The buoy is designed to deliver good performance in extreme metocean conditions. (Source: Buoyant Production Technologies Ltd.)

[Editor's note: This story originally appeared in the January 2020 edition of E&P. Subscribe to the magazine here.]

The combined value of stranded (i.e., marginal) offshore oil and gas global reserves is estimated at more than $700 billion.

In the U.K. Continental Shelf alone, there are more than 360 marginal discoveries holding more than 3.5 Bbbl of technically recoverable oil. Most of these reserves are too small to be economically recovered by conventional FPSO vessels or fixed facilities, and many are unsuitable for a subsea tieback to shore or existing facility due to distance, flow assurance or facility modifications requirements.

In recent years, normally unattended installations (NUIs), which leverage low manning concepts and increased autonomy, have emerged as a viable solution to exploit marginal fields. However, the industry is still in the early stages of deploying these facilities, and their capabilities are limited. The vast majority in operation are being used solely as wellhead platforms for gas production. Very few can process oil, and none are floating installations.

In 2018 a consortium of international companies set out to change that by launching a study to push the envelope of NUIs, both in terms of water depth, oil production and processing capabilities. The initiative, which has been led by Buoyant Production Technologies Ltd. and co-funded by the Oil and Gas Technology Centre and collaborating partners, including Siemens, focuses on leveraging advances in compact processing technology, rotating equipment and digitalization to improve NUI economics, enabling producers to unlock stranded reserves in the U.K. North Sea and farther afield.

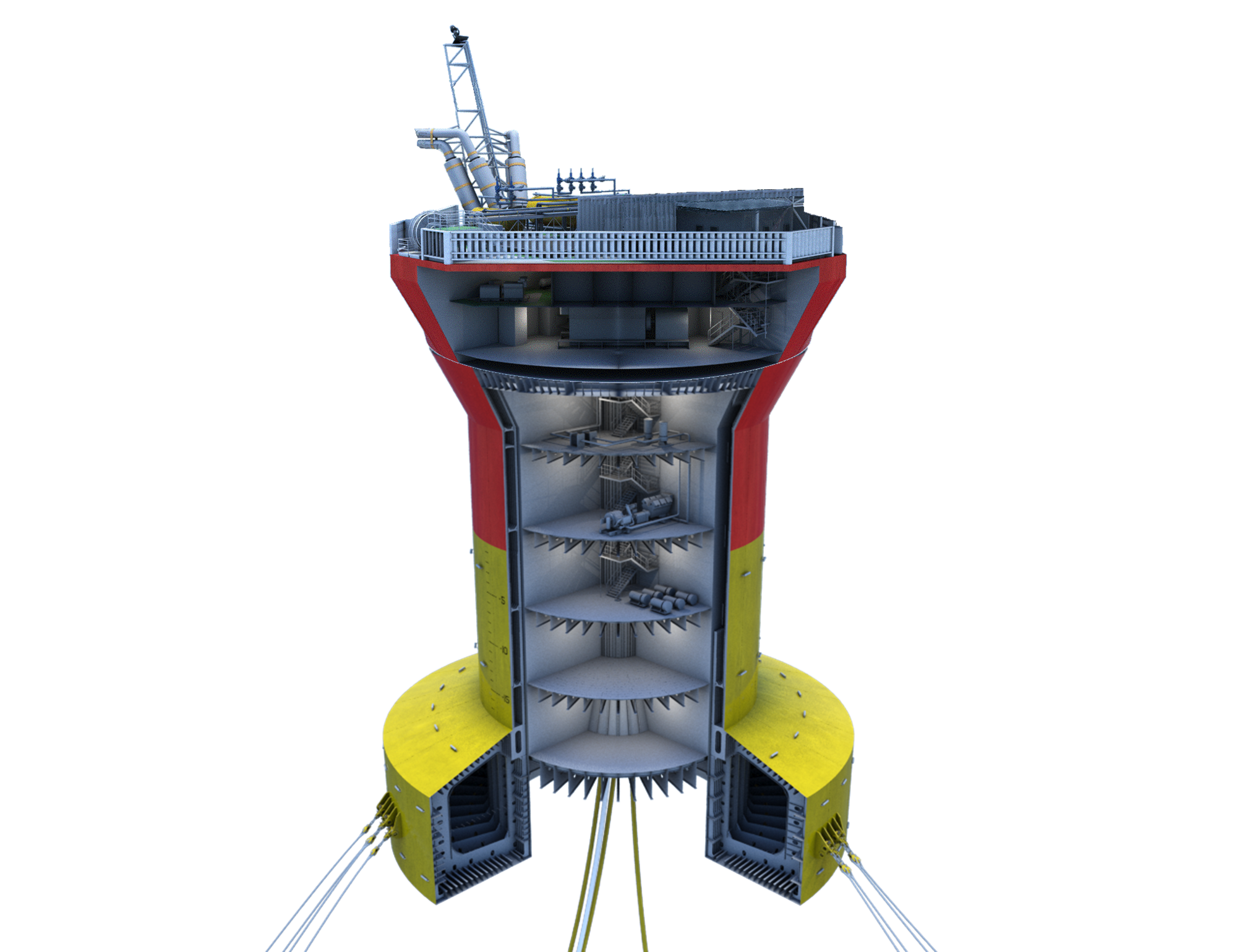

Production buoy design The NUI concept explored in the study was an unmanned floating production buoy designed for the recovery of small hydrocarbon pools in water depths beyond the reach of traditional installations. The standalone facility is based on a deep-draught, single-column slender hull structure and integrated, buoyant “deck box.” The buoy is designed to deliver good motions performance in extreme metocean conditions, enabling deployment throughout the North Sea.

The NUI concept explored in the study was an unmanned floating production buoy designed for the recovery of small hydrocarbon pools in water depths beyond the reach of traditional installations. The standalone facility is based on a deep-draught, single-column slender hull structure and integrated, buoyant “deck box.” The buoy is designed to deliver good motions performance in extreme metocean conditions, enabling deployment throughout the North Sea.

To enhance the viability of deploying the floating NUI, particular focus was placed on minimizing upfront capex. To achieve this, a “back to basics” (i.e., minimalist) design strategy was employed that minimizes sparing and reduces auxiliary systems.

The design strategy also focuses on the integration of compact process, separation and compression modules as well as, where possible, low maintenance materials, such as fiber-reinforced plastic in place of steel to reduce the need for coatings and maintenance and to reduce weight. A particularly high priority was placed on reliability and availability when screening and selecting production equipment to minimize redundancy, maximize uptime and reduce maintenance, thereby reducing offshore manning requirements.

Reducing the size, weight and maintenance of traditional processing infrastructure, while improving performance and reliability, was a major change in mindset and necessitated extensive engagement with the supply chain to provide solutions that were field-proven but still pushed the operational envelope.

Leveraging digitalization

Leveraging technology and automation to create a digitally enabled facility was also a key focus area during development, as it allows reduced opex through remote operations, the adoption of condition-based maintenance and data-driven decision-making.

To realize these benefits, the automation system and digital solutions must be designed and configured to provide the quantity and, most importantly, the quality of data to safely operate the facility from a remote location. Several prerequisites were identified in the study to achieve that goal, including enhanced data acquisition, an integrated control and safety system, unified data storage, information management and analytics, and cybersecurity.

Enhanced data acquisition

Instrumentation is the cornerstone of effectively controlling and operating a facility remotely. Providing enhanced data acquisition from instrumentation enables detailed insight into the condition and performance of the facility. Instrumentation technology is typically well-established, with recent improvements focused on enhanced data acquisition, troubleshooting and remote functionality. The NUI design leveraged these incremental improvements to provide data for a digitally enabled facility and increase the scope of instrument maintenance that is performed remotely.

Integrated control and safety system

The proposed integrated control and safety system and supporting infrastructure for the NUI was an enhancement of existing designs, practices and standards rather than a fundamental change. The design extends the controller and human-machine interface network to a remote control room and includes an SIL-certified critical action panel to provide remote operators with a push-button interface for critical actions (i.e., shutdown, blowdown and extinguishant release). The NUI can be operated simultaneously from both the central control room on the NUI and the duplicated remote control room; however, the central control room can at any time disconnect operations from the remote control room. The integrated control and safety system’s architecture provides enhanced data acquisition of all equipment, enabling advanced digital capabilities such as condition monitoring and predictive maintenance.

Unified data storage

A unified data historian (i.e., data lake) is a single location for all data related to the facility, regardless of origin. This allows data analytics across multiple systems and a complete understanding of the facility’s performance and condition from a remote location. The data lake forms one of the core building blocks for a digitally enabled facility.

Data from the NUI primarily originate from the integrated control and safety system; however, other edge systems also will provide data, including the metering system, vibration monitoring and maintenance management systems. The historian itself will be located offshore with replication between onshore and offshore to enable faster data access and allow buffering during high data demand scenarios.

Information management and analytics

The information management and analytics system is critical to the successful operation of the facility in a normally unmanned state. The system aims to process operational data into a format that focuses on maintenance efforts through predictive maintenance, decision support and automated testing.

Data analytics is the powerhouse of the information management and analytics system, featuring an interface that presents the information from the data historian and analytics in a clear and concise format to focus the attention of the onshore team on those areas where they need to take action. The system provides a standardized, vendor-agnostic view into many aspects of daily operations and maintenance, including key performance indicators, enabling onshore teams to monitor the operation of the NUI and take quick and decisive action when required.

Cybersecurity

To ensure safety and continuous operation, the production buoy integrated control and safety system and supporting infrastructure are designed per IEC 62443 and the HSE Industrial Automation Cyber Security guideline. Consequently, to provide depth in defense, strategic measures are implemented, including the segregation of corporate and automation networks, perimeter protection, device hardening and monitoring/update capability.

Facility of the future

The floating NUI was developed in accordance with relevant international standards and is ready for pre-FEED study. Overall, its development widens the scope of what a NUI can deliver in terms of water depth and production capabilities.

References available. For more information, contact Jennifer Presley at jpresley@hartenergy.com.

Recommended Reading

Battalion in Compliance with NYSE American after 2023 Meeting

2024-02-13 - Previously, Battalion Oil was not in compliance with the NYSE after failing to hold an annual meeting of stockholders during the fiscal year ending Dec. 31.

SilverBow Rejects Kimmeridge’s Latest Offer, ‘Sets the Record Straight’

2024-03-28 - In a letter to SilverBow shareholders, the E&P said Kimmeridge’s offer “substantially undervalues SilverBow” and that Kimmeridge’s own South Texas gas asset values are “overstated.”

enCore Energy Appoints Robert Willette as Chief Legal Officer

2024-02-01 - enCore Energy’s new chief legal officer Robert Willette has over 29 years of corporate legal experience.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.

W&T Offshore Adds John D. Buchanan to Board

2024-04-12 - W&T Offshore’s appointment of John D. Buchanan brings the number of company directors to six.