Companies are prioritizing strategic deals over divestments.

At year-end 2016, as this article was being written, the exploration and production industry was showing signs of recovery after a prolonged period of pressure and uncertainty.

Although a number of E&P companies are highly leveraged, and Chapter 11 filings are still a concern, history shows that commodity prices can recover as quickly as they fall. West Texas Intermediate (WTI) crude hovered at around $50 per barrel in late October—nearly double February’s lows. OPEC members and other countries are starting to commit to production cuts that would further bolster prices.

Still, Kevin Schroeder, leader of Grant Thornton LLP’s national energy practice, cautioned, “I don’t think we’re coming back to $100 oil anytime soon. Companies have to produce oil and gas for less.”

Producers have to learn to operate in the new normal and be ready to move quickly as the market recovers. This may be a new way of thinking for companies that have been primarily focused on surviving through the downturn.

In the 2016 Grant Thornton LLP/Hart Energy survey, only 17% of respondents said they were ready to move quickly when the market recovers. Some 52% indicated that their current cash position allowed them to maintain only current activity. Just 15% would add new rigs, and only 1% would add drilled but uncompleted wells.

What can producers do now to adapt to the new normal? In the words of Winston Churchill, “Never let a good crisis go to waste.”

Our survey findings show that producers need to secure talent they may have lost during the downturn, invest in creating more efficient operations based on better data and analytics, and shore up their balance sheets. Many are going back to basics, using new technologies on well-developed fields with critical infrastructure already in place. Our findings also describe an industry that is wiser, more cautious and more willing to see the potential in areas where mutual collaboration and cooperation would benefit all parties.

Securing talent

The industry sharply cut staff in the wake of collapsing prices, but that trend is subsiding, and some producers are beginning to hire. About 45% of survey respondents indicated that they plan to keep current staffing levels; 31% have either begun hiring or plan to start hiring in 2017; and only 14% plan further cuts.

But the industry faces constraints as it seeks to add staff. Demographics are unfavorable as the baby boomers, representing a high percentage of industry workers, prepare for retirement. The deep cuts have left laid-off workers wary of recommitting to such a volatile business. While the first round of hiring may still be easy to recover, the second will be harder. As one respondent commented, “We need to expand staff, but finding qualified geoscientists and combating industry malaise remain a problem.”

Where will producers find the next generation of talent when prices recover? One solution will be to review processes and outsource or offshore routine functions. John LaBorde, Grant Thornton’s energy tax leader, commented, “We’re seeing that happening in the tax area. For example, some of the large integrated energy companies have offshored portions of their tax compliance function. Reducing infrastructure for routine functions makes it easier for companies to ramp up in recovery and keep the best talent focused on the highest value-add activities.”

Investing in technology

While producers were trying to survive the downturn, rapid advances in technology were underway. Producers are realizing that their technologies and systems—both inhouse and in the field—are outdated and negatively affecting operational efficiency. Additionally, they realize they may be missing out on the benefits of data analytics, cloud computing and improved communications. Out-of-date technology is particularly problematic for companies preparing for M&A.

Real-time data and analytics and cloud computing offer great advantages, but new technologies also create new concerns regarding data privacy and security, as well as the risk of cyberattacks if controls are not in place.

In the survey, 25% of respondents indicated that access to relevant data for decision-making is their biggest technology infrastructure challenge. The survey also asked respondents what information they were having trouble getting that would help them run their business. Thirty-three percent said their No. 1 need was play/basin analytics.

Schroeder said, “There is a benefit to improved real-time information for decision makers. Well performance is an example. Better use of analytics could optimize decisions around water content. Better data could improve controls on expenditures and essentially provide real-time information on each well to better handle the next cycle.”

Shoring up balance sheets

The oil and gas business is very capital-intensive. Producers raise billions of dollars each year through various forms of financing, but they still need to spend more than they raise to cover infrastructure and drilling expenses. “Maybe they’re raising $2 billion, but they are also spending about $2.3 billion each year,” Schroeder said.

The combination of falling profits and tightening credit markets has led to an unprecedented, industrywide focus on balance sheets. Any rise in investment activity puts severe working capital demands on already constrained balance sheets. For example, pressure-pumping equipment for fracking has faced years of extreme wear and tear with reduced upkeep and little or no reinvestment.

But better news is on the horizon: Although about 40% of respondents in the 2016 survey think obtaining capital is slightly or much more difficult this year than last year, that’s down from 54% in the 2015 survey. These results indicate that constraints to acquiring capital may be easing, if only moderately.

Bryan Benoit, Grant Thornton’s energy advisory leader, said, “E&P companies are looking to restructure before debt obligations become difficult, if not impossible, to refinance. Private equity firms appear increasingly interested in stepping up to the plate for needed capital. There is roughly $200 billion in dry powder in private equity funds, according to an article in Business Insider in May 2016. Is this the time for private equity to activate that dry powder on the exploration and production industry?”

Returning to basics

Shoring up the balance sheets allows survivors to cherry-pick the best assets from struggling competitors, and many strong producers are using this opportunity to come home and concentrate holdings in the fields they know best. Indeed, some industry leaders have returned from the Bakken Shale to the Permian Basin, which was first drilled around 90 years ago. The Permian has the critical infrastructure missing from newer fields. Combined with new technologies for long, horizontal drilling, the deep reservoirs in the Permian are proving to be profitable plays for producers.

An emphasis on solid, long-standing plays is reflected in our survey results. Asked which strategy fits their company within the next three years, respondents indicated they were pulling back to and sharpening their focus on a few core areas. Only 22% indicated a strategy to diversify their asset portfolio across multiple plays/basins. In a related trend, service companies are abandoning less active basins. In lightly drilled areas, producers are likely to experience higher costs and fewer choices.

Politics and policy

As players in a highly regulated industry, producers face fines and costs, as well as reputational risk, for noncompliance with myriad regulations. In 2016, the industry received new final rules from the U.S. Environmental Protection Agency (EPA) on oilfield emissions. The SEC approved a rule that required oil, gas and mining companies to disclose payments made to foreign governments; that rule was mandated by the Dodd-Frank Wall Street Reform and Consumer Protection Act, but had stalled in the courts until this year.

In the survey, more than one-half of respondents indicated that regulatory hurdles and delays were a top business risk for their companies. Producers have long dealt with the EPA and Bureau of Land Management (BLM) regulations. In November, BLM issued final rules on flaring and venting from oil and gas operations. A new wrinkle is that states are increasingly taking action, particularly on fracking. A charged political environment in state courthouses means that rules vary across state lines.

Roughly 60% of respondents indicated that the following regulatory issues were either significant or very significant to their business decision-making:

• EPA regulations on emissions;

• water disposal issues; and

• state and federal regulations on fracking.

A willingness to collaborate

There are indications that producers are working together more to meet challenges. When asked where they saw the best potential for achieving operational efficiencies, the top response (25%) was consolidating field services such as water handling, recycling and disposal.

Queried on which big data and data analytics were most relevant, the top responses indicated a desire for more open and transparent data across the industry on items like drilling permits, rig counts and reservoir data.

Schroeder commented, “Producers tend to cooperate in the downturn. You’ll see transactions where there are acreage exchanges to support where individual producers have particular strengths. But there tends to be less cooperation in an upturn, and this is where a coordinated, smart national energy policy makes sense.”

Although there seems to be little cooperation between the opposite ends of the political spectrum these days, there are areas of common ground. A coordinated energy policy could address legitimate environmental concerns with groundwater disposal in fracking that would simplify today’s piecemeal policies that vary across state or even county lines.

There are also legitimate business concerns where a fresh view on energy policy could challenge regulatory restraints that no longer make sense, such as was the cause when the ban on exporting crude was overturned. Transparency in critical data could help all producers better manage their business and control risks, and anticipate and prepare for cycles.

Optimism for the future

Overall, the survey points to an industry cautiously optimistic about growth and the future. Asked about their companies’ plans for capital spending for U.S. expenditures in 2017 vs. 2016, 45% of respondents indicated an increase, and less than 10% a decrease. Last year, only 36% said an increase, and 32% a decrease.

In other results, 48% of respondents this year plan to increase A&D activity and just 2% plan to make cuts.

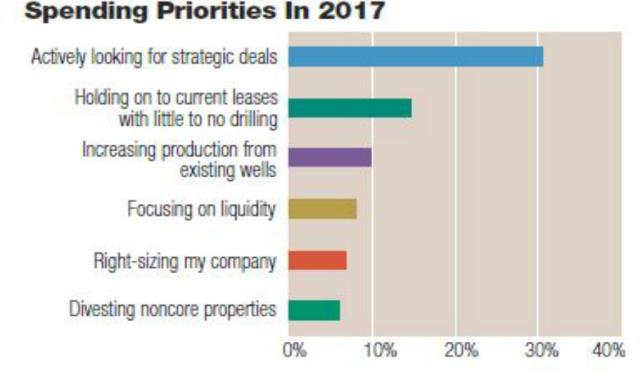

On a question asking how their spending would be prioritized going forward, the top response was that they would be actively looking for strategic deals (31%); only 7% said right-sizing their company.

The overwhelming factor in the energy business will continue to be commodity prices. That’s something individual producers can do little about. What they can do is find top people, make smart investments in technology and burnish their balance sheets. Producers can also look for ways to collaborate on smart policy that helps them manage their business and helps the country manage its energy needs into the future. Entering 2017, the best companies will position themselves to meet those challenges.

The survey is based on answers from 595 respondents collected in October 2016. Respondents were C-suite and senior executives from U.S. independent producers, midstream operators, oilfield service companies and financial companies. Participant titles included CEO, COO, CFO, CIO, senior vice president, board member, general counsel and tax and finance professionals.

Founded in Chicago in 1924, Grant Thornton LLP (Grant Thornton) is the U.S. member firm of Grant Thornton International Ltd., one of the world’s leading organizations of independent audit, tax and advisory firms. Grant Thornton works with a broad range of dynamic publicly and privately held companies, government agencies, financial institutions and civic and religious organizations.

Recommended Reading

Hess Midstream Announces 10 Million Share Secondary Offering

2024-02-07 - Global Infrastructure Partners, a Hess Midstream affiliate, will act as the selling shareholder and Hess Midstream will not receive proceeds from the public offering of shares.

Venture Global Acquires Nine LNG-powered Vessels

2024-03-18 - Venture Global plans to deliver the vessels, which are currently under construction in South Korea, starting later this year.

Imperial Oil Shuts Down Fuel Pipeline in Central Canada

2024-03-18 - Supplies on the Winnipeg regional line will be rerouted for three months.

Hess Midstream Subsidiary to Buy Back $100MM of Class B Units

2024-03-13 - Hess Midstream subsidiary Hess Midstream Operations will repurchase approximately 2 million Class B units equal to 1.2% of the company.

Apollo Buys Out New Fortress Energy’s 20% Stake in LNG Firm Energos

2024-02-15 - New Fortress Energy will sell its 20% stake in Energos Infrastructure, created by the company and Apollo, but maintain charters with LNG vessels.