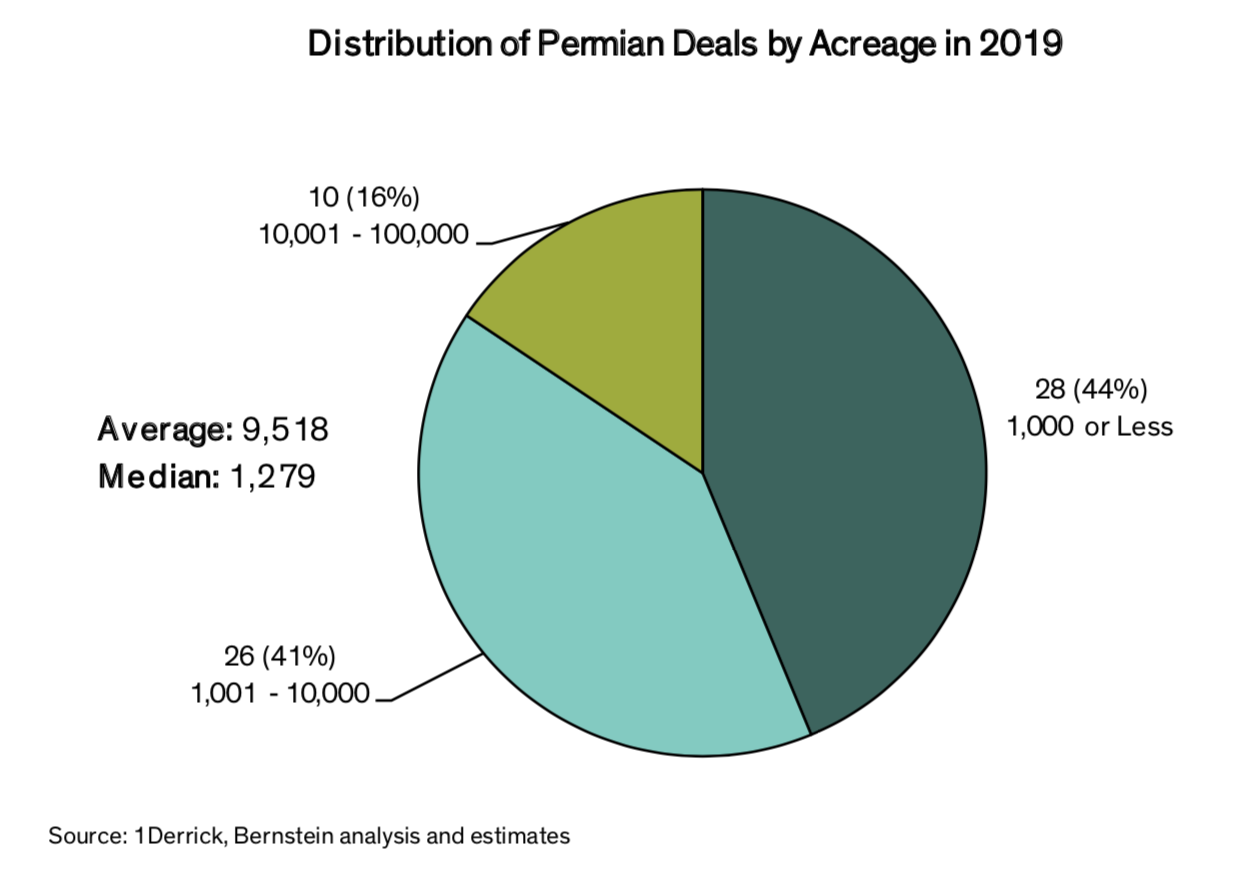

The firm’s analysis showed that in 2019 the average deal size of 9,500 acres was little changed from the year previous. However, the median deal size fell significantly, to 1,300 acres, “and 90% of deals were below 25,000 acres.”

Developed, producing acreage continued to hold sway with a premium of 45% over that of undeveloped. As has long been the case, acquirers are seeking portfolio synergies via consolidation.

The Bernstein analysts identified WPX Energy, Occidental Petroleum and Halcón Resources (now known as Battalion Oil Corp.) as top targets for acquisition in the Permian Basin, while also noting there is still upside for some smaller names.

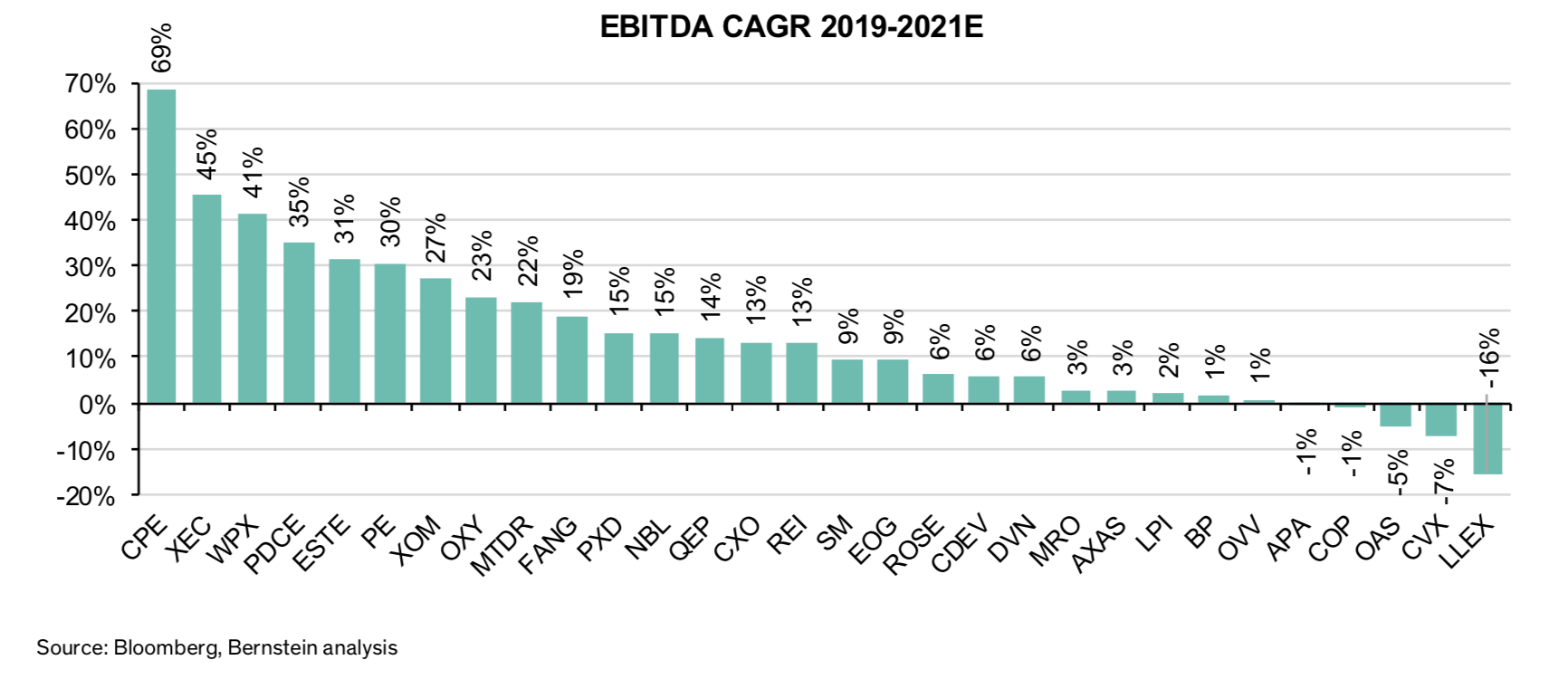

“Consensus EBITDA CAGR shows that even some of the cheaper names could grow quickly—the assets could be valuable to a suitor,” the report said. Bernstein sees “room for improvement for smaller companies” in total production and G&A costs via M&A. And looking at price to 2021 estimated cash flow, “there is an opportunity to buy up the cheaper players,” the firm said.

How can smaller players best position themselves given Permian M&A trends? “As a smaller player who could be an acquisition target, showing production is one of the most important elements.”

Sellers should seek to be above in having more productive, developed acreage while capable buyers would like to buy underdeveloped acreage and unlock value, according to the report.

Additionally, while it is attractive to sell to a major in terms of average price per acre, “a smaller producer would benefit from selling to a mid-cap or private E&P.” The Bernstein analysis showed that selling to a larger public company offers 3.4 times the spread between dollar per acre as compared with selling to a private equity-backed or private company.

In the Midland Basin, public companies are contributing about 80% of the production, “but there are still opportunities to buy smaller players,” the report noted. The publics hold an even greater share of production in the Delaware Basin.

With ownership in the Permian still diffused, and with crude price pressures looming, the analysts expect continued consolidation and acreage swaps.

Recommended Reading

ONEOK CEO: ‘Huge Competitive Advantage’ to Upping Permian NGL Capacity

2024-03-27 - ONEOK is getting deeper into refined products and adding new crude pipelines through an $18.8 billion acquisition of Magellan Midstream. But the Tulsa company aims to capitalize on NGL output growth with expansion projects in the Permian and Rockies.

EIA: E&P Dealmaking Activity Soars to $234 Billion in ‘23

2024-03-19 - Oil and gas E&Ps spent a collective $234 billion on corporate M&A and asset acquisitions in 2023, the most in more than a decade, the U.S. Energy Information Administration reported.

Matador Bolts On Additional Interest from Advance Energy Partners

2024-02-27 - Matador Resources carved out additional mineral and royalty interests on the acreage it acquired from Advance Energy Partners for $1.6 billion last year.

Vital Energy Again Ups Interest in Acquired Permian Assets

2024-02-06 - Vital Energy added even more working interests in Permian Basin assets acquired from Henry Energy LP last year at a purchase price discounted versus recent deals, an analyst said.

EQT Ups Stake in Appalachia Gas Gathering Assets for $205MM

2024-02-14 - EQT Corp. inked upstream and midstream M&A in the fourth quarter—and the Appalachia gas giant is looking to ink more deals this year.