(Source: E&P/Hart Energy)

Presented by:

Editor's note: This "Tech Trends" section appears in the new E&P newsletter. This weekly section highlights the latest upstream technologies and services for the oil and gas industry. The copy herein is compiled from press releases and product announcements from service companies and does not reflect the opinions of Hart Energy. Submit your company’s updates related to new technology products and services to Ariana Hurtado at ahurtado@hartenergy.com.Subscribe to the E&P newsletter here.

De Nora's new system designed for marine biofouling prevention in offshore oil and gas

De Nora has released its SANILEC TRP low-maintenance seawater electrochlorination (SWEC) system for marine biofouling prevention in offshore oil and gas and coastal applications. Powered by a new self-cleaning cell technology, the SANILEC TRP system improves safety and efficiency while minimizing operating expenses. Marine biofouling, the accumulation of detrimental biological matter on the surface of submerged objects and in pipes, is an age-old problem. The damaging impacts of marine biofouling, including environmental and economic consequences, are of particular concern for offshore production facilities. Marine growth can reduce a firewater or cooling system’s efficiency, leading to equipment damage, compromised safety and unexpected maintenance costs. SWEC systems use a simple electrolytic process, combining two standard consumables (seawater and electricity) to safely generate a critical hypochlorite solution. Like other similar technologies, prior De Nora electrodes have required chemical cleaning to maintain and extend their service life. The new self-cleaning cell technology in the SANILEC TRP unit eliminates the need to purchase, store and handle hazardous chemicals for system maintenance.

EQT partners with Cheniere and others to advance GHG emissions monitoring technologies and protocols

EQT Corp. has joined a project that is led by Cheniere Energy Inc., the largest U.S. producer of LNG, and includes several other upstream operators and academic institutions, with the purpose of advancing quantification, monitoring, reporting and verification (QMRV) of greenhouse-gas (GHG) emissions performance at natural gas production sites. The project is intended to improve the overall understanding of upstream GHG emissions and further the deployment of advanced monitoring technologies and protocols. As part of this collaborative R&D initiative, multiple ground-based, aerial and satellite monitoring technologies will be utilized to establish baseline emissions levels, monitor sites for CO2 emissions and both fugitive and vented methane emissions, verify emissions performance and identify opportunities to reduce emissions. Independent technical experts will verify the emissions data. EQT's participation in the project will cover nine wells located in southwestern Pennsylvania. The project will follow a QMRV protocol designed by Cheniere and a QMRV plan jointly developed by Cheniere and EQT, which has been specially tailored to EQT's operations and facilities. EQT will also deploy continuous detection technologies as part of this project.

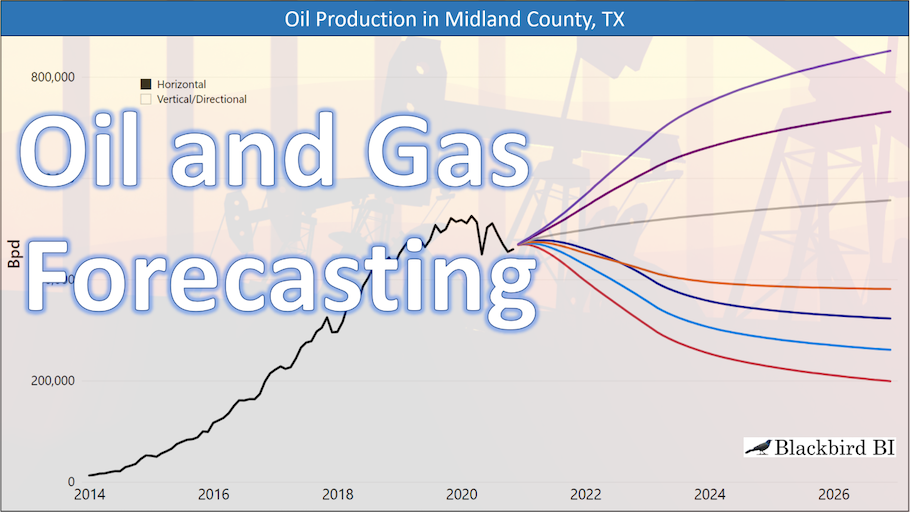

Blackbird BI's new online oil and gas production forecasting tool

Blackbird BI LLC has announced the availability of its featured Power BI data visualization tool called Oil and Gas Production Forecast Scenarios. The new tool provides extensive scenario capabilities and a county-level view of production from horizontal and vertical wells. This online data report combines historic monthly production for more than 650 counties with 10 forecast scenarios to help users gauge risk and likelihood of outcome. The Blackbird BI data platform allows users to quickly see the trends and forecast assumptions driving U.S. oil and gas production; analyze base declines faster than the competition with Blackbird's Zero Rig case; easily find counties and scenarios with the most growth over the next five years; and see permits, rig counts, well starts, IP rates, decline curves, GORs and more.

"The purpose of Blackbird BI is to easily make sense of the vast amounts of oil and gas data that market participants struggle with every day," Blackbird BI President Ben MacFarlane said. "Not only do we provide an amazing resource for the oil and gas industry to better understand how rig activity impacts production at a county level, but we're also able to provide it at a fraction of what it would cost from other providers."

CGG software enhancements improve E&P project performance

CGG GeoSoftware has released version 11.0 of its extensive portfolio of reservoir characterization and petrophysical interpretation software solutions. GeoSoftware 11.0 integrates all of GeoSoftware’s technologies, including Jason, HampsonRussell, PowerLog, RockSI, InsightEarth and VelPro, so they can now work together on a single platform. This advanced integration features flexible cross-product workflows to improve E&P project performance and provide a better understanding of reservoir properties. "Continuous innovation leveraged in GeoSoftware 11.0 includes enhanced cloud and machine learning capabilities, optimized computing performance and a superior user experience," the company boasted in a release.

Talos Energy and Storegga form CCS JV focused on US Gulf Coast and GoM

Talos Energy Inc. has formed an exclusive joint venture (JV) with Storegga Geotechnologies Ltd. to source, evaluate and develop carbon capture and storage (CCS) project opportunities on the U.S. Gulf Coast and Gulf of Mexico (GoM), including state and federal waters offshore Texas, Louisiana, Mississippi and Alabama. The partners are actively exploring opportunities with counter-parties along the CCS value chain. Under the JV framework, the partners, in collaboration, will originate and mature CCS ventures with emitters, infrastructure providers, service companies and financing partners, among others. The JV combines the strengths of Talos' offshore operational and subsurface expertise with Storegga's end-to-end CCS project experience. Under the terms of the agreement, as individual CCS projects are matured in the future, each will be ring-fenced with separate operating agreements, financing structures and the possibility of additional working interest partners. The agreement requires zero upfront capital commitments, and the partnership will share costs 50/50 in the initial phases. Talos is designated as the operating partner of the JV.

Hunting releases dual-mode firing head

The Titan Division of Hunting Energy Services, a subsidiary of Hunting Plc, has added a dual-mode firing head to its comprehensive tubing-conveyed perforating equipment line. Utilized as either a bar-drop or a hydraulic firing head, this latest addition is an economical solution to maintaining two different firing head inventories, while allowing the operational flexibility to run either type of toolstring.

Pillsbury map tracks global hydrogen projects

Pillsbury has released the only public resource tracking the development of hydrogen projects worldwide. This valuable resource is accessible at TheHydrogenMap.com. The Pillsbury map concentrates on green and blue hydrogen projects—production facilities that meet low-carbon thresholds by using either zero-carbon sources such as renewables or nuclear power or by capturing, storing or reusing carbon emissions produced by fossil fuel-based hydrogen production methods—with more than 200 projects already included. This dataset will expand over time, with existing entries updated as projects progress and the potential to add more information to help readers find projects of interest to them. Some notable findings based on Pillsbury's research include:

- While 57 hydrogen projects (26% of those tracked) are currently operational, 58 others will be in development by the end of 2021, and construction of another 92 is scheduled to begin in the next decade.

- Global growth is thus far being driven by Western Europe and Asia Pacific, with these regions accounting for more than 83% of known low-carbon hydrogen projects, but hydrogen projects in the U.S. are on the rise.

- Green hydrogen projects—which generate hydrogen using zero-carbon sources such as renewables or nuclear power—currently dominate the market, with 52 operational projects globally.

- A hydrogen production facility being built at the Tabangao refinery in Batangas, Philippines, is slated to be the first to generate blue hydrogen, in which hydrogen is produced using fossil-fueled sources but the resulting carbon emissions are captured, stored or reused.

Recommended Reading

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

E&P Highlights: April 1, 2024

2024-04-01 - Here’s a roundup of the latest E&P headlines, including new contract awards.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

Remotely Controlled Well Completion Carried Out at SNEPCo’s Bonga Field

2024-02-27 - Optime Subsea, which supplied the operation’s remotely operated controls system, says its technology reduces equipment from transportation lists and reduces operation time.