In early April, crude began flowing through the Murphy Oil Corp.-operated King’s Quay floating production system in the Gulf of Mexico. And there is, as they say, a lot more where that came from. Given the tightness in the rig market, though, it might be increasingly more costly to get it.

King’s Quay, built in South Korea, was delivered in 2021 and moored in January. The 22,000-ton structure is 295 high, or 70 feet taller than Murphy’s 14-story headquarters in Houston’s Energy Corridor. Capacity is 85,000 bbl/d from fields in three Green Canyon blocks: Khaleesi in Block 389, Samurai in Block 432, and Mormont East and Mormont in Block 478. The area is about 130 miles south of Houma, La.

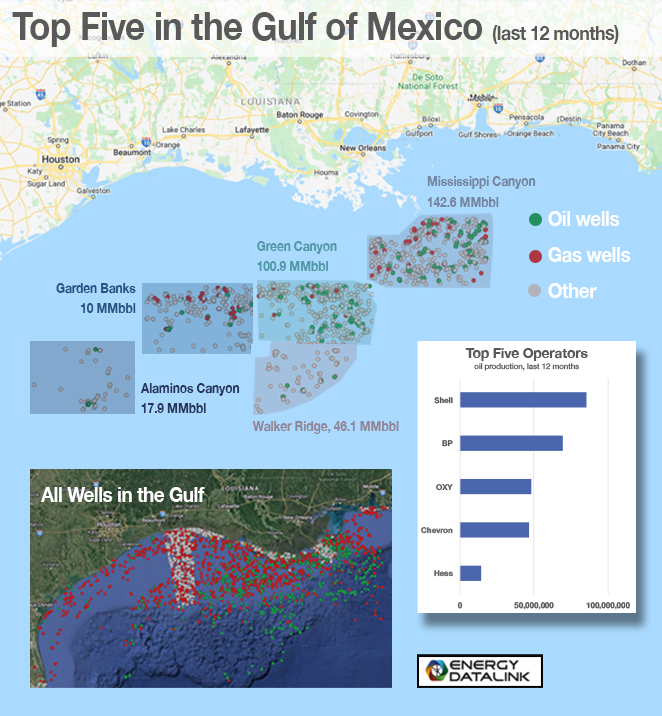

Green Canyon’s production trails its neighbor, the prolific Mississippi Canyon, but it delivered about 101 MMbbl in the last 12 months, compared to Mississippi’s 142.6 MMbbl.

Murphy pumped about 13.9 MMbbl of oil from the Gulf of Mexico in the past 12 months, good enough to be ranked No. 6 in the region. The leader is Shell, with 85.5 MMbbl, followed by BP with 69.4 MMbbl.

How much more can come out of the Gulf? Globally, offshore is coming back, James West, senior managing director and partner at Evercore ISI, told Hart Energy recently. However, that has led to a tight market for rigs and pushed day rates to almost $400,000 in the U.S. Gulf of Mexico. At the moment, though, utilization in the U.S. GoM is at 100%, with little chance of the rig market loosening up in 2022 and for the first part of 2023.

Utilization is also growing in plays such as the Suriname-Guyana Basin, offshore Namibia and South Africa’s Orange Basin.

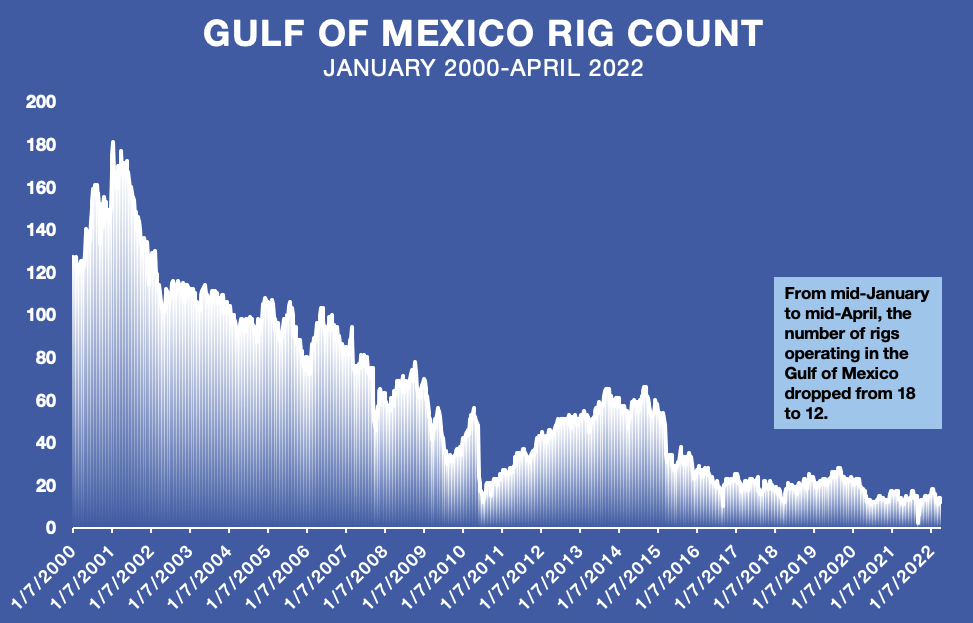

The rig count in the Gulf, as reported by Baker Hughes, bottomed out at zero for the week ending Sept. 3. It rose to 15 by year-end and peaked at 18 in January.

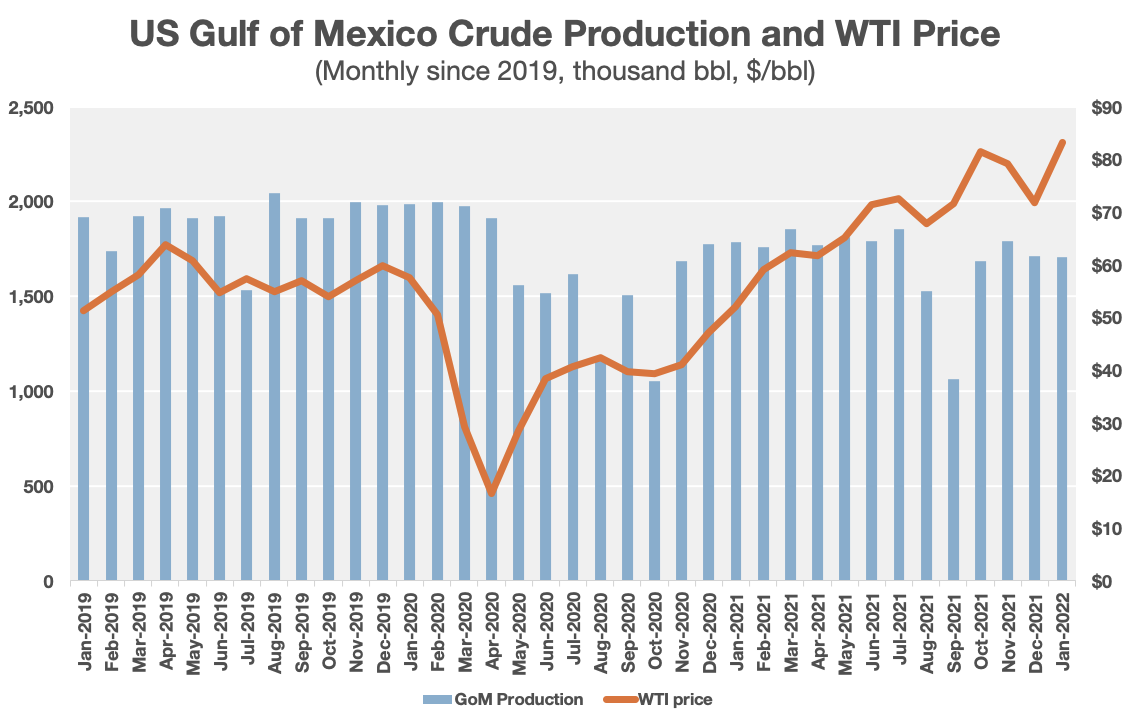

Gulf of Mexico oil production fell sharply with the onset of the COVID-19 pandemic. By March 2021, it had recovered to an average of about 1.85 MMbbl/d—well below the pre-pandemic high of 2.04 MMbbl/d in August 2019.

Recommended Reading

NextEra Energy Dials Up Solar as Power Demand Grows

2024-04-23 - NextEra’s renewable energy arm added about 2,765 megawatts to its backlog in first-quarter 2024, marking its second-best quarter for renewables — and the best for solar and storage origination.

BCCK, Vision RNG Enter Clean Energy Partnership

2024-04-23 - BCCK will deliver two of its NiTech Single Tower Nitrogen Rejection Units (NRU) and amine systems to Vision RNG’s landfill gas processing sites in Seneca and Perry counties, Ohio.

Clean Energy Begins Operations at South Dakota RNG Facility

2024-04-23 - Clean Energy Fuels’ $26 million South Dakota RNG facility will supply fuel to commercial users such as UPS and Amazon.

Romito: Net Zero’s Costly Consequences, and Industry’s ‘Silver Bullet’

2024-04-22 - Decarbonization is generally considered a reasonable goal when presented within the context of a trend, as opposed to a regulatory absolute.