The assessments are continuous with interactions that broadly fall into four key areas. (Source: DNV GL)

For aging assets that can no longer produce at economically sustainable rates, identifying the right time, method and model for decommissioning is considered by many as the decision to have a major impact on achieving this target.

But to conduct decommissioning as efficiently and cost-effectively as possible, there is now a growing consensus that more can be done well before the late stages of an asset’s life.

Explore SIM data for decommissioning

A structural integrity management (SIM) system is widely adopted by many offshore operators to look after their asset. Apart from capturing degradation, it records changes in loading, modifications catering for new modules and all design documents used for the assets from installation through to decommissioning.

The SIM system ensures that assumptions made in the design phase are safely controlled and managed throughout the life cycle of the structure. The assessments, according to API RP 2SIM, are continuous with interactions that broadly fall into four key areas: data collection, data evaluation, SIM strategy and inspection program.

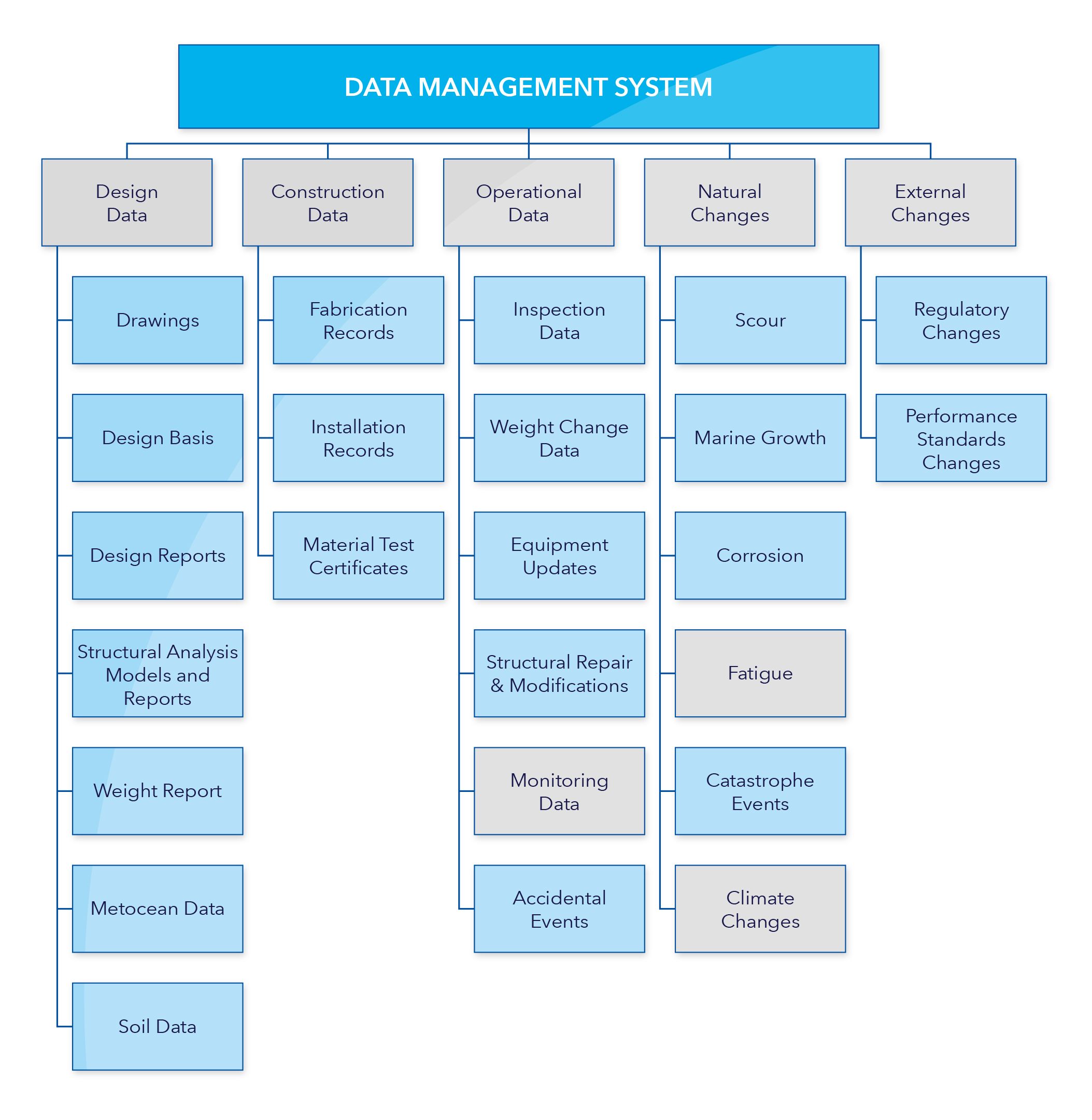

A data management system is the backbone of the SIM system. It is set up for archival and retrieval of structural data, inspection data and pertinent records, and collected during design, construction and operational stages of an asset.

Comparing the common activities associated with a decommissioning project, such as removal, lift and transportation, there are many interrelated areas in the SIM data management system where efficiency can be targeted during an asset’s operational life.

Over the past two decades, DNV GL’s Fixed and Floating Structures team has been responsible for more than 30 offshore assets worldwide using the SIM system.

Weight control

For any asset to be decommissioned, adopting and maintaining a good weight control procedure as early as possible can be vital in choosing the right decommissioning method, avoiding schedule delays and preventing cost escalation.

For instance, when the lifting methodology needs to be developed and the estimated weight of an asset is close to the capacity of the crane or the removal vessels, the completeness and credibility of existing weight records can play a major role during the decision-making process.

Any proposed weight change needs to be verified to ensure the installation remains safe within the allowable limits. It is not unusual that some small weight changes, once safely approved, are not recorded properly in a central weight database, either because the extra weight is considered trivial, hence making little impact to the overall center of gravity, or simply due to the noncompliance of an established procedure.

Minor changes once deemed inconsequential can accumulate and have a significant impact on the overall center of gravity, which is crucial for offshore lifting and transport operations. If many unregistered items are identified, without a proper record, severe delays can be expected. Therefore, it is necessary for a clear weight change procedure to be established for offshore installations and for all weight changes to be registered promptly and correctly.

If neither design nor installation records are available, obtaining the exact weight of certain topsides items on offshore facilities can be practically impossible. Weight allowances are introduced to provide a certain degree of flexibility throughout the decision-making process. Such figures can vary significantly between 5% and 15% of the proposed weight. A robust weight control record would help this contingency to lean toward the lower end, indicating substantial cost savings.

DNV GL’s latest code of practice for marine removal operations provides guidelines on the level of allowance to be introduced, in line with the details and sources of information available.

Knowledge of structural conditions

The inspection program in the SIM system details work scopes to obtain quality inspection data, which show the as-is structural conditions with structural anomaly details. While several codes of practice are available, what is less common is a sound anomaly management system to follow up on those identified variances.

All offshore assets under the care of DNV GL’s Fixed and Floating Structures unit have a centralized anomaly database that records the details of all historical anomalies. During the operation of the asset, this database has the benefits of monitoring the evolving history of an anomaly and feeding into the development of regular inspection plans.

As an example, during discussions on the removal lifting method for a North Sea jacket platform, various possible lifting scenarios were considered against the cost and schedule. Without the existence of a well-kept anomaly database, the asset owner would need to commission and wait for the results of predecommissioning survey findings, which can cause inefficiency.

For integrity issues that are difficult to be spotted from a topside decommissioning survey, an anomaly database is a useful guide for any decommissioning project to minimize the number of unwelcome surprises.

For instance, loose bolts for a section of a J-tube close to the seabed were recorded in the anomaly database but missed from the commissioned subsea survey. The reality is, no matter how thorough a decommissioning survey is, there is always a possibility of missing certain issues that may become critical during the incoming decommissioning operation. This margin of error can be reduced by a properly maintained inspection data and anomaly database, saving hundreds, if not more man-hours.

Information management

Given any aging asset’s long service life, a SIM service provider, along with its understanding of the historical and ongoing issues concerning the weight, is well-positioned to provide help in identifying any missing or inconsistent information that may affect key decisions.

Asset-specific knowledge, together with the weight database, can help minimize the efforts associated with weight reviews and offshore surveys.

Even if all information is well maintained and available, to fully digest and then prepare it into a list of actions requires an uncertain length of time, which can be unfavorable. The SIM provider can expertly justify and prioritize the required mitigation measures.

The dynamic nature of offshore operations means all aging assets may have experienced substantial modifications. From a decommissioning point of view, SIM providers can help verify the records of all implemented changes and identify key information that is relevant to the decommissioning exercise. The other is to review, justify and close out all incoming changes as well as make simultaneous updates to the weight database and structural model. Therefore, an up-to-date asset profile is always maintained.

Reaping the benefit of the digital age

More than 400 oil and gas fields have stopped producing in the last five years, and analysts expect $32 billion to be spent on decommissioning to 2025.

Digital innovation through artificial intelligence, automation and machine learning are expected to play a stronger role in decommissioning activity in the future. DNV GL has been working with Rolls-Royce and the Norwegian University of Technology Science to fully explore the idea of digital twins and develop a cloud-based virtual representation of marine assets.

The creation of a global weight library is also underway to provide a valuable benchmark tool for decommissioning weight assessments. This will be available on Veracity, an open and secure platform built by DNV GL, facilitating the exchange of datasets, APIs, applications and insights.

References available. Contact Jennifer Presley at jpresley@hartenergy.com for more information.

Have a story idea for Industry Pulse? This feature looks at big-picture trends that are likely to affect the upstream oil and gas industry. Submit story ideas to Group Managing Editor Jo Ann Davy at jdavy@hartenergy.com.

Recommended Reading

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

US EPA Expected to Drop Hydrogen from Power Plant Rule, Sources Say

2024-04-22 - The move reflects skepticism within the U.S. government that the technology will develop quickly enough to become a significant tool to decarbonize the electricity industry.

For Sale? Trans Mountain Pipeline Tentatively on the Market

2024-04-22 - Politics and tariffs may delay ownership transfer of the Trans Mountain Pipeline, which the Canadian government spent CA$34 billion to build.

TotalEnergies to Acquire Remaining 50% of SapuraOMV

2024-04-22 - TotalEnergies is acquiring the remaining 50% interest of upstream gas operator SapuraOMV, bringing the French company's tab to more than $1.4 billion.

TotalEnergies Cements Oman Partnership with Marsa LNG Project

2024-04-22 - Marsa LNG is expected to start production by first quarter 2028 with TotalEnergies holding 80% interest in the project and Oman National Oil Co. holding 20%.