Presented by:

Editor's note: This article appears in the new E&P newsletter. Subscribe to the E&P newsletter here.

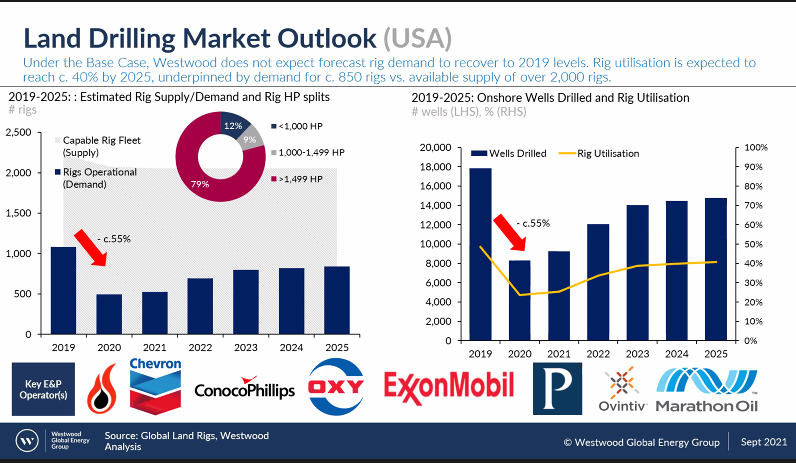

2021 has seen a promising recovery from the substantial market setbacks of 2020, both in the U.S. and globally. Although rig utilization is progressing, it is taking its time to close in on the high levels of utilization the market enjoyed pre-pandemic—and may never even get there.

According to a report from Westwood Global Energy Group, the U.S. rig utilization market is not predicted to return to 2019 levels of productivity over the forecast period. However, if E&P operators continue to focus on capital discipline, levels are expected to improve by 10% between 2020 and 2025.

In the recent Westwood webinar, “International Land Rigs: A Road to Recovery,” Arindam Das, head of consulting, and Ben Wilby, senior analyst, shared a report that explained the gradual growth the oil and gas industry is facing in the U.S. The growth rates in China and the Asia-Pacific region are expected to surpass those of the U.S. by 2025.

Combined, the Asia-Pacific, Eastern Europe and former Soviet Union (FSU), and North American regions will account for about 80% of oil rig demand by 2025, with Asia-Pacific leading, Eastern Europe and FSU in second place and North America in third.

“Asia-Pacific, which is expected to have the greatest utilization over the forecast, at around 66%, overtook North America as the largest region for rig demand in 2019," Wilby said. "It's expected to continue to lead demand through to 2025. The vast majority of this demand is expected to come from China, but countries such as India, where there is a sustained drive to increase domestic production, and Australia, are also potential bright spots for demand in that region over the forecast.”

China’s rise to one of the largest global rig fleets began even before the market downfall in 2020. With about 1,500 rigs in each of the country’s fleets at present, it is helping bolster the Asia-Pacific standing among the world’s drillers.

“After 2014, there was a significant contraction in drilling activity, and the maturity of the place and low prices were disincentivizing drilling. But since they hit a low point of around 11,250 wells drilled in 2016, the government intervened and following concerns over plummeting production and being highly sensitive to energy security made increasing that domestic production a focus,” Wilby said. “As a result, by the time we get to 2019, we were back up to about 14,000 wells. In 2020, China actually overtook to the USA as the world’s largest driller. Probably most importantly, it bumped that global trend by actually increasing the rate of drilling activity compared to 2019.”

While the Eastern Europe region should stay relatively stable, the North American region is projected to increase slowly. While it is the largest driller, it was also “among the worst affected areas in 2020,” and both the U.S. and Canada “saw a major contraction in demand.”

“When you looked at the USA and Canada, both have particularly large rig fleets, and we really aren't expecting to see the rig demand to match the size of those fleets,” Wilby said. “Average North American utilization is estimated at about 35%, significantly below the levels of other major regions. It's a good illustration of the fact the NOC [national oil company]-driven countries, which have that strong economic backing, such as those in China, Russia and the GCC [Gulf Cooperation Council], are expected to see stronger levels of demand than those with large numbers of IOC [international oil companies] or independent countries, or those NOC's in countries where economies are struggling.”

Although the data and predictions may sound bleak for the U.S., that doesn’t mean progress isn’t being made. According to Das, third-quarter 2021 prices “have continued to rally.” Prices in the third quarter average $73 per barrel, compared to $61 in the first quarter and $69 in the second quarter. Additionally, future rig utilization is expected to increase from 40% in 2020 to 50% by 2025.

“[Oil prices have] really been driven by a resurgent demand across the OECD [Organization for Economic Co-operation and Development], despite the tapering of the OPEC+ cuts and an additional 40,000 barrels of supply coming into the market. The market really is quite delicately balanced,” Das said. “What we also start to see today is that the U.S. crude supply, which has remained relatively flat since second quarter last year, is just slowly starting to creep up a little bit. So we’re at 11.3-ish barrels per day, just higher than the 11 barrels per day in Q2 [second quarter].”

Recommended Reading

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.